Exports’ Wild Ride

Like most aspects of life and business in 2020, United States base oil exports took some unexpected turns off the usual route, as highlighted during the virtual ICIS Pan American Base Oils & Lubricants Conference in early December.

Home to a quarter of the world’s total base oil capacity and more than a third of API Group II capacity, the U.S. is accustomed to shipping around 60% of its barrels overseas each year. But despite operating rates that were down by about 50%-60% in April, storage tanks were full after the pandemic caused a plunge in demand, said Amanda Hay, acting managing editor for the Americas with ICIS.

“The U.S. did not have its usual outlet to clear Group II overhang in the export markets, as most other regions were experiencing the same [demand] conditions,” she explained.

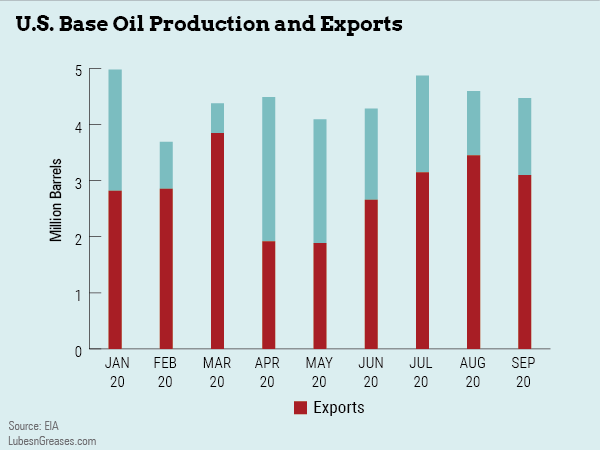

Data from the U.S. Energy Information Administration show that base oil exports slowed 11% from January to September last year compared to the same period in 2019, totaling 25.7 million barrels. Spring numbers were the most dramatic, with a decrease of 39% in April and 47% in May.

Exports picked up speed in late summer, accelerating past the previous year by 11% in August and 8% in September. According to Hay, lighter grades were in better supply than heavier grades for both Group I and II, so those oils were sent on their way.

Summer’s increased demand for exports was largely driven by Brazil and India, Hay noted. “Brazil was experiencing some local production constraints, and that has been driving buyers into [U.S.] export markets since around June.”

By the third quarter, Brazil’s industrial production was back to pre-pandemic levels thanks to a substantial fiscal stimulus from the government, said Claudio Pereira da Silva, director of LubeKem in Sao Paulo. This may have contributed to the country’s 2.8 million barrel thirst for U.S. base oils from January to September, a 5% increase over 2019.

“Brazil is highly dependent on base oil imports, mainly high quality base stocks,” he said during the conference, and those imports are expected to increase in the future. The country has brought in more than 500,000 tons of base oil each year since 2018, mainly from the United States.

Production at Petrobras, the state-owned oil company that is Brazil’s only domestic source of virgin base oil, has been falling year after year. Its Reduc refinery, the largest in the country, “had a big drop in production this year,” da Silva said, operating at just under 56% of its 11,200 b/d capacity.

While volumes headed to India were far smaller, the country upped its purchases of U.S. base oil by 54% to 964,000 barrels in the first three quarters. Volumes from June through September increased seven-fold over 2019.

According to Hay, India ran up against a shortage of Group II oils from its usual suppliers in Asia and the Middle East. Available U.S. barrels swerved eastward to a peak of 314,000 barrels in August, but volumes dropped back to 127,000 barrels in September after Hurricane Laura pumped the brakes on a significant portion of U.S. Group II production. Suppliers suspended spot export sales for a couple of months because of operational disruptions caused by the hurricane, Hay said.

She indicated that supply had begun to loosen up a bit at the beginning of December, with renewed talk of cargoes departing for India, but had not improved dramatically. “The U.S. remains balanced to snug on Group II with spot availability quite tight still,” she said.

Prices also headed down a new road. Hay reported that exported base oils typically cost 20-30 cents per gallon less than what’s sold at home, but prices had risen to about 5 cents more than domestic gallons in autumn. She attributed this reversal to suppliers’ increased focus on domestic sales.

Despite these detours, the distributional balance of U.S. export destinations remained in line with previous years. India had the only notable increase in share, rising from less than 2% in full-year 2019 to 4% by the end of 2020’s third quarter.

With a vaccine and a potential return to normality just up the road, da Silva reminded conference attendees that the industry is still headed toward some challenges. “We cannot forget that in spite of the big short-term problems … the global base oil market is oversupplied, and we also cannot forget that the global demand for lubricants is flat,” he concluded.

Caitlin Jacobs is managing editor of Lubes’n’Greases magazine. Contact her at Caitlin@LubesnGreases.com.