Feeling All at Sea

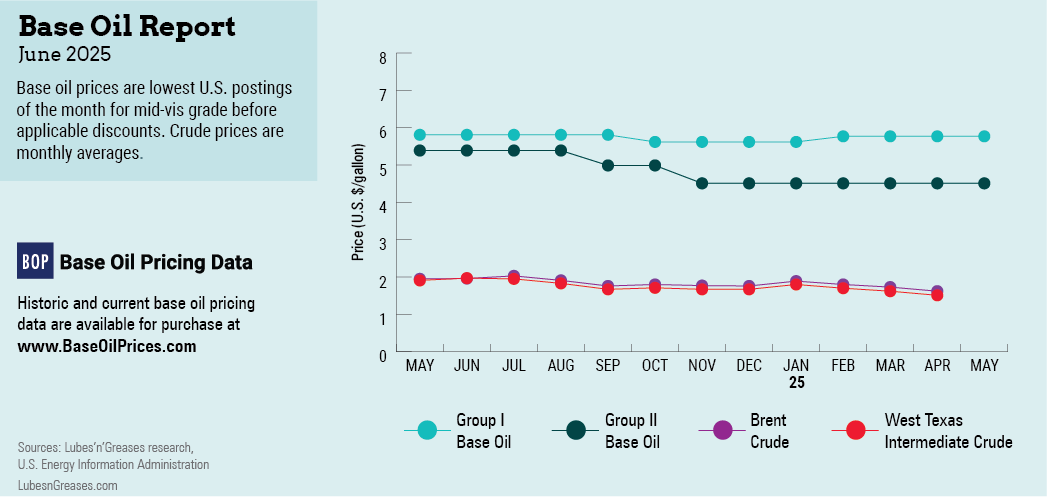

Amid a tempestuous sea of trade tensions and tariff announcements, posted prices for paraffinic base oils offered an isle of stability, until a producer announced a decrease in mid-May. Values had been steady since early February, when the last posted price increases had been introduced, and most producers appeared reluctant to rock the boat.

Refiners’ margins had eroded significantly by the end of 2024 and beginning of 2025, but significantly weaker crude oil and vacuum gasoil values since April led to a slight improvement, which producers hoped to maintain by keeping base oil prices largely unchanged. A tighter supply and demand scenario on the back of a string of plant turnarounds offered support to prices and partly offset the downward pressure coming from the feedstocks side.

However, in mid-May, Chevron stepped out with a 35 cents-per-gallon posted price decrease on its API Group II base oils, effective May 13. The adjustment was thought to be driven by lower crude oil and feedstock prices, along with prospects of improved supply given that the company was heard to have restarted its plant in Pascagoula, Mississippi, following a turnaround and a catalyst change that was expected to increase the plant’s yield. There were no other announcements by the publishing deadline.

Similarly, naphthenic base oils succumbed to the downward crude oil pressure in early May. Producers Ergon, Process Oils (which markets Cross Oil’s products) and San Joaquin Refining stepped out with a 20 cents/gal decrease, to be implemented May 9-15 on all pale oils, except transformer oils.

Naphthenic base oil prices lacked some of the supply and demand support that paraffinic prices seemed to enjoy, perhaps because there were no turnarounds to curtail supplies and some grades lengthened on the back of lackluster consumption from segments tied to the automotive industry. The light-viscosity grade enjoyed healthy buying interest, but the heavy grades, which typically see a pickup in demand from the rubber and tire industry ahead of the summer driving season, seemed to languish rather than flourish, likely because of tariff-related disruptions in automotive production rates. Additionally, suppliers actively tried to pursue export opportunities to Europe, Latin America and Asia to help reduce growing domestic inventories.

In contrast, several paraffinic plants underwent turnarounds between March and May, including those of Chevron, Ergon, Calumet and Motiva, while there were indications that Excel Paralubes was running its API Group II plant at reduced rates for most of that period.

As observed since the beginning of the year, fundamentals in the Group I category remained fairly snug, with the SN500 grades and bright stock showing strained conditions and firm prices on reduced output in most regions.

Tight Group I supplies persisted in Europe and Asia following permanent plant closures in recent years, including units in Japan and Italy, along with ongoing turnarounds at a number of plants. This situation had triggered inquiries for U.S. Group I supplies for export to Europe and Africa.

As mentioned above, Group II grades were balanced to snug in the U.S. because of reduced production levels and plant turnarounds. The 100N cut was on the tight side, while the mid-viscosity 220N grade showed some length. Rerefined light grades had also tightened, helping support pricing. The 600N appeared to be well-balanced against requirement levels, with no extra barrels for export, but no shortage to cause concern either. The completion of maintenance programs by the end of April or early May was expected to allow for more product to be reintroduced into the supply stream.

In the Group III category, the restart of Petro-Canada’s Group III plant, following a turnaround, and reduced demand for factory-fill lubricants from the automotive industry started to exert downward pressure on spot prices in early May.

At the same time, some price support came from decreased Group III production at U.S. facilities as producers switched to higher Group II output. There had also been more limited import volumes in the previous months, and several turnarounds at Group III facilities in Asia and the Middle East were expected to curtail availability.

Concerns about tariffs on imported base oils seemed to be partly assuaged by reports that South Korean imports would not be subject to tariffs as base oils fall into the energy commodities category, which are exempt, and this could also be the case for Middle East imports. Canadian base oils can enter the U.S. without tariffs as long as the products are compliant with the U.S.-Mexico-Canada Agreement (or USMCA), and this seemed to be the case for U.S. products moving to Mexico as well. Unfortunately, difficulties in extending or renewing Mexican import licenses for U.S. base oils were expected to thwart the conclusion of some export transactions.

Downstream, lubricant and finished products manufacturers were facing price pressure because of tariffs on certain raw materials and the climbing cost of some inputs, particularly additives, which were expected to be increased in May. Competition among suppliers was thwarting efforts to improve margins, and blenders were therefore expected to resist the additive increases as these would squeeze margins even further.

The summer driving season starting on Memorial Day at the end of May may boost base oils and lubricants demand, but participants have generally tempered their expectations as ongoing trade tensions and economic uncertainties were anticipated to dampen consumer spending and travel.