While the novel coronavirus pandemic has impacted the lubricants industry in some unexpected ways—by motivating some lube manufacturers to temporarily pivot to hand sanitizer production, for example—it has also accelerated many trends that were already in place. One of those trends is automation, which seems to have gained the most traction among lubricant manufacturers in packaging systems.

Tim Stoinski, senior systems sales engineer for MMCI Automation in St. Louis, Missouri, believes the increase in manufacturing automation is specifically linked to labor shortages. “We have a very wide, diverse customer base, and across the board, without exception, the number one issue is the inability to get—in warehouse as well as manufacturing environments—the labor needed to get the production rates that companies need,” he told Lubes’n’Greases

The engineering services company, which specializes in material handling automation, has customers ranging from Bayer pharmaceuticals to Caterpillar and Idemitsu Lubricants, according to the company’s website.

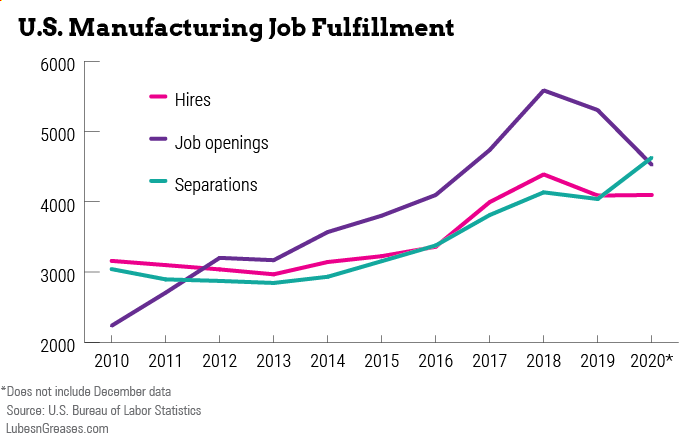

Stoinski and his colleague Mike Lee, who is director of sales and marketing, said they noticed demand for automation was ramping up in late 2018 and into 2019 when unemployment rates were low. The COVID-19 pandemic accelerated the labor shortage as “people stepped out of the workforce because they were afraid or got the virus and had to quarantine,” Stoinski noted.

Their observations are corroborated in Modern Materials Handling’s 2020 Annual Warehouse and Distribution Center Equipment Survey, conducted in January and February 2020, just before the pandemic hit the U.S. The survey included 145 qualified respondents with a median revenue of $58 million and an average revenue of $268 million.

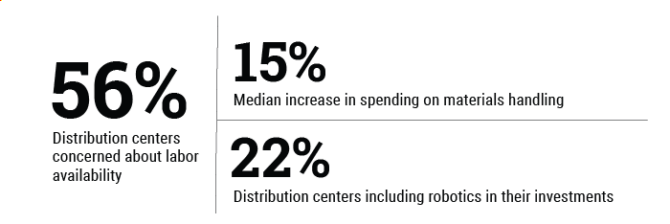

The most important issues flagged in the survey included safety—listed as a concern by 83% of respondents —cost containment at 65% and labor availability at 56%.

Over a third of survey respondents said they would increase spending on materials handling in 2020 compared to the previous year, with a median increase of 15%. Nearly half said they would up their spending over the next two to three years. Many expected an increased need for automation that can measure cycle time and performance, as well as on-time shipping.

Robotics are another area of automation growth. For those making investments, 22% planned to include robotics. Nine percent of respondents reported current use of robotics, and another 19% were considering their use within the next two years—up 3% from the year before. Use of robotics in packaging was up 2% from 2019, while palletizing was one of the most frequently cited applications.

Stoinski pointed to a shift in the mindset of American workers, who are seeking less physically demanding work. “In a lot of cases, the labor is being used to package boxes, to hand palletize. If boxes are heavy, who wants to stand at the end of the line and stack 40-pound cartons to a skid for eight hours a day, 40 hours a week? They’re going to look for something else to do as soon as they can.”

This creates turnover, which is bad for the bottom line. Businesses don’t want to invest in training employees who will leave for a better opportunity within a few weeks. “[Human resources] costs are through the roof,” Stoinski remarked.

Productivity also takes a hit when employees are absent. “If labor doesn’t show up, [manufacturers] have to slow the line down and can’t meet their customers’ demands,” Lee added.

There is also increased competition for packaging and distribution labor, he pointed out. Amazon, for example, dominates the distribution marketplace, and the benefits and higher pay it offers make its jobs the ones to beat. The company had an excellent year in 2020, thanks to increased online shopping during the pandemic, and grew its global physical footprint by 50%.

And it’s not stopping. Around the end of the year, Amazon announced plans for new fulfillment centers in Springfield, Missouri; Carencro, Louisiana; San Antonio, Texas; Sioux Falls, South Dakota; and North Little Rock, Arkansas, all set to open this year or next and to create more than 500 jobs each. An expansion of its facilities in the Detroit metro area this year will require 1,200 workers.

“Companies are looking for ways to remove the need to have a worker in any of the positions, so automation is an answer for them at every turn in every industry,” said Stoinski. “If they can replace a body with a robotic arm or a better designed control system, they will.”

Robotic palletizers—robotic arms that pick boxes from the end of a conveyor and neatly stack them, shrink wrap them and send them down the line—can keep working 24 hours a day, 7 days a week, 365 days a year, Lee explained. “No breaks, no worker’s comp, they’re not tardy, and they show up every day—and they don’t get COVID.”

In the past, Stoinski said, companies would want a return on investment within 12 to 18 months in order to justify an automation project. Now, a stretch of two to three years is justifiable due to rising HR costs.

MMCI has been involved in about $10 million to $12 million in automated lubricant packaging systems in recent years, but Stoinski observed this number is not much in comparison to the over $125 billion automation market. “We feel like the lube industry is a little bit slow in adopting compared to some other sectors,” he said.

Today’s automation technology is reliable, with little routine maintenance causing minimal downtime, according to Lee. Of course, seven- to 10-year old equipment will require more maintenance, which is typically conducted by a combination of in-house and contract workers. Manufacturers tend to have the technical expertise on site to conduct much of the preventative maintenance, he said.

“Using the proper lubes and greases and such when changing out gearbox oil and keeping things in motion and greased properly is very important,” Stoinski added. “Obviously, the [equipment] manufacturer will coach a factory through that.”

Automation for packaging lines can include multiple types of hardware and software, designed into a complete system from filling to shipping or in isolated functions.

For example, business for Idemitsu Lubricants Americas, an MMCI customer, was growing rapidly and the company needed to increase uptime and output as quickly as possible to meet demand. Idemitsu evaluated its entire packaging system and chose to install high-speed conventional palletizers, an automated filler and case packer, automated bottle handling systems, and integrated controls to maximize productivity along the entire packaging line.

The automated system replaced much older equipment, including 20-year-old bottling lines. According to MMCI, the new system doubled productivity, enhanced worker safety, and reduced downtime, maintenance, material handling and energy costs.

In addition, the automated system allowed the company to analyze data across its system and identify opportunities for greater efficiency.

Fairhaven, Massachusetts-based Nye Lubricants began investing in automated packaging systems in 2005, and has increased its emphasis in that area since 2015, according to Martin Weinstein, directory of quality, engineering & EHS [environment, health and safety], and Bernadette Ferreira, director of lean manufacturing.

Nye’s approach has been to implement cellular semi-automation where production volumes make it necessary. Cellular automation refers to machines, operations and process steps placed side by side for a continuous workflow.

“Automation of specific steps results in enhanced product repeatability and decreased labor times,” Weinstein and Ferreira told Lubes’n’Greases in an email exchange. “Across the packaging department, there is a wide range of specialized equipment that automates or semi-automates process steps to fill pipettes, tubes and jars. In some cases, linear robots fill cartridges and jars. Automated labeling has been introduced, as well.”

They noted that specialty packaging automation and semi-automation is an area of growth for the company, which intends to invest wherever a timely return is identified. “ROI expectations for payback on automated packaging vary from project to project,” Weinstein explained. “ROI is based upon the overall commitment of the customer to the project.”

Nye believes that the flexibility provided by a combination of packaging options sets it apart in the marketplace.

|

“Manufacturing rates are way up, and we see it continuing for another 10 to 15 years. There will not be enough of our kind of companies to meet the needs of all the companies that want to automate.”

— Mike Lee, MMCI Automation

|

One challenge for companies considering automation systems is that, contrary to pandemic-related trends in other industries, the supply chain is getting longer rather than shorter, Stoinski said, chalking it up to increased demand. “It’s not something that can be done right away. It could be six to nine months or longer for the lead time, which seems to be getting longer.”

Nye’s experience confirms this. Decreased availability of automation components has slowed the company’s ability to implement automation solutions since the pandemic began, Ferreira and Weinstein said.

“We thought we were in a recession earlier this year, but that was really a dip because of the pandemic,” said Lee. “Manufacturing rates are way up, and we see it continuing for another 10 to 15 years. There will not be enough of our kind of companies to meet the needs of all the companies that want to automate.”

Caitlin Jacobs is managing editor of Lubes’n’Greases magazine. Contact her at Caitlin@LubesnGreases.com.