As electric vehicles threaten to drain away the lifeblood of the lubricants industry—engine oil accounts for about 40% of the market—many companies are looking for ways to rebalance their portfolios for long-term success, said Suzan Jagger, vice president for oil markets, midstream and downstream with IHS Markit.

Lube companies are investing in new product technologies as well as offsetting pressures in automotive segments by shifting their focus to high-value industrial products, including greases, she told Lubes’n’Greases. But the grease market is also changing and comes with its own challenges that companies must understand and prepare for.

“Overall the global grease market is relatively flat,” commented Johan Stureson, CEO of Sweden-based Axel Christiernsson. The largest demand is in China, which together with Europe and North America accounts for three-quarters of the global market.

IHS pegs the market for greases, including consumer, commercial and industrial applications, at about 1.1 billion metric tons per year.

Grease, along with metalworking fluid, delivers strong profit margins among the industrial lubricants and specialties businesses, Jagger explained. Margins for grease in the United States average about 45%, but can range widely depending on the manufacturers’ mix of products and route to market, and qualifications with leading automotive and aerospace equipment manufacturers, she said.

According to Jagger, ExxonMobil began to focus on grease in the mid-2000s as part of its global strategy. “Over the past decade, as other majors and regional marketers anticipated a downward trajectory of traditional consumer products, they also saw how the grease segment offered an opportunity to re-balance their portfolios to deliver new value,” she continued. “With increased focus on renewable products and sustainability, interest in high-value, high-margin industrial segments has only increased.”

Royal Dutch Shell, the world’s largest lubricant supplier for the past 14 years according to Kline & Co. consultancy, said during a company presentation in February that it is placing an emphasis on premium lubricants. Greg Morris, Americas product application specialist team lead and grease product application specialist with the company, confirmed that for 15 years Shell has classified grease as a premium product across all categories, with the exception of entry-level products.

The company classifies its greases as S1-S5, with S1 being mineral oil based products made with basic soap thickeners. S2 includes simple soap greases, and S3 products include complex thickeners and polyurea. S4 greases are semi-

synthetic and S5 denotes fully synthetic. Another high-performance class of greases is coming, said Morris.

Shell launched its e-greases in May 2019 and is formulating all of its EV lubricants with gas-to-liquid base stock from its Pearl refinery. More such products are in development, but he noted that OEMs are keeping details about performance requirements close to the chest.

However, some basics are already clear. EVs generally are heavier than their ICE counterparts, so greases in hubs and other applications must be able to handle heavier loads, Morris said. Greased parts are anticipated to be fill-for-life, so long-lasting, high-performance grease components such as synthetic base oils and complex thickeners will become more prevalent.

Grease will play a pivotal role in electric vehicle lubrication, said Jacob Bonta, product development chemist for Valvoline. Without engine oil, the main opportunities to save energy and increase efficiency will be in grease-lubricated parts such as wheel bearings and constant velocity joints.

While Lexington, Kentucky-based Valvoline has been selling greases for more than 50 years, now in most major markets around the world, it only recently started manufacturing products in-house when it acquired Serbian lubricant company Fam in 2019. “It brings another level of commitment and understanding by getting into manufacturing,” observed Dean Wilson, the company’s senior director of product strategy and management.

Valvoline’s initial interest was acquiring a lubricating oil blending plant in Eastern Europe, but the company saw an opportunity in the facility’s grease manufacturing capabilities and Fam’s presence in industrial markets such as steel, mining, power generation and food-grade lubricants, Wilson explained. Products made at the Serbia location are now sold beyond the Baltic region into Western Europe, Russia, the Middle East and Africa.

Shell’s Morris observed that a mix of contract and internal production seems to be best for many grease marketers. For example, basic lithium greases are becoming a commodity, and it can make sense to contract out such basic manufacturing while using more precious internal resources for research and development and the production of higher-tier products.

Wilson agreed: “It takes a blend of a lot of different things” to strike a successful balance, including a mix of turnkey, contract and in-house manufacturing, depending on a company’s goals. With turnkey manufacturing, the marketer provides a set of performance specifications that the product must meet. For contract manufacturing, an actual formulation is specified.

Axel Christiernsson’s Stureson noted the benefits of acquisitions, too. The manufacturer has acquired three companies and four grease plants in the past 21 years.

“Efficient operations need a certain scale,” he said. “In a flat market, you can grow through gaining additional market share and through acquisitions. We have done both. Growth only through market share takes too long to reach a reasonable size.”

Axel’s manufacturing capacity is evenly distributed between Europe and the U.S., with three plants in each region predominantly making private label grease. In the U.S., the company owns and produces greases under the Royal brand, but this is a relatively small portion of its overall operations, Stureson said.

Changes and Challenges

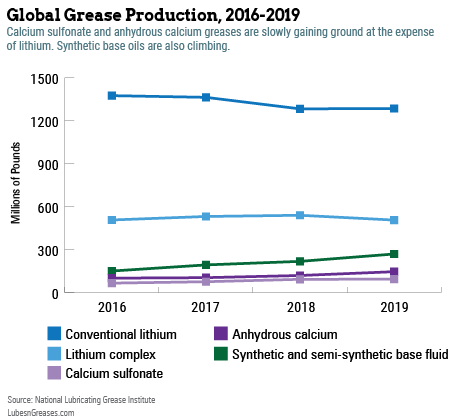

Valvoline, Shell and Axel Christiernsson all agreed that raw material costs will have an effect on grease manufacturing, and lithium is top of mind. “We’re keeping an eye on the lithium market supply-demand balance,” Wilson stated. “There are suitable alternatives now, which makes it less critical than in the past, but it’s still something to watch.” Recent growth in calcium greases is partly due to a desire to move away from lithium’s volatility.

Stureson pointed to regulations as another challenge. He anticipates that some tried and true raw materials will no longer be available to formulators because of future changes in chemical classifications, such as those imposed under the European Union’s REACH program. “Manufacturers will have to reformulate, which will have a knock-on effect for OEMs that don’t like the change,” he warned. “That’s something that everybody will have to adapt to.”

All three companies market their greases in multiple regions. Shell has separate marketing plans for each region, tailoring its local approach to market demand, said Morris. For example, rail is a significant portion of the grease markets in North America and Europe, but North American performance needs are dictated by freight rail while European rail is mainly passenger.

Morris emphasized that Shell has spent significant resources to develop a common performance platform globally. “The same name product performs the same no matter where you buy it. OEMs like that—test it once, approval is done, and you can use it no matter where it’s bought.”

For its part, Valvoline has been investing in quality control and, more recently, in R&D. “As we continue to grow, we’re expanding into true R&D operations,” said Bonta. “We’re considering new technology, and the goal is to have a world-class grease lab and R&D operation.”

The company recently expanded grease capabilities at its Lexington product development laboratory and is modernizing the lab at its Serbian location.

Each company also highlighted the importance of offering a wide range of products through a reliable supply chain, accompanied by services that add value for customers.

“We like to offer one-stop shopping for customers, to have a complete product range from bread-and-butter commodity grease to specialty, including some unique formulations or technologies not available elsewhere,” said Stureson. “In order to add more value, we try to complement the physical product with different services.”

In an increasingly global trading environment with various real and practical trade barriers, “I believe some of the regulatory services are part of that [added value] going forward,” he continued. For example, companies can help customers with the administrative side of international trade, such as developing test data for compliance with chemical regulations and ensuring that registrations are complete.

According to Stureson, contract manufacturers must also offer highly customized products. “There is a very clear desire to customize, to tailor-make not only the product but also the composition of services around that.”

As a traditionally consumer-facing company, Valvoline points to salesforce training and technical service as its keys to success. “For us it’s about putting together a great offering that lowers the total cost of ownership and provides great service, and a lot of that is around [customer] training,” said Wilson.

Higher Performance, Lower Volumes?

In terms of the products themselves, “performance expectations are only going up” as equipment gets smaller, loads get heavier and operating temperatures increase, Morris said.

Valvoline believes the National Lubricating Grease Institute’s new High-performance Multiuse grease specifications, for which the company was involved in development, will also boost grease quality. HPM will set a high bar across the board, Bonta commented.

“Historically, technology and innovation have not been a major driver for a lot of grease manufacturers,” said Bonta. “There’s a lot of room for growth for grease manufacturers to find innovative ways of making and applying products.”

Recent innovations such as manufacturing aids to simplify the process of making more challenging products, like calcium sulfonate greases, have allowed more manufacturers to produce these higher-performing options, he explained.

Morris pointed out that high-performance products will support greater sustainability by increasing energy efficiency and prolonging equipment life. Sustainability is a trend that all three companies identified.

NLGI’s annual grease production survey has begun to show a subtle shift toward higher-performance greases in markets outside of North America, observed Morris. If the trend continues, grease consumption could potentially decrease due to longer service life.

Use of synthetic base oils has also steadily increased, according to the survey, from 4% of the global reported total in 2016 to over 7% in 2019. Combining complex thickeners and synthetic base oils produces a dramatic increase in both oxidative and mechanical grease life, Morris continued. For example, grease replacement interval recommendations from major bearing manufacturers such as SKF and FAG are set based on high quality lithium complex products made with mineral oil. Using synthetic lithium complex grease could allow double the service life.

Stureson is more optimistic about future volumes. “We believe there will be less grease use in certain applications but more in others, probably with a high degree of specialization,” he said. Volumes for oil exploration and refining will decline over time, but new applications like wind turbines already have a considerable presence.

Caitlin Jacobs is managing editor of Lubes’n’Greases magazine. Contact her at Caitlin@LubesnGreases.com.