Local economic uncertainty and a global pandemic delivered a one-two punch to Turkey’s lubricants industry this year. Even before reports of the country’s first official case of COVID-19 in March, finished lubricant sales had tumbled in 2019 by 10%, according data shared by a Turkish base oil trader. Stay-at-home orders, travel bans and business closures chilled demand even further.

Turkey’s economy—a barometer of lubricant demand—has been stumbling since 2018, when a series of domestic and foreign policy decisions spooked financial markets and sent the currency into freefall.

The industry has since been walking a tightrope of currency volatility. The crude oil crash in April brought down base oil prices, almost offsetting the lira’s devaluation for local blenders using imported base stocks. Meanwhile, blenders kept prices the same, which meant higher margins that were in turn offset by low demand, explained one Turkish base oil trader, who asked not to be named.

“It is a delicate balance. The lira devaluation has increased the working capital requirement; only 12% to 15% of the total lubricants cost is lira-based and the rest is in foreign currency, mainly dollars,” he said.

|

“This year has been the worst in memory, I had never seen such a drop.”

– Kerem Belgin, Belgin Oil

|

Until official figures are published, it is hard to assess how much damage has been inflicted on the market by these two blows, but it is likely to be more than a bloody nose.

“This year has been the worst in memory,” Kerem Belgin, the research and development director of family-owned lubricants company Belgin Oil, told Lubes’n’Greases in an interview at the company’s lab and production facility on the outskirts of Istanbul. “I had never seen such a drop.”

Best Base Scenario

Turkey’s base oil market is dominated by API Group I, according to Belgin. Much of this goes to industrial applications such as steel and cement manufacturing and construction. Tupras, the country’s lone base oil refiner, contributes about 150,000 metric tons per year of Group I—far less than its capacity of 400,000 tons. A decade before, it put out almost 313,000 tons, according to a report at the time produced by Turkey’s Energy Market Regulatory Authority.

“Producing Group I is a cumbersome duty for Tupras,” the base oil trader said. “Turkey is a huge diesel consumer, and [when] the economics permit, the refinery is always in favor of producing diesel. When the conditions are reversed, Tupras produces at 50% of its base oil capacity, and the price is uncompetitive.”

Turkey imports around 375,000 tons of base oils from a variety of sources, according to oil industry association Petder. Local company Ekim Kimya is the authorized distributor of Chevron’s API Group II material, while Abu Dhabi National Oil Co.’s Adbase Group III oils are distributed by Penthol’s Turkish unit. Petroyag also offers Group II and Group III oils that are branded under the name Caprio.

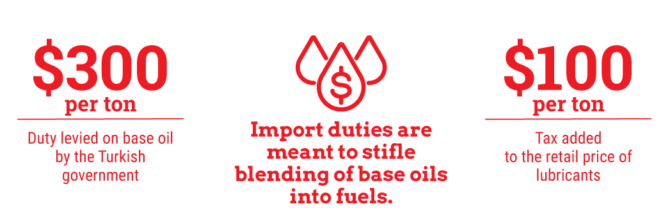

What may keep Tupras’ base oil unit ticking for now is the import duty on base oils. Before 2012 when the duty was implemented, some unscrupulous traders took advantage of the price disparity between base oil and fuels and imported large quantities of base oil that were blended into diesel and gas oil. To close the loophole, the government slapped a tax of U.S. $300 per ton on base oil to render the dodgy business unprofitable. The duty included lubricants, and $500 per ton was placed on additives, too. In 2019, legislators added another $100 per ton on the retail price of lubricants.

Despite the import-export balance and high taxes in its favor, Tupras has had its fair share of challenges this year, as demand fell sharply after March. The Izmir plant was closed in early May—while runs were cut at other sites—and was still closed at the time of publication. However, a common expectation among some industry insiders is that the refiner will switch to more fuels production in the future.

So far, this has been a tale of decline, but there are a few plot twists along the way. Many of the major lube manufacturers have blending plants in the country, enticed by the low cost of doing business. Before the pandemic, they would import raw materials and manufacture finished products, mostly automotive, for export around the region as well as sale on the local market.

|

“It’s very simple maths—things are not moving, so no lubricants are needed. That’s a fact. At the same time, the sales numbers say the opposite.”

|

That was before borders were closed, trucks were parked and ships were left at anchor. Lube blenders are still buying additives, and suppliers’ order books are healthy, said another industry insider who also asked not to be named. But behind the figures could be another story: Blenders may well be stockpiling inventory, which would mean no substantial exports are occurring.

“It’s very simple maths—things are not moving, so no lubricants are needed. That’s a fact. At the same time, the sales numbers say the opposite,” he said.

Home Front

The economy isn’t entirely to blame for the fortunes of lube blenders. Advancing engine and lubricant technology have extended drain intervals and eaten away at demand. Once common on Turkish roads, an ancient Tofas car leaving behind a trail of blue exhaust fumes is now a rare sight.

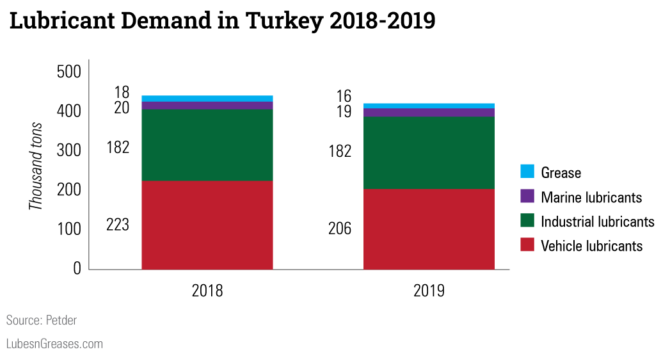

In 2018, 223,000 tons of automotive lubricants were sold in Turkey, representing a decline of 36,000 tons from 2017. In 2019, the total dropped further to 206,000, according to Petder.

Even though the vehicle parc grew tenfold between the 1990s and 2015—easy to believe when sitting in a notorious Istanbul traffic jam—car ownership is well below that of Europe. The European Union average motorization rate is 602 cars per 1,000 people, according to the European Automobile Manufacturers’ Association. In Turkey, it’s about 150, likely kept low by high vehicle and fuel taxes, lower per capita income than Europe and affordable mass transit.

“If you look at the number of cars per person, there is a huge gap,” Belgin said.

There is still an extensive automobile industry in Turkey, and major global carmakers such as Fiat, Ford and Hyundai have made it a central pillar of the economy. Auto exports from Turkey in 2019 were worth $30.6 million, making it the number-one exporting industry, according to state news agency Anadolu Ajans.

Last year, the country produced 1.46 million heavy- and light-duty vehicles, according to the country’s Automobile Manufacturers Association, of which some 75% went to Europe. This presents a substantial factory fill market.

On the service fill front, many internationally known brands are available, including Shell, ExxonMobil, Total, Lukoil and Petronas. There is also a competitive domestic scene that includes fuel retail chains such as Opet—whose parent company Koc Holding also owns Tupras—Petrol Ofisi and a host of smaller players serving the market’s spectrum.

Last year, Petrol Ofisi, owned by Dutch energy trading company Vitol, took Shell’s crown as the PCMO sales market leader. But as demand dwindles, competition is stiffening.

Turkey is not a do-it-yourself fill market. Despite inflation, it is affordable for Turks to get a new filter and oil change, leaving almost no DIY oil changes, Belgin said. It also leaves the decision about which lubricant to use in the hands of the person performing the oil change.

“The decision-makers are mostly the mechanics,” he said. Those decisions are following trends from the rest of Europe, with Turkish blenders keeping up with the latest technology to satisfy performance demands.

“The [SAE] 5W-30 and 5W-40 segments are growing very fast, and 15W-40 and 20W-50 are going down [in Europe]. That’s the same trend here,” Belgin said.

Another recognizable market driver is original equipment manufacturers promoting their branded lubricants for service fill and trying to gain market share through authorized service centers.

Industrial Strength

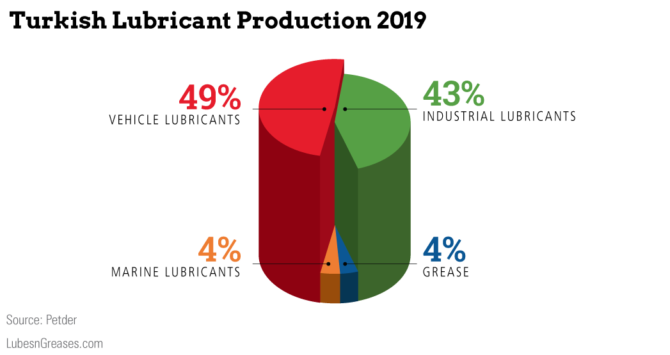

As service fill and factory fill PCMO demand has fallen, blenders have been switching focus toward industrial lubricant production. Turkey has an extensive industrial base beyond automobile manufacturing. It is Europe’s third-largest white goods manufacturer and exporter, has the world’s sixth-largest cement industry and berths a merchant marine fleet of more than 1,500 vessels.

However, this segment may offer scant respite since, like the world over, demand has slumped during the pandemic. Demand for metalworking fluids from some of Belgin’s customers fell by 25% lately, said Belgin. These products comprise around a quarter of his company’s business, so the loss is substantial. Competition is also high, with homegrown players like Belgin vying for market share with the usual suspects: Fuchs, BP Castrol and Quaker Houghton.

|

“In five years, we believe we will recover from this economic crisis. Turkey has been a manufacturing hub for Europe, especially in the automotive sector, so we will continue to grow.”

|

While sales of industrial lubricants are low, they might be a route to general recovery by increasing the efficiency of industries such as power generation and agriculture. Inflation has sent the price of energy and food sharply upward.

Unless internal demand can be stimulated, any recovery could drag on. Industries such as cement, steel, mining and agriculture are mainstays of the Turkish economy and major consumers of lubricants. But as infrastructure projects are on hold and energy is expensive, demand from these industries has shrunk. And without another two essential pillars of the economy—auto manufacturing and tourism—in full flow, recovery could be slow.

Belgin is more optimistic. Like its electrical appliances and cars, Turkey is an exporter of lubricants, made affordable by a favorable exchange rate. Exports can keep the wolf from the door, he said.

“In five years, we believe we will recover from this economic crisis. Turkey has been a manufacturing hub for Europe, especially in the automotive sector, so we will continue to grow.”

Simon Johns is an editor with Lubes’n’Greases. Contact him at Simon@LubesnGreases.com.