When It Rains, It Pours

The world—and more specifically, the base oils and lubricants industry—can’t seem to get a break. Just when market conditions seemed to be improving, with some segments seeing a moderate demand recovery and prices stabilizing after the onslaught of the coronavirus pandemic, hurricane and typhoon season began.

In late August, the United States Gulf Coast, where several base oil and lubricant production sites are located, was threatened by not one but two hurricanes: Marco and Laura. And two powerful typhoons hit the South Korean peninsula and were expected to affect base oil production there.

Plant operators prepared for the storms by throttling down operating rates or shutting down. While Marco inflicted less damage than expected, Hurricane Laura pummeled the coast near the Texas-Louisiana border with heavy rain, a hefty storm surge and powerful winds.

One of the plants that bore the brunt of the storm’s wrath was Excel Paralubes’ API Group II unit in Westlake, Louisiana.

Aside from the structural damage brought about by the storm, the plant suffered a power outage, and there was speculation it could take weeks for the power to be restored after substantial damage to the power grid.

Once power is restored and any damage to the plant is repaired, transportation problems may arise from impassable roads and restrictions on railroad usage, limiting the producer’s ability to ship product.

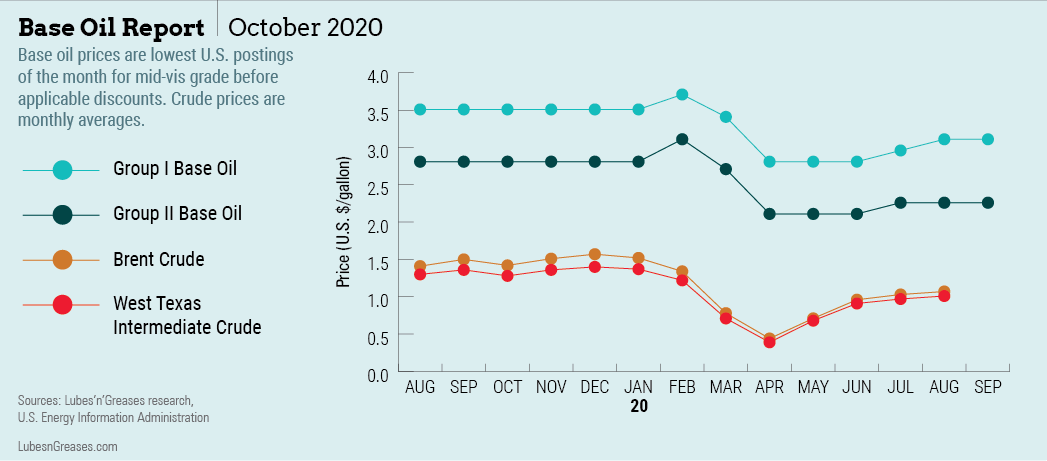

Motiva’s Port Arthur, Texas, Groups II and III plant was also shut down ahead of Laura, but resumed production shortly after the storm. Given the tight supply situation from the output disruptions coupled with firm crude oil and feedstock prices, Motiva stepped out with a posted price increase in early September. The initiative called for 15, 20 and 25 cents per gallon markups as of September 7. Several other suppliers, including Chevron, Calumet, HollyFrontier and Petro-Canada, also announced increases of between 15 and 30 cents shortly thereafter.

Group II supplies were likely to remain tight in the U.S. given healthy export activity from June to August and moderate domestic demand.

The repercussions of the severe weather, together with lingering issues related to the pandemic, were expected to be a game changer during the last quarter of the year, requiring suppliers and buyers alike to swiftly adapt to the evolving market conditions.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com.