Every Rose Has its Thorn

With base oil demand showing a strong recovery in the United States after slumping during the height of the pandemic last year, and margins at very healthy levels, one would surmise that producers should be celebrating the market’s fortuitous performance this year.

However, not everything is as bright as it seems. Producers have also had to deal with supply shortages due to reduced operating rates at refineries, which were caused by weak fuel demand. And with unexpected plant shutdowns due to extreme weather conditions, a number of producers were forced to place customers on allocation.

While suppliers were thankful that business was going well and requirements were robust, their inventories were strained to the limit, and some found themselves unable to meet the contractual product needs of their customers. This meant that many struggled to catch up with orders and timely deliveries, while inventories remained uncomfortably low. Most buyers and sellers try to pad stocks ahead of the hurricane season in the Atlantic basin—which runs from June 1 to November 30—to mitigate potential shortages caused by inclement weather, but they were not able to do so this year.

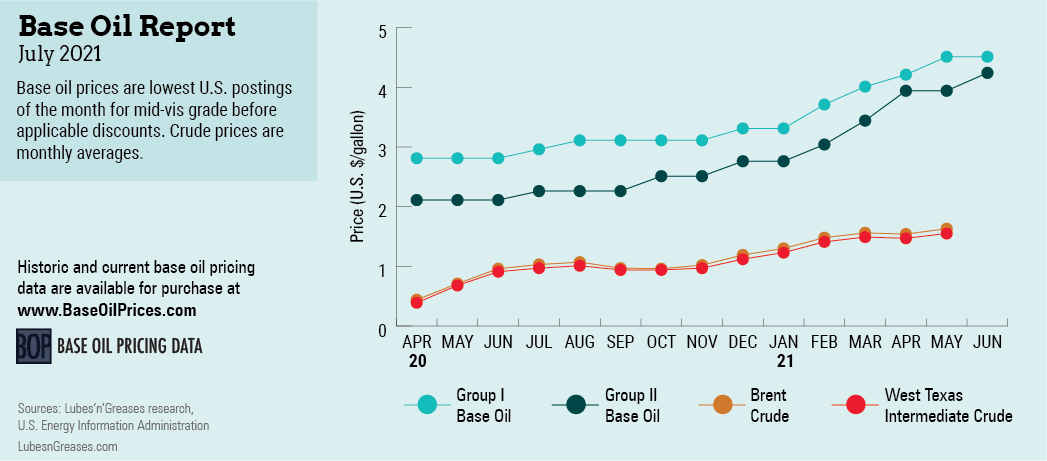

The strained supply conditions—together with steady demand, climbing spot prices and firm crude oil and feedstock values—drove base oil producers to seek posted price increases for implementation in late May and early June. This was the fifth round of price increases since the beginning of the year.

A majority of paraffinic suppliers communicated markups of 20, 30 and 40 cents per gallon, depending on the grade and the producer. These markups were implemented between May 26 and June 11. Suppliers who do not publish posted prices also adjusted prices up by 30 cents for most grades.

On the naphthenic base oils side, most producers also raised prices by 30 and 35 cents per gallon during the same timeframe.

Furthermore, a fire that broke out at Ergon’s paraffinic refinery in Newell, West Virginia, on May 29 forced the producer to declare force majeure and stoked concerns that the supply tightness would be exacerbated if the producer remained off-line for an extended period of time. The base oil plant at the refinery produces Group I and Group II base oils.

Other suppliers received numerous calls from buyers trying to locate product during the outage, but most were left empty-handed as producers did not have any extra availability. There was a significant drop in export volumes moving to India, Mexico and South America.

The price increases seen since the beginning of the year led to a slightly prickly situation between base oil suppliers and downstream producers. Manufacturers of lubricants, greases, additives and other finished products lamented the fact that so many raw material price increases had placed immense pressure on their markets, and the markups had been very difficult to absorb or transfer down the supply chain.

Despite much resistance from their own buyers, a number of finished lubricant manufacturers announced price increases between 8% and 14%, with implementation dates set for late June and early July. Meanwhile, additive suppliers also announced similar increases driven by the higher raw material values, as well as increased transportation, packaging and other production costs.

The base oil supply tightness was not expected to let up much until July or August. Buyers hoped that if production stabilized and operating rates continued to ramp up, downward pressure on pricing would start to emerge.

This was already happening in the Asian market at the beginning of June. Since a few plant turnarounds had been completed in the region and demand in some countries weakened due to growing COVID-19 infection numbers, the perception that the market tightness had started to ease led buyers to balk at steeper spot prices. This compelled some producers to lower prices for the more readily available grades.

Whether a similar scenario may take place in the U.S. remained difficult to forecast, since many unpredictable factors could come into play in the coming months. For instance, an active hurricane season may result in unexpected plant shutdowns, a facility may suffer from various production issues, or crude oil prices might shoot up, keeping the current status quo largely unchanged.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com