PAGs are learning to love their mineral oil counterparts

The lubricating benefits of polyalkylene glycols have been known for many years to developers of industrial lubricants, such as those for gas compressors and gear boxes. However, the main blocker to their wider adoption over most of their 70 years of existence has been compatibility with mineral oils.

The PAGs that show excellent performance in worm gears, for example, do not mix with mineral oils, often producing “soft cheese” texture. Therefore, customers resist their introduction, fearing lost production and expensive clean-up if a gearbox is accidentally topped up with the wrong oil.

The Holy Grail has been a relatively low-cost PAG that retains most of its performance attributes—high viscosity index, high lubricity, low volatility and excellent hydrolytic stability—while adding solubility in mineral oils or polyalphaolefins.But despite substantial research efforts in both the private and public sectors, the received wisdom was that the raw materials required to make oil-miscible PAGs were too rare, too expensive or both. So, for almost a decade, only Dow Chemical’s Oil Soluble PAGs have been on the market.

Dow has recently been joined by BASF and PCC Specialties, each touting their own mineral oil-friendly materials. Not to be outdone, Dow is also developing a new generation of products. Each company is bringing something different to the market, whether it be chemistry or marketing pitch.

Even the third edition of Leslie Rudnick’s book “Synthetics, Mineral Oils and Bio-Based Lubricants,” which was published in February, contains a new chapter called Oil Soluble Polyalkylene Glycols.

So, are we entering a new phase of PAG development?

While each company is coy about the chemistry on offer, they all state that their approach is slightly different from the others. Dow Chemical and PCC Specialties are comfortable sharing that their products are copolymers of propylene oxide and butylene oxide. However, BASF describes its products as “a hybrid structure based on a polyether.”

BASF’s new products are high-viscosity and promoted primarily as base fluids for industrial lubricants markets, such as wind turbines. Dow’s latest products are low viscosity and targeted at transportation lubricants. PCC Specialties is presenting its products as either base fluids or additives with viscosity grades in a range between the new oils from Dow and BASF.

The differences are the result of adjusting the three different parts of a PAG: the initiator, the alkylene oxide polymer backbone and the capping molecule. Changing the chemistry of the initiator and cap, or adjusting the oxide composition, length and structure of the polymer in block or random arrangements can significantly affect the properties of the resulting fluid.

Manufacturers can design products with specific tribological or rheological properties, but the oxides are extremely reactive, as evidenced by the explosion at an ethylene oxide plant in Tarragona, Spain, in January. There is a lot of skill involved in extracting a worthwhile product out of such an apparently simple mix of three or four chemicals.

Energy Efficiency

Frank Rittig, technical marketing manager for BASF, based in Ludwigshafen, Germany, explained to Lubes’n’Greases, “the name EEBs [energy-efficient base stocks] of course implies the major use as a base stock.” Typical applications for these PAG fluids are industrial gear oils, high-performance axle fluids, compressors and greases.

“Our benchmark during the developmental phase were PAOs, but also other [API] Group V oils like PAGs and their use in top-tier lubricants.” BASF’s two products, Synative EEB 45 and Synative EEB 130, are slightly more viscous than ISO 320 and ISO 1000, respectively. BASF began selling both products this year.

In a presentation at the 22nd International Colloquium on Tribology organized by the Technische Akademie Esslingen, Rittig emphasized the energy savings that are possible by switching to his company’s products for certain applications. Four ISO 320 gear oils were compared using a ZAE worm gear efficiency test rig. The formulations based on BASF’s EEB products showed efficiency improvements of over 2% relative to a commercial PAO-based formulation.

“The main benefit [of EEB use] is a reduction in friction, which translates in day-to-day usage into a reduction of energy and fuel consumption and less greenhouse gas emissions,” said Rittig. “The EEB products show a significantly higher viscosity index versus PAO, for example,” which also aids energy efficiency at low operating temperatures. The high viscosity index and mild anti-wear performance of the EEBs—PAGs are attracted to metal surfaces due to their high oxygen content, forming a protective film—also enhance durability. “We see benefits in wear scar,” he added.

Rittig’s presentation at the January colloquium included a lifecycle assessment of different oil chemistries in a gearbox. The use phase dominates results relative to production and disposal, so the reduced friction of EEB-based formulations translates into reduced carbon dioxide emissions and a lower lifecycle impact than PAO-based formulations.

It’s not all about heavy industrial lubricants, though. “Usage in metalworking fluids and as a booster additive should not be neglected,” said Rittig. “We have done development work in these areas and showed that the EEBs can boost Group I to III oils [toward] PAO performance regarding friction and wear.”

Return to Crankcase?

Dow Chemical’s Martin Greaves also presented at the Esslingen colloquium, but the title of the talk—“Ultra-low-viscosity Polyalkylene Glycols for Transportation Lubricants” —indicated that Dow is taking a radically different approach with its Ester-capped Oil Soluble PAGs. These products allow crankcase formulators to access low volatility at low viscosity—3 and 4 centistokes at 100 degrees Celsius.

For hydrocarbons, such as mineral oils and PAOs, lower viscosity is mainly a consequence of lower molecular weight. The downside is higher volatility, as the forces between molecules in the liquid are relatively weak, so the mass of the molecule strongly influences whether it escapes into a vapor. Polar base fluids, such as esters and PAGs, have stronger intermolecular forces, so these require more energy in the form of higher temperatures to induce the same levels of evaporation. In this way, oil-miscible PAGs can help meet future volatility specification targets.

Dow’s first-generation OSPs are used in passenger car motor oils as friction modifiers and deposit control additives, Greaves told Lubes’n’Greases. “These oxygen-rich polymers are surface active and also function by solubilizing degradation products of hydrocarbon oils that have oxidized, thereby helping to keep equipment and the lubricant clean.”

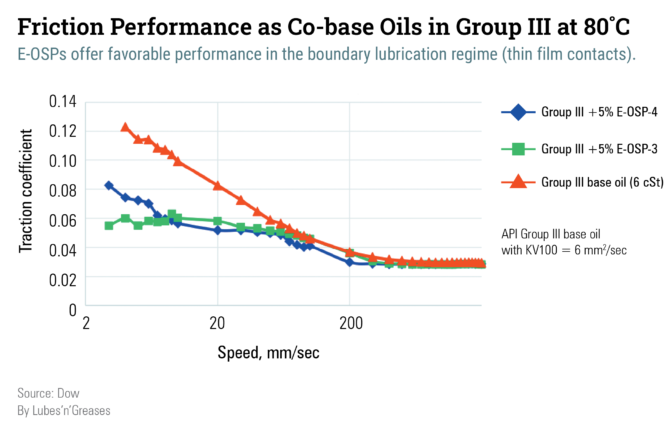

Greaves’ presentation demonstrated some of the additional benefits of Ester-capped Oil Soluble PAGs. As co-base oils with API Group III stocks, the fluids enhance viscosity index and lower the low-temperature viscosity. This benefit is also observed in formulations of Group III with either polymethacrylate or olefin copolymer viscosity modifiers.

Dow is working with development partners, which have samples of the new experimental products in field trials, “to assess their deposit control functionality, their volatility characteristics and their ability to act as friction modifiers to help improve vehicle fuel economy,” said Greaves.

A New Player Enters the Game

PCC Group is the new entrant. The group has established PCC Specialties as the customer-facing company within the group, and Hans Gerdes, business unit manager for lubricants, characterizes that company as a true start-up.

PCC Group has grown since its creation in 1993, both organically and by acquisition, from a small German commodity trader to a pan-European chemical manufacturing operation with global outlets. They offer polyglycols, phosphate esters and surfactants (mainly alkoxylated fatty alcohols, acids or amines) that can be used as base fluids, additives, emulsifiers and fire-resistant hydraulic fluids.

PCC Lubricants, which has produced both water-soluble and water-insoluble PAGs, began sending samples of mineral oil-soluble PAGs in lab-scale volumes to customers in the fourth quarter of 2019 and reports an enthusiastic response. “We are a small company, so [we] are looking to our customers to generate some of the data on performance,” said Gerdes.

PCC Lubricants seems to have found something new. “Our Rokolub PAG products show high conductivity and low electrical resistance, whilst mineral oils act more as insulators. We are now investigating whether our mineral oil-soluble PAG can improve formulations as additives to increase conductivity for, say, hydraulics or bearings that minimize electro-corrosion,” said Gerdes.

A saying in the business world holds that there’s no such thing as a bad idea, just bad timing. However, the English adage, “You wait a long time for a bus, then three come along at once,” implies that choice is not welcome in some circumstances.

Some have argued that Dow’s decade-long sole residence in the oil-miscible PAGs space was evidence of a good idea before its time. But the arrival of two new players at the turn of the year and Dow’s persistence with product development may be an indication that the time is right for oil-miscible PAGs to enter a new era as base fluids and additives outside their current niches.

What’s in a name?

Dow Chemical utilized “Oil Soluble PAG” as a marketing term, so competitors have used other terms to describe their products. PCC Lubricants, part of the PCC Group, has Mineral Oil Soluble PAGs, or MOS PAGs, while BASF refers to its products as Energy Efficient Basestocks, or EEBs.

The generic term oil-miscible PAGs is used in this article. While “miscible” implies solubility in all ratios, this is not strictly correct. It’s important to note that some products are not compatible with some base fluids under certain conditions.

Trevor Gauntlett has more than 25 years’ experience in blue chip chemicals and oil companies, including 18 years as the technical expert on Shell’s Lubricants Additives procurement team. He can be contacted at trevor@gauntlettconsulting.co.uk