Turning Down the Heat

Just like the Olympic flame was extinguished in Tokyo in early August following the completion of an unusual and challenging event, the fire that has been burning the base oils market has started to subside. While supply remained scorchingly hot in many segments of the market, a few corners have eased to a slight simmer, eliciting a sigh of relief from buyers and suppliers alike.

Buyers have faced product shortages, skyrocketing prices and logistical issues for most of the year, while numerous suppliers dealt with production issues, depleted inventories and a seemingly endless backlog of shipments.

Base oil demand remained unusually healthy during a time of the year when requirements typically weaken as the summer driving season winds down. Orders continued to pour in, and suppliers found it difficult to keep up with shipments.

Unexpected incidents earlier in the year—like the freezing winter storm in the United States in February, refinery fires and extended turnarounds—forced a number of producers to place customers on allocation, but the situation has improved. Many suppliers were still trying to catch up with contractual commitments, with deliveries sometimes delayed by one or two months.

Nevertheless, production rates have been ramped up, and most refineries were running at a higher pace. There appeared to be increased availability of a number of grades, although supply of API Group I bright stock and a couple of Group III cuts remained limited.

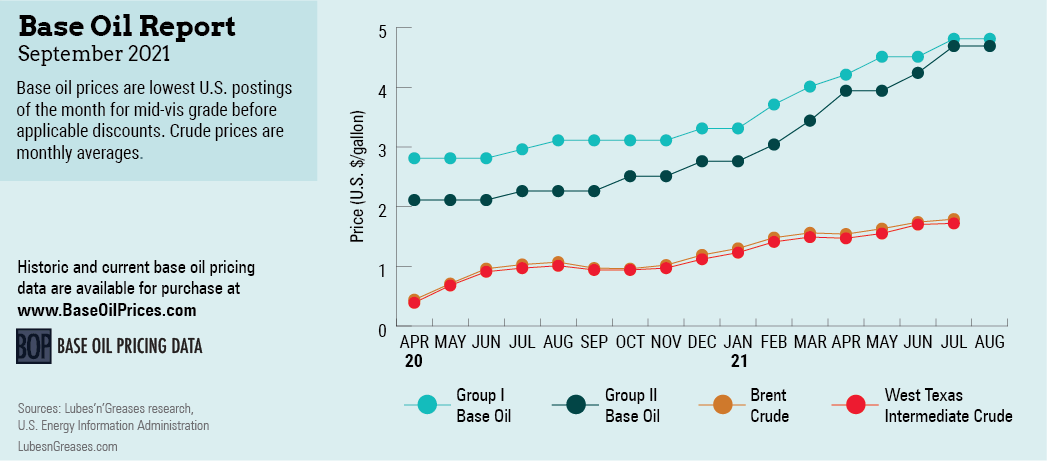

The strained conditions had fanned the fire beneath rising spot values, which hovered at historical highs and triggered six rounds of posted price increases since January 2021. July was an exception, as there were no fresh increase announcements that month. By August, prices appeared to have stabilized.

The latest round of posted price increases, which went into effect between June 15 and July 1, lifted paraffinic postings by 15 to 55 cents per gallon, depending on the grade and whether the supplier had participated in all the previous rounds of price hikes.

On the naphthenic front, similar conditions to those seen on the paraffinic side prevailed, and a majority of naphthenic producers implemented increases of 30 cents per gallon between July 5 and July 12.

Availability of naphthenic base stocks might be further tightened by a minor 12-day turnaround and catalyst change at Cross Oil’s Smackover, Arkansas, 5,000 barrels-per-day base oil plant, starting on September 13.

Given the steep prices and snug conditions in the United States, suppliers in other regions looked for opportunities to move product there.

Brokers and traders scoured the market for base oils, with both light- and heavy-viscosity grades and rerefined product expected to ship to the U.S. from faraway places, such as South Korea. This product was likely to then move on to Mexico. Additionally, a couple of parcels were discussed for shipment from the Baltic Sea, and some cargoes of Chinese origin were rumored to have been offered for shipment to South America.

As more plants resumed production following turnarounds, a lengthening of supply in other regions, such as Asia and Europe, may start to weigh on market sentiment in the U.S., with buyers starting to take a more cautious position in terms of purchase volumes and acceptable price levels.

Downstream, manufacturers of lubricants, greases, additives and other finished products hoped to transfer some of the raw material price increases down the supply chain. They announced a round of markups between 5% and 18%, with effective dates peppered between late July and August.

Other difficulties that downstream manufacturers were dealing with were related to transportation delays and a shortage of additives, which have caused temporary shutdowns at blending plants. The increase in coronavirus infections in the U.S. linked to the Delta variant was also seen as a potential disruptor of manufacturing operations if many employees found themselves forced to stay away from their workplace or new restrictions were imposed.

The Delta and Lambda strains may turn into variables that could inflame the precarious situation in which many countries find themselves. A tropical storm or hurricane may also deeply affect fundamentals in the U.S. These uncertainties, among others, have increased concerns about what may happen in base oil markets in coming months.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com