In the Eye of the Storm

One of the unrelenting concerns for base oil market participants over the past several months was the fact that both buyers’ and suppliers’ inventories were generally low entering the hurricane season, which runs from June 1 until November 30 in the Atlantic Basin. Without extra supply to fill the gaps potentially left by weather-related output disruptions, the market could easily turn into complete pandemonium if a hurricane were to strike.

As many had feared, in late August, a hurricane arrived to batter large swaths of the Southeast and Northeast of the United States. Hurricane Ida caused relatively minor damage to refineries and base oil plants in Louisiana and Mississippi, but utility outages hampered the restart of many refining, transportation and pipeline operations.

The hurricane, which became a powerful tropical storm when it touched down in southeastern Louisiana, not only forced refineries and petrochemical plants located along its predicted course to reduce run rates or shut down temporarily, but it also caused port and terminal closures and affected rail movements, causing product shipment delays.

While a majority of the affected refineries and base oil plants were able to ramp up rates or resume output a few days after the storm, a number of petrochemical plants remained shut, which was expected to impact the availability of additives and other chemical components for lubricants and finished products.

ExxonMobil’s refinery in Baton Rouge, Louisiana, was understood to have first cut production to 50% capacity ahead of the storm, but later shut down the whole refinery complex. Since the refinery did not sustain significant damage, it was restarted a couple days after the hurricane.

Phillips 66 operates the Excel Paralubes base oil plant in Westlake, Louisiana. The company reported that its Lake Charles Manufacturing Complex deactivated its hurricane preparedness plan and resumed normal operations on August 30. The company’s Gulf Coast Lubricants Plant in nearby Sulphur was expected to reopen on Aug. 31.

Calumet’s base oil refineries in Princeton and Shreveport, Louisiana, were not impacted by the storm and shipments were also unaffected.

Chevron’s base oil plant in Pascagoula, Mississippi, was not affected by the storm and the company was able to meet customer product needs, but sources said that transportation might still be an issue.

Ergon’s refinery in Vicksburg, Mississippi, was not impacted by the storm, either.

The Motiva base oil plant in Port Arthur, Texas, which is located close to the Louisiana border, also continued to run at normal rates throughout the storm.

Most of the issues that suppliers were facing were related to logistics and transportation, as port and terminal operations in Louisiana were impaired by a lack of electricity and water supply.

Stolt-Nielsen, which operates a key terminal for the distribution of base oil imports to the U.S., declared force majeure at its Stolthaven terminal near New Orleans due to the storm. Officials said the terminal was undamaged but that its power and water supplies had been knocked out. The terminal’s operations resumed the week after the hurricane at reduced capacity.

One of the companies affected by the Stolthaven disruptions was global supplier and distributor Penthol, which markets ADNOC’s Group III base oils in the U.S. The company reassured its customers that it would be able to resume marine and land-based operations about a week after the storm, despite ongoing power outages.

The U.S. Coast Guard reopened the lower Mississippi River to nearly all vessel traffic shortly after the hurricane, but barge movements on the river were likely to suffer delays for a few days.

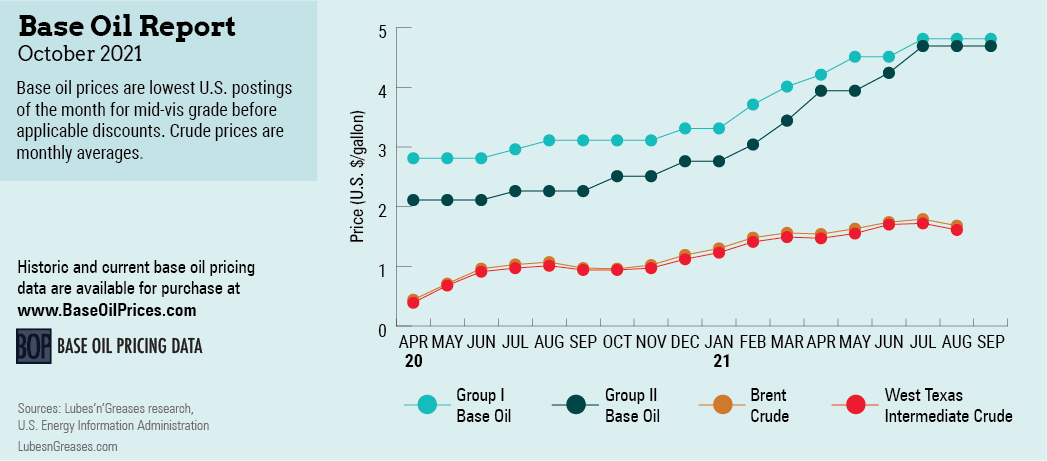

While all this turmoil was expected to impact base oil pricing, postings remained fairly stable through mid-September, with the exception of two producer initiatives. Motiva increased its Group III postings by 50 and 55 cents per gallon on Aug. 26, but left its Group II prices unchanged. Petro-Canada also increased its Group III 4-, 6- and 8-centistoke grades by 55 cents across the board on Sept. 7.

Downstream, several lubricant and finished product manufacturers announced increases in the realm of 5%-15% for September implementation to offset the frequent markups in base oil pricing and other climbing costs observed since the beginning of the year.

At the time of writing, it was too early to evaluate the full impact of Ida, but most players were thankful that at first glance the storm had caused less damage and fewer disruptions than anticipated.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com