The COVID-19 pandemic wreaked havoc on the United States base oil market during 2020. It was, as industry veteran Stephen Ames called it, the “year of the perfect storm for refiners.”

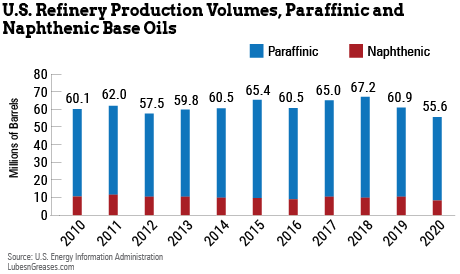

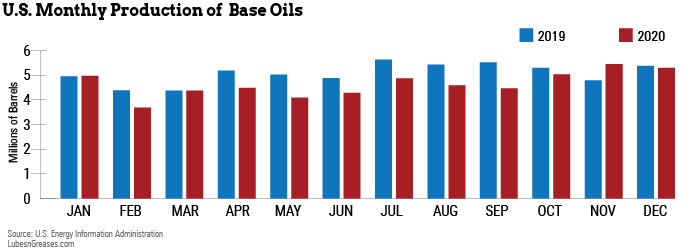

For the entire year, the U.S. produced only 55.6 million barrels of base oils, lagging about 9% behind 2019’s 60.9 million barrels, according to data from the U.S Energy Information Administration. After steep declines early in the pandemic, monthly base oil output rebounded to 2019 levels by the end of 2020, but hurricanes and maintenance turnarounds also made dents in full-year output.

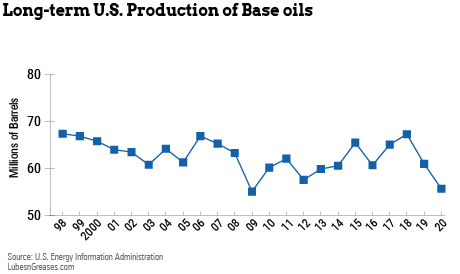

Ames, who is managing director of SBA Consulting LLC, pointed out that base oil production was on the decline even before the virus reared its ugly head. “Poor refining margins since late 2019, before the outbreak of the pandemic, were a big disincentive to running crude, even for base oils. Most refiners were losing money in the fourth quarter of 2019, all during 2020 and even into the first quarter of 2021. They minimized their crude runs to curb losses, even shutting a number of refineries.”

As explained in the January issue of Lubes’n’Greases (“No Base Oil Plant is an Island”), most base oil plants are integrated into larger fuels refineries. This integration makes base oil production at least partially dependent on what is going on at the refinery as whole. When demand for fuels tanked at the beginning of the pandemic, refinery economics necessarily changed.

Ames elaborated, “Those refineries that continued to operate had to adjust their production to align their output to reflect the tremendous decline in demand for their fuels, especially jet fuel. In April, many were running at 65%-70% utilization and rose to only 75% during the latter part of the year. In order to do so, they adjusted their crude slate and shut certain operating units. This generally resulted in less [vacuum gas oil] being available for diesel and base oil production.”

Joe Rousmaniere, director of business development with Chemlube International, concurred. “When the pandemic came, people quit driving cars or they stopped flying airplanes. The refineries just can’t keep pumping out gasoline and jet fuel if it’s got no place to go, so they cut back their production. When refineries are only running at about 60% for fuel, what that means is they’re making less feedstock for the base oil unit. So the base oil production was cut way back.”

Hurricanes along the Gulf Coast also stunted production by forcing a number of base oil operations to shut temporarily in the second half of the year. Hurricane Laura made landfall in late August, forcing Excel Paralubes’ 22,200 barrel-per-day API Group II plant to close for two months and Motiva’s 40,300 b/d Group II and III plant to shut for one month. Calumet’s two Louisiana plants—in Shreveport with 11,900 b/d of mixed groups and in Princeton with 6,900 b/d of naphthenic capacity—also closed, but for a shorter time, said Ames.

Production then spiked in October and November. One reason for this may be that Excel Paralubes came back online, contributing to a 17% bump in paraffinic production over November 2019—the first time this happened since the onset of the pandemic.

“The surge in base oil production during October and November was mainly a result of both Excel Paralubes and Motiva returning from their hurricane-induced shutdowns,” Ames said. “Also, there has been a general increase in refining utilization, reflecting a somewhat increase in fuels demand. That would have made additional VGO available for base oils. And of course most of the maintenance turnarounds had been completed.”

Naphthenic production suffered greatly in 2020 and was unable to recover to 2019 levels. While production in January and February was a little lower than the same months in 2019, output dropped by 287,000 barrels from February to March, with March lagging 38% behind the same month a year earlier. Output picked up a bit after that initial fall but stayed well below 2019 levels.

According to Ames, a major reason naphthenic production plummeted in March was that the two largest naphthenic producers in the U.S.—Ergon and San Joaquin Refining—underwent extended turnarounds, taking advantage of the pandemic-induced drop in demand. Together, the two producers account for about two-thirds of U.S. naphthenic production. Ergon can make 22,000 b/d in Vicksburg, Mississippi, while San Joaquin Refining in Bakersfield, California, has capacity to produce 8,100 b/d.

Production perked up in June, reaching 183,000 barrels shy of the same month in 2019. Things looked even better in July and August, when the gap was shortened to 158,000 barrels and 105,000 barrels, respectively.

That momentum was short-lived, however, as September ushered in another significant drop in naphthenic production, falling to 640,000 barrels that month—271,000 barrels less than September the year earlier. This drop is likely the result of a brief outage at Ergon’s Vicksburg plant.

Naphthenic production picked up a bit in the final quarter, but still fell short of 2019 levels. At nearly 8.2 million barrels, overall production for the year was 2 million barrels less than 2019—a decline of 20%.

Regional Production

Some of the five Petroleum Administration for Defense Districts seemed to fare better in 2020 than others. For instance, while the rest of the country ended the year behind 2019 output levels, the only plant in PADD 2—HollyFrontier’s 9,500 b/d Group I facility in Tulsa, Oklahoma—actually increased its full-year output to 2.2 million barrels, up 7% from 2019.

Output in PADD 3, which runs along the Gulf Coast and has the largest base oil capacity in the country, fell by about 8% from 2019 to 44 million barrels. After the rash of storms that halted production in the latter half of the year, producers increased run rates to catch up with unfulfilled demand, which likely contributed to a bump in production in October and November. September’s 3.4 million barrels increased to 4 million barrels in October—above October 2019—and soared to 4.4 million barrels in November. At 4.2 million barrels, December was on par with the same month a year earlier.

Refineries in the Texas Gulf Coast subsection of PADD 3 produced 17.8 million barrels of base oils in 2020, just 4% below what it produced in 2019. While the Texas Inland subsection increased production by 61% from the first half of the year to the second, its refiners churned out just 195,000 barrels during the entire year, 30% less than in 2019.

The North Louisiana-Arkansas subsection fared slightly better, but its production lagged by 12% last year at 9.1 million barrels. The rest of PADD 3, along the Louisiana Gulf Coast, saw a 10% drop in production, reaching 16.9 million barrels for the full year.

Production in PADD 1, which covers refineries located along the East Coast, didn’t pick up much in the second half of the year, landing the area just short of 4 million barrels in 2020. This was down 15% from its full-year total in 2019.

The West Coast refiners in PADD 5, including Chevron’s plant in Richmond, California, (20,700 b/d of Group II and 1,000 b/d of Group III) and San Joaquin Refining in Bakersfield, California, made 5.4 million barrels last year, down 11% from 2019.

Imports Imply Recovery?

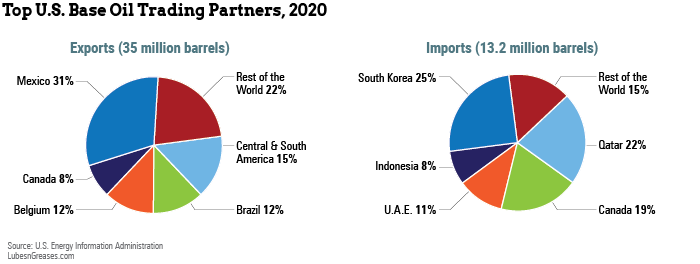

Total U.S. imports for 2020 clocked in at 13.2 million barrels, down 19% from 16.3 million barrels in 2019.

Imports were on par with the previous year’s levels until June when they plunged to just 327,000 barrels for the month—just a quarter of June 2019’s intake. While the pandemic penetrated the U.S. in March, it may have taken some time for the market to feel the effects of the slump in demand for lubricants and fuels, as mobility was constrained by lockdowns and other measures.

Ames offered another reason for the steep decline in imports in June: “Most of the base oil imports into the U.S. are Group III from Qatar, Bahrain, UAE and Korea. Those base oil plants in Bahrain (Bapco/Neste), UAE (Adnoc) and South Korea (SK and S-Oil) had undergone turnarounds mid-year, likely limiting shipments to the U.S., which had already experienced greatly reduced demand from COVID lockdowns.”

July and August also saw lower than normal imports—down 66% and 45%, respectively. Imports did steadily climb after the initial drop in June, indicating that U.S. demand picked up slightly as the year went on. However, imports from the last half of the year totaled only about 6.5 million barrels, down 27% from the same period in 2019.

As is usually the case, most of the U.S.’s imports in 2020 came from South Korea (3.4 million barrels), Qatar (2.9 million barrels), Canada (2.5 million barrels), United Arab Emirates (1.5 million barrels) and Indonesia (1.1 million barrels).

Exports Exceed Expectations

Demand for base oil exports from the U.S. helped to offset subdued domestic demand in 2020. While the pandemic and a series of hurricanes along the Gulf Coast stunted export volumes for part of the year, outbound shipments did see some recovery and were high year-over-year each month beginning in August.

The U.S. exported over 35 million barrels of base oils in 2020—only 6% below 2019’s total exports. The country typically exports more than half of its base oils, and that remained true for last year.

The top recipients of U.S. base oils were Mexico, with 10.8 million barrels; Belgium, with 4.3 million barrels; Brazil, with 4.2 million barrels; Canada, with 3 million barrels; and India, with 1.3 million barrels.

Brazil and India were two relatively unexpected drivers of U.S. export demand last year. Brazil increased its share of U.S. exports to 12% from 9% in 2019 and India upped its share to 3.6% from 2.3%.

According to Ames, “In addition to the numerous worldwide maintenance shutdowns that could have prompted replacement U.S. cargoes, Petrobras had reduced throughput and cut production at its Duque de Caxias plant, which represents 80% of Brazil’s total base oil production. That may have prompted [Petrobras’] customers to step up imports from the U.S.”

As for India, demand for Group II oils started to take off after its COVID-19 restrictions were lifted in May and June. According to Rousmaniere, “India has traditionally been a huge buyer of base oils. India does not produce a whole lot, so they either bring it from the United States, or they bring it from Korea and Singapore. Korea and Singapore are their normal suppliers, and if Korea and Singapore get distracted, then all of a sudden a big slug will come from the United States.”

Turnarounds at SK and S-Oil in South Korea are the likely reason that India turned to the U.S. for a large portion of their base oils in 2020.

Sydney Moore is assistant editor for Lubes’n’Greases magazine. Contact her at Sydney@LubesnGreases.com.