The Winds of Change

After several months of fairly tumultuous and heated market conditions—with monthly posted price adjustments and product shortages keeping players on their toes—it seems that the United States base oils industry has started to feel the chilling effect of a winter breeze, settling into a more tepid but manageable pattern.

Supply of several grades has improved. While producers have initiated a few rounds of increases, they have come after a long hiatus of not seeing any general price movements, except for decreases on spot transactions.

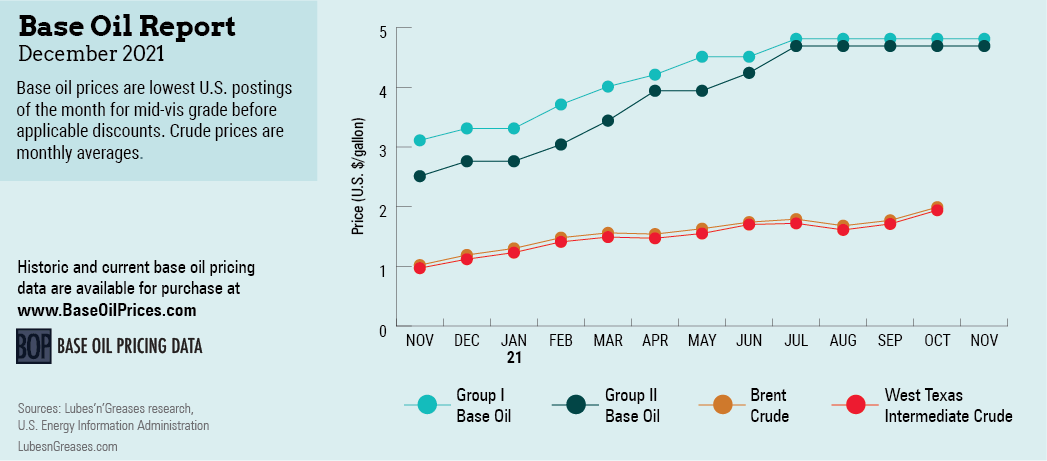

On the paraffinic side, Chevron communicated a posted price increase on its API Group II grades, lifting them by 12, 15 and 20 cents per gallon on October 19. The initiative was driven by steeper crude oil and feedstock prices, squeezed margins, tight base oil supply, and rising transportation, labor and energy costs. The higher increase amount of 20 cents was applied to the heavy-viscosity grade—which appeared to be the tightest—while the lighter cuts were more readily available.

Other paraffinic suppliers considered following Chevron’s lead, but the approach of the end of the year and the need to lower inventories appeared to thwart additional initiatives.

On the naphthenic front, Cross Oil and Calumet communicated a price increase of 20 cents per gallon for all naphthenic base oil grades, effective November 4 and November 3, respectively. The increases were prompted by similar conditions that drove Chevron to announce markups in late October.

The naphthenic base oils segment was expected to remain strained over the next few months, as most producers have scheduled turnarounds during this period.

Likewise, several maintenance programs have been slated at paraffinic plants for 2022. It was interesting to note that several of these turnarounds had originally been planned for the first quarter of 2022, but were delayed to later in the year. This means that availability should be balanced to long in the first quarter, depending on demand and whether there are any unexpected production issues.

While a majority of suppliers were focusing on meeting contractual obligations in October and November, a few have embarked on spot export transactions to find a home for surplus supplies of certain grades. A number of U.S. light-viscosity base oil cargoes were heard to have been sold to Mexican and Indian buyers. These transactions were completed at lower values than domestic indications.

Several parcels of light grades were also sourced from Asia and Europe to move to the U.S. Gulf and Mexico in recent months. These cargoes arrived in September and October, placing downward pressure on pricing.

Producers said that base oil demand for November volumes was very promising and would likely surpass October levels. However, business may also be slowing down toward the end of the month because of the Thanksgiving holiday, perhaps weakening even further as the market enters December and the holiday season.

Logistical and transportation issues continued to plague the base oil and lubricants supply chain as well. A global shortage of certain raw materials—such as additives—was hampering the manufacturing of lubricants and other finished products, while a lack of truck drivers, railcars and vessel space was causing shipment delays.

Similar market fundamentals were observed in Asia, but there was one significant difference with the U.S. market: The heavier grades have started to lengthen, and prices for these cuts have softened. Just like in North America, pandemic-related port congestions, labor shortages and other logistical issues were hampering the smooth operation of refineries and finished product manufacturing plants.

The automotive industry saw factory shutdowns and a shortage of new cars due to a lack of computer chips and other components. This was also having an impact on lubricant demand and prices.

One factor that was common in all regions was that margins were being squeezed by climbing crude oil and feedstock prices. Crude supply was expected to remain tight in coming months while the world economies recover from the pandemic. Numbers were pressured by expectations that OPEC+ members would stick to their plans to increase production only gradually over the next few months, preventing prices from slumping. This was one of the elements that base oil market participants were likely to evaluate very carefully. Other important factors were domestic consumption levels and refinery production rates.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com