Moving up to the Majors

How did private label lubricants move from the minor leagues to the majors, and will they continue to grow, or will they falter in the face of stiff competition?

Marketers, installers and consumers have many choices to sort through when buying passenger car motor oil. Among them are viscosity grades; type, such as high-mileage and synthetic; and product specifications like those from the American Petroleum Institute or original equipment manufacturers.

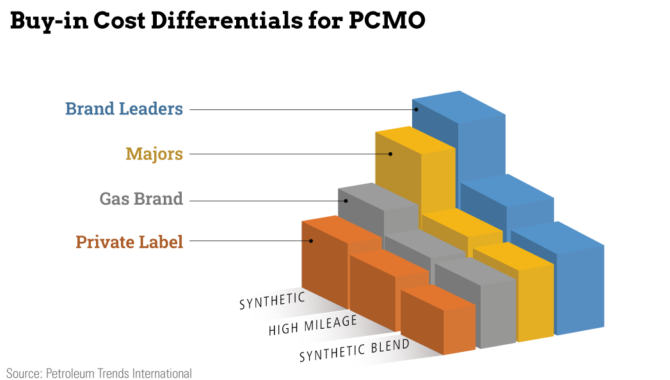

The choices are further expanded by the price tiers seen among five groups of brands. These groups include the brand leaders (Castrol, Mobil1, Pennzoil and Valvoline), other major brands including Havoline, Kendall and Quaker State, and what are often referred to as “gas brands,” including Citgo, Exxon Superflo, Shell Formula, Gulf, Sinclair and Sunoco. There is also a group of boutique brands such as Amsoil and Royal Purple, as well as a large group of private-label motor oils.

Although there is plenty one can say about the dynamics within each of these groups, the competitive hot spot continues to flare between the majors and private-label PCMO.

It’s little secret in the lubricant business that the major brands and private label are slogging it out. At one time, private label motor oils were no more than small players on a big field, mainly store brands at retail outlets. Now many have stepped up their game, selling under the brands of lubricant distributors and capturing the attention of a growing number of fans.

In the minds of many, the success of private label lubricants can be summed up in one word: price.

The most visible example of the price disparity is seen with motor oils on the shelves at big box stores. Where Walmart’s Supertech conventional motor oil, for example, is priced at $2.78 a quart, the average price for the major brands is $4.08, or $1.30 more on average. This means consumers are looking at a $6.50 decision if five quarts are required for an oil change.

An even wider gap is seen at auto parts stores, where the price difference between private label and brand leaders averages close to $3.50 a quart.

But that’s retail, and those stores represent an estimated 20% of sales and a shrinking class of trade for PCMO in the United States market. A more significant area where price is swinging volume to private label is seen with lubricant distributors.

Distributors can source semi-synthetic private-label PCMO from independent manufacturers at prices in the range of $4.00 to $5.00 a gallon in bulk, and it doesn’t take much looking to find some manufacturers moving product for less. These prices contrast sharply with an average of close to $7.50 a gallon for major brands and even more for brand leaders. Such gaps have and continue to be leveraged to draw installers to private label.

In addition, an increasing number of marketers are adding private label to their line cards in an effort to increase margins and ensure control of the brand.

With such large price gaps, it’s hard to argue that the success of private label has not been driven by low-price strategies. But there are other factors at play, and quality is one of them.

As with many private label products, these oils historically were perceived as off-brands—no-name, low-price, lower-quality alternatives to the major brands. While sometimes this was deserved, they have come a long way.

Today, most private-label PCMO manufacturers source raw material from the same suppliers as the majors and formulate products to meet or exceed the same standards. Furthermore, some are manufactured at state-of-the art plants, and a number of blenders are very large enterprises with significant buying power and sophisticated management, marketing and distribution. Although there are still some bad apples in the basket (who could spoil it for the whole bunch), the real and perceived gaps separating major brands from private label have compressed.

But there is more to their success, and that is trust. Consumers generally trust the quality and product integrity of brands with which they are familiar and that have high visibility. Although it took decades and untold millions in marketing to build, ecommerce, social media and online product reviews accelerated the process and have eased the way for private label to more readily and economically build trust and gain visibility.

Furthermore, both trust and the mark of quality are migrating from the manufacturers to the behemoths in both brick-and-mortar and online retailing. Such titans in the industry as Walmart, Amazon, Costco and others have the buying power to assure consistent quality of their private label motor oils at discount prices. In addition, as gatekeepers of their stores, they have the place to promote other private label products.

So, from a marketing perspective, the accelerated growth in private label has come about by working all the “Ps” in the marketing mix: product, place and promotion—but price remains their strongest suit. Although there is evidence that the majors are willing to move prices and reposition products to be more competitive with private label, without decreasing the price gap or creating more real or perceived distance between their offerings, it’s likely that more players from the ranks of private label will be called up to the big league.

Tom Glenn is president of the consulting firm Petroleum Trends International, the Petroleum Quality Institute of America, and Jobbers World newsletter. Phone: (732) 494-0405. Email: tom_glenn@petroleumtrends.com