The Dog Days of Summer May Be a Thing of the Past

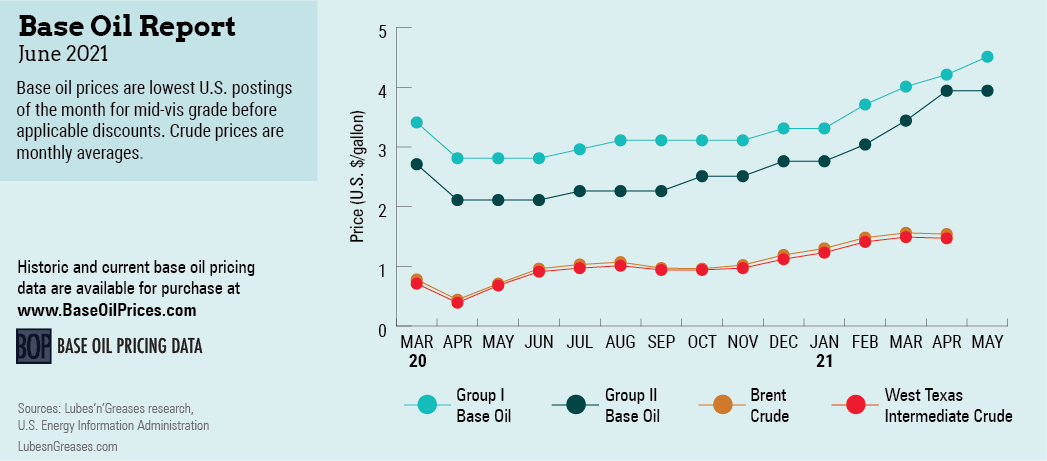

Up until a couple of years ago, most base oil market players in the United States started to prepare early in the year for the hectic spring production cycle when lubricant demand picked up and prices spiked ahead of the summer driving season. After this season faded out, everyone was able to relax for a while because the summer doldrums would set in and the market would turn quiet. Posted prices were generally adjusted upward at the beginning of spring, but they usually remained fairly stable throughout the rest of the year. However, most years saw prices come down during the last quarter when suppliers attempted to lower their inventories before December 31.

This year started out with a whirlwind of activity in terms of supply and pricing, and it looks like nobody will be getting much of a break this summer. In the past, there were sometimes three or four base oil price adjustments in a whole year. This year, however, there have been four price increases in the first five months alone.

During the most recent round of increases, paraffinic base oil suppliers raised posted prices by 15, 30 and 40 cents per gallon, depending on the grade, with implementation dates dotted between April 26 and May 5.

On the naphthenic base oils front, producers nominated price increases of 25, 30, 35 and 40 cents per gallon, depending on the product and the location, for implementation in early May.

All of these increases were driven by extremely limited supply set against a backdrop of healthy demand, reduced refinery run rates, soaring spot prices and firm crude oil and feedstock values.

The latest series of base oil price increases placed additional pressure on manufacturers of finished lubricants, greases, additives and other related products. Many of these manufacturers announced fresh price increases of up to 12% on their products, which were to be implemented in early June. These increases would be in addition to a previous round, which called for price hikes of 3%-15% for implementation in late April and early May. These increases came as manufacturers tried to offset the rising cost of base stocks and other raw materials.

Suppliers and consumers were also concerned about potential product outages brought about by severe weather, as few have been able to build their inventories to cover possible supply disruptions during the hurricane season.

One of the main factors impacting base oil supply was reduced production rates at several refineries. While there has been a slight improvement in operating rates in recent months, the fact that jet kerosene demand was still fairly lackluster due to coronavirus-related travel restrictions—particularly on international long-haul routes—meant that refiners continued to run at trimmed rates to avoid an inventory build. This, in turn, resulted in reduced availability of feedstocks for base oil production, both on the paraffinic and the naphthenic sides of the business. This situation could change soon, as air travel seems to be increasing along with the growing number of vaccinated travelers, leading to improved jet fuel demand.

The tight base oil supply situation was not expected to see any relief in the short term. Aside from ongoing maintenance shutdowns and unplanned extensions to recent turnarounds at some base oil facilities, the shutdown of the Colonial Pipeline caused by a ransomware cyberattack on May 7 was also expected to result in feedstock supply disruptions and affect base oil production. As a result, some refiners along the U.S. Gulf Coast chose to idle production temporarily or to secure additional storage because refined products could not be moved out through the pipeline.

Sources reported that Motiva had shut down two of its three crude distillation units, a reformer and the lubricant oil hydrocracker at its Port Arthur, Texas, refinery because of the Colonial Pipeline outage. The company operates an API Group II and Group III base oil plant in Port Arthur. Production at the facility had already suffered a setback following a winter storm in mid-February that had forced the refiner to shut down operations and declare force majeure. Base oil contract shipments were also experiencing delays, and there would likely be no spot volumes available for months, sources said. Motiva did not comment on the status of its operations.

In both Europe and Asia, base oil prices continued on an upward trek, propelled forward by conditions similar to those in the U.S. However, Asian buyers appeared to have grown increasingly cautious regarding both volumes and price levels, given market uncertainties brought about by an alarming flare-up of coronavirus infections in some countries such as India. There was also the possibility that values could soften if the supply tightness starts to ease after the completion of several base oil plant turnarounds. From most indications, though, everyone should get ready for a fairly eventful summer this year.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com.