Palm Oil Industry Looks to H1 to Boost Sales in the West

Southeast Asia’s palm oil mills and refineries are turning to food-grade lubricants in a bid to make their products more attractive to Western markets.

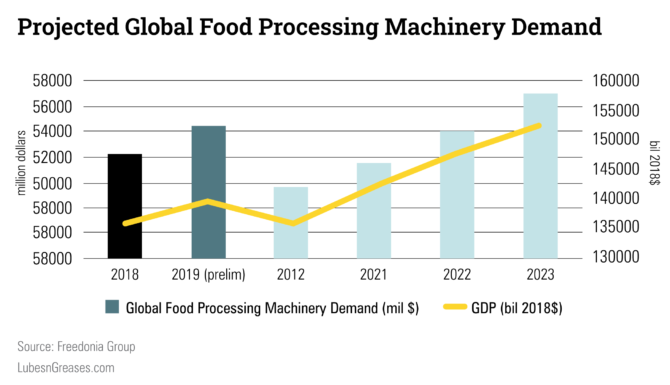

Global demand for food processing equipment has been rising fairly steadily over the past two decades. According to the Freedonia Group, demand for such equipment will continue to climb from $52.2 billion in 2018 to $57 billion in 2023, despite the setback of the covid-19 pandemic. Industry in Southeast Asia is poised to take advantage of the growing appetite evidenced by this trend, including providing the palm oil that goes into a large number of processed foods.

But selling to lucrative Western markets requires some adaptation. European consumers, in particular, are concerned about the presence of mineral oil saturated hydrocarbons and mineral oil aromatic hydrocarbons, also known as MOSH and MOAH, in processed foods. Their presence can come from many sources, including lubricants used in food processing. Some studies have suggested that MOSH may cause liver damage, and some fractions of MOAH are carcinogenic. Industry experts say these hydrocarbons can get into palm oil at the harvesting stage, in the mills and in refineries.

Malaysia is the second-largest producer of palm oil, following Indonesia. “There are about 500 palm oil mills in Malaysia, and 90 percent of them are not using food-grade lubricants,” said Norman Kum, CEO of Sumber Petroleum Cemerlang Sdn. Bhd., an industrial and food-grade lubricant manufacturer in the country. “If contamination happens, people will lose jobs, and there will be branding and legal implications. The Philippines and Indonesia are also getting the pressure.”

|

“If you use food-grade lubricants, this helps with the safety of the final product and the safety of the consumer—certainly a must for the producers, and it will support their hazard analysis and critical control points and good manufacturing practice programs.”

– Andreas Adam, Fragol AG

|

The mills are upstream in the palm oil industry. “If there is contamination in the upstream, even if the downstream refineries like edible oil producers comply [with use of food-grade lubricants], but the actual raw material does not comply, there will be a problem. I think European food manufacturers like Nestle are going upstream to the palm oil producers like the mills,” and asking them to lower MOSH and MOAH levels, he added.

“If you use food-grade lubricants, this helps with the safety of the final product and the safety of the consumer—certainly a must for the producers, and it will support their hazard analysis and critical control points and good manufacturing practice programs,” Andreas Adam, international sales director for German industrial lubricants company Fragol AG, told Lubes’n’Greases.

However, Adam has stated that it is impossible to make mineral oil based lubricants that are completely free of MOSH and MOAH. “If you use food-grade lubricants and do not change anything in the working practice, you will continue to find MOSH and MOAH from lubricant in the final product,” he cautioned.

“There must be a work process to maintain proper records of how much food lubricants are used, disposed of and leaked—although there is not supposed to be any leakage,” said Kum.

“Malaysia is the second-largest palm oil producer in the world, and there is a tremendous amount of cooking oil produced. Many years ago, some producers did not care. There was hydraulic oil leaking into the product,” Kum continued. “Some of the bigger producers exporting, however, have been forced to change to food-grade lubricants. We see people changing to food grade, and we still hold many education programs.”

One company that has made the change is Malaysian palm oil company United Plantations Bhd. “Regulations from EU member states such as Germany quite often end up being adopted by greater Europe—a trend which we have seen in the past. Currently, customers favor suppliers whose thresholds, through consensus, are guided by the rule ‘as low as reasonably achievable,’” said the company in its annual report two years ago.

The chemicals are not currently regulated in Europe, but the European Union has established a monitoring program, and the German government is considering proposals that would set limits on their levels in food and require measures aimed at preventing their migration into foods.

In 2018, the United Plantations set up a MOSH and MOAH mitigation task force chaired by its chief executive officer to look into the production processes in their mills and refineries. “We have various procedures in place to try and minimize various contaminants that may be found. [Products are] now able to meet stringent customer demand for oils used in the production of infant formulas. We are committed to further reduce the levels of these contaminants to the benefit of customers globally,” Martin Bek-Nielsen, executive director of United Plantations, told Lubes’n’Greases.

The company declined to elaborate further, but said it is monitoring levels internally. The group is involved in the upstream and downstream of palm oil production and has a total of 43,000 hectares of plantations in Malaysia and Indonesia.

Similarly, a spokesperson for Musim Mas Holdings, headquartered in Singapore with plantations in Indonesia and refineries in the region, told Lubes’n’Greases, “There is currently no legislation regarding mineral oil hydrocarbon contaminants in foodstuff. But having worked with the customers with headquarters in Europe that requested higher levels of quality control, our operational team adopted a proactive approach in optimizing our output for health and quality.”

“As a large, vertically integrated corporation, we can focus and coordinate relevant resources on the needs of the customers to optimize the overall performance of the chain. Managing the quality of our operations starts from the fresh fruit bunches that go into our mills, and then monitoring the quality of the product through the chain,” she added.

MMH has been working since 2018 to lower mineral oil hydrocarbon levels in their products by evaluating its logistics, machinery and refining processes. “The team has been able to deliver according to customer requirements by identifying several contaminant sources early in our sourcing and manufacturing processes,” the spokesperson said. “We followed the machine manufacturer’s recommendations on the type of food-grade lubricants suitable. Still, where it isn’t an option, we replaced the machines with models that can work with food-grade lubricant oil.”

“The use of food-grade lubricants was one major area we identified, and to lower MOH levels even further, our team made far-reaching changes to our processes, too,” she continued. “It is an essential factor that Musim Mas is an integrated supplier of palm oil, meaning we control the harvesting, transportation and production of our palm oil.”

The lack of knowledge of food-grade lubricant applications is not limited to the palm oil industry. Local companies like one syrup manufacturer believe using non-food-grade lubricants is not an issue. “They say that [their company] has been around for more than 30 to 40 years and nobody dies from their drinks,” said Kum.

On the other hand, he noted that there are companies paying the price of a food-grade lubricant, only to find out when clients inspect their plants that the lubricant is not actually registered or certified as food grade.

|

“Demand for low mineral oil hydrocarbons will drive supply, and the industry will develop ways to push for higher quality of products.”

– Norman Kum, Sumber Petroleum Cemerlang

|

Only two organizations in the world register or certify food-grade lubricants: Sweden’s 2Probity and United States-based NSF International. The United Kingdom’s InS Services Ltd., which ran its own program, was acquired by NSF last year. These independent organizations evaluate and register H1 lubricants according to U.S. Department of Agriculture guidelines. Lubricant production plants can also obtain ISO 21469 certification, which includes an annual audit with product testing to ensure continued compliance.

H1 lubricant formulations are registered as safe for incidental food contact, based on submitted formulations. “This is a U.S.-based system and is widely adopted in the industry because it is the only system available,” said Fragol’s Adam. “It is not accepted in the EU, but it is a good marker in any HACCP [hazard analysis and critical control point] and GMP [good manufacturing practices] program that all foodstuff producers will have.”

According to Adam, in 2013, a German consumer organization published a report that MOSH and MOAH had been found in chocolate. “The effect on the food producing industries was a serious one. The chocolate sales over Christmas dropped severely, in some cases by 25 percent, and producers of food were forced by their customers to deliver MOSH- and MOAH-free products under pressure of public sentiment.”

Some lubricant suppliers have even received requests from their customers for MOSH- and MOAH-free lubricants, Adam chuckled.

“Mineral oil in lubricants is being blamed,” Kum said, “but in the highly refined base oil for food lubricants, carcinogenic elements are already removed with [refining] technology [introduced] about 30 years or so ago and proven to be safe for incidental contact of a maximum level of 10 parts per million.”

However, “there is still much discussion on what the actual threshold limits are for MOSH and MOAH, and before any firm figure is announced and agreed upon, we have our internal targets and various procedures in place to try to minimize contaminants,” said United Plantations’ Bek-Nielsen.

“While we cannot comment for the entire industry, we find that in general, the major consuming countries of palm oil have started to take note of the minute presence of mineral oil contaminants. Demand for low mineral oil hydrocarbons will drive supply, and the industry will develop ways to push for higher quality of products, as with the industry’s commitment to continuous improvement in general. Our peers in the region may look to change to food-grade lubricants before they reevaluate their production lines,” said the MMH representative.

Palm Oil producers in Malaysia are guided by the recommendations of the Malaysian Palm Oil Board, which is the regulatory and licensing agency for palm oil producers. “We are talking to MPOB about limits and educating them so that the mills upstream are under control with the setup of proper guidelines,” said Kum.

Lam Lye Ching is a freelance business-to-business writer and editor based in Singapore. Contact her at asklclam@gmail.com.