Asia’s Increasing Influence on the Global Lubes Market

After a tumultuous year for lubricant markets around the globe, many uncertainties still lie ahead. Lubrizol attempts to illuminate what’s in store for the Asia-Pacific region this year and into the future.

Although 2020 was quite a challenging time for the Asia-Pacific lubricants market, the region is still leading the recovery from the COVID-19 pandemic.

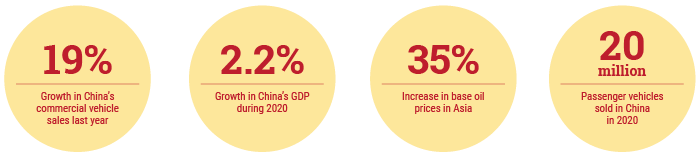

According to the China National Bureau of Statistics, China’s gross domestic product grew by 2.2% in 2020, while the GDPs of many other countries around the globe contracted. Early stringency in and compliance with public health protocols prevented China from experiencing the pandemic as deeply as other countries and allowed for a steady stimulation of the economy.

In contrast, it is expected to take at least two to three years for most countries to return to pre-pandemic levels of aggregate demand.

Additionally, China has been the largest auto market in the world since 2009. In 2020, more than 20 million passenger vehicles were sold in the country, despite the 6% decrease in auto sales due to the impacts of the pandemic, according to the China Association of Automobile Manufacturers. Over 5 million commercial vehicles were also sold, representing growth of 19% over the previous year.

Meanwhile, the China 6 emissions standard—the world’s most stringent emissions regulation to date—goes into effect this year and will further drive upgrades in vehicle technology as well as demand for higher quality lubricants.

As our industry pushes forward into 2021, more stringent emissions and fuel economy regulations, along with electrification and supply security concerns, will join the ongoing COVID-19 pandemic as key challenges that the lubricant and additive industry will need to address.

China 6 Changes Everything?

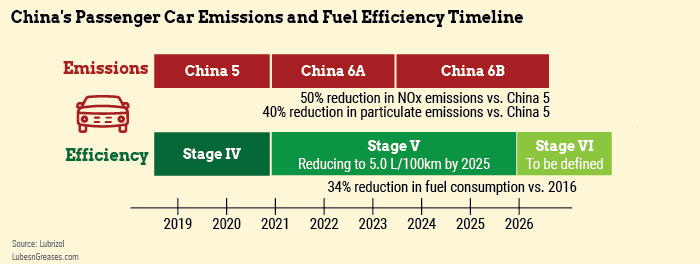

With China 6 in effect, the industry will begin to see the impact of one of China’s most aggressive strategies to curb its own emissions. The new standard is largely targeted at prohibiting many thousands of tons of serious pollutants, including particulate matter and oxides of nitrogen, from being emitted into the air. Compared to China 5, the updated regulations seek a 40% reduction in particulate matter and a 50% reduction in NOx.

Though delayed in some areas because of the pandemic, the first phase of China 6 is now in effect. The next phase with even stricter demands is scheduled for introduction in 2023. The ramifications of this standard will be felt around the world, as any original equipment manufacturer hoping to sell new vehicles into the massive Chinese market will need to adhere to the standard.

The emissions limits are being combined with strict fuel economy legislation that applies to both passenger cars and commercial vehicles. This will require OEMs to achieve increasingly high fuel economy targets while dramatically reducing emissions throughout a vehicle’s entire lifespan.

|

The ramifications of China 6 will be felt around the world, as any original equipment manufacturer hoping to sell new vehicles into the massive Chinese market will need to adhere to the standard.

|

China 6 is based on several important criteria that reduce emissions, including emissions durability and in-use compliance enforced by periodic real driving emissions testing. To remain compliant with these emissions and fuel efficiency demands, it is expected that OEMS will utilize several key technologies, including turbocharged gasoline direct injection engines and gasoline and diesel particulate filters.

With the official arrival of China 6, higher quality lubricants are required to provide appropriate protection for advanced after-treatment devices. Lubrizol expects to see China, along with Japan, lead the pursuit of more advanced sustainability targets that will drive the overall market toward ultra-low viscosity grades—SAE 0W-12 and below—in the near future. In fact, Japan already makes recommendations for SAE 0W-8 in some vehicles.

An overall market upgrade for the new generation of vehicles is underway, and Lubrizol is already looking ahead to China 7, which is now in the early stages of development and expected to be effective beyond 2025. While it is too early to predict specific targets, it is expected that NOx and particulate matter emissions will be curtailed even further and will likely require advanced after-treatment devices and more complex engine configurations, and even alternative fuels.

Leading in Electrification

In recent years, China has become the fastest-growing market in the world for new energy vehicles. Over 54% of global new energy vehicles, including battery electric and hybrid vehicles, have been sold in China in 2020, and the market continues to show significant annual growth.

China New Energy Vehicle policies will further drive market growth in 2021 and beyond, and we expect to see more advanced technology and hardware introduced into the marketplace. These developments will bring further challenges and opportunities to the lubricants industry. One area of particular interest is the hybrid segment, where we expect a growing need for dedicated hybrid vehicle lubricant formulations to provide advanced protection for their unique operating conditions, such as frequent engine starts and stops, and new transmission hardware designs.

Lubrizol is conducting an extensive hybrid vehicle field trial to gain an in-depth understanding of lubricant performance required by hybrid operating conditions. Multiple formulations are being tested in a severe-duty taxi driving cycle in Shanghai. The majority of testing should be complete in the third quarter of this year.

Meanwhile, the lubricants industry should be keeping a close eye on how the value chain is evolving with the entry of new players in the electric vehicle market. While Tesla is presently the highest-profile battery lectric vehicle maker in the world, many new entrants in the Chinese market such as Evergrande and Leapmotor are beginning to compete for market share.

It is important to remember that the new BEV manufacturers’ route to market may look entirely different than the traditional automotive model. For example, Tesla favors its e-commerce platform to sell vehicles directly to consumers versus the traditional dealership network. For forward-thinking oil marketers, this kind of shift will require careful analysis of how and where they can provide value to these new players.

Syncing with the Supply Chain

COVID-19 has been well controlled in China, and the lubricant market is moving forward with positive momentum. However, this is not necessarily the case in the rest of the Asia-Pacific market, where recovery has lagged, particularly in Japan, Australia, and Southeast Asian countries.

One of the ways this has already manifested is in raw materials shortages and supply chain challenges, leading to higher prices throughout the region. The COVID-19 crisis in much of Asia-Pacific has created logistics challenges throughout the supply chain, and it has become increasingly difficult to move freight.

As of late January, we had witnessed a roughly 35% increase in base oil prices, according to data from ICIS Base Oils. This represents a dramatic increase in just three months. As a result, many oil marketers announced price increases.

|

The COVID-19 crisis in much of Asia-Pacific has created logistics challenges throughout the supply chain, and it has become increasingly difficult to move freight.

|

While the tight base oil market will hopefully peak within the first or second quarter of this year, we expect to feel market-wide reverberations stemming from these developments throughout the year.

As businesses navigate these rough waters, one impact we expect will outlast the pandemic is the influence of business continuity planning requirements throughout the value chain. The onset of the virus in late 2019 and into 2020 rocked global supply chains. Now, more than ever, major stakeholders want assurance from their vendors and partners that contingencies are in place so supply can carry on uninterrupted.

If a future event cuts off shipping from a country from which a lubricant manufacturer sources a certain raw material, for example, that manufacturer needs a redundancy plan to source that material from somewhere else. It is likely that major customers will value their suppliers’ ability to offset these risks.

As 2021 progresses, these are the developments that Lubrizol will be following in the Asia-Pacific region, along with the reverberations they will have throughout the world.

For its part, Lubrizol aims to enable a reduction in vehicle emissions of more than 50% by 2040. As the market grows and evolves, so do opportunities for product innovation and advanced problem-solving. By capturing these opportunities, it is possible to anticipate the next generation of performance requirements and standards, as well as OEM and end-user needs and expectations.

JianWei Dong is vice president, Lubrizol Additives Asia Pacific. His 23 years of industry experience include over a decade in leadership positions in Asia, Europe and North America. Contact him at Lubrizol.additives@lubrizol.com.