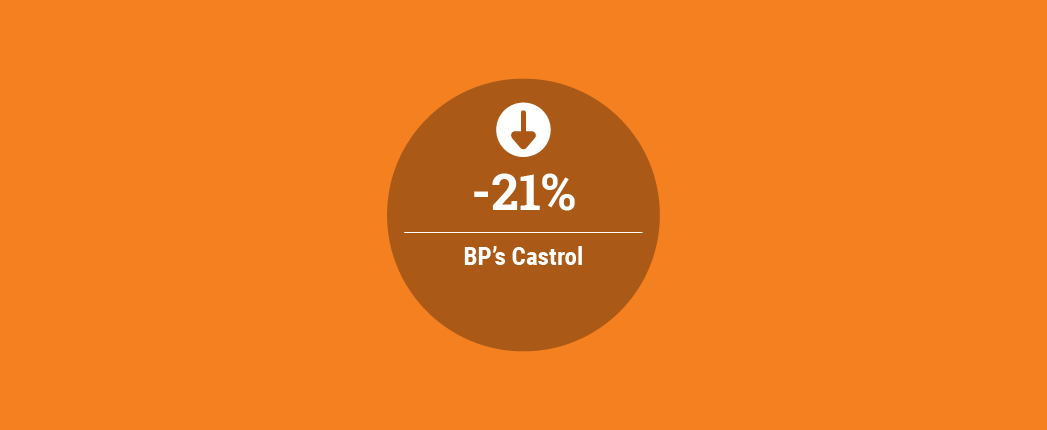

BP reported that the underlying replacement cost profit before interest and tax for its Castrol lubricants business climbed 27% in 2021, driven by growth in premium product sales and growth markets, but dropped 21% in the fourth quarter because of additive shortages and higher base oil prices.

London-based BP said that its Castrol unit reported an underlying replacement cost profit of $1 billion for the 12 months of 2021, improving from $818 million in 2020.

For the fourth quarter, the lubricants unit turned a profit of $207 million, off from $262 million in the same period of 2020. “

“Castrol’s result in the quarter was lower than 2020 with the benefit of higher volumes more than offset by the impact of significantly higher industry base oil prices and continuing additive shortages,” BP said in its stock exchange announcement. “The full-year result was stronger than 2020. Premium volumes grew, and growth markets delivered material earnings growth despite the impact of significantly higher industry base oil prices and additive shortages.”

In its first quarter 2022 guidance, BP noted that, “In our customer businesses we expect product demand to remain impacted by ongoing uncertainty around COVID-19 restrictions and continued additive supply shortages in Castrol.”

Overall, BP rebounded in 2021, posting a $7.6 billion profit, compared to a $20.3 billion loss in 2020. For the fourth quarter, the company turned a $2.3 billion profit, a 71% improvement from $1.4 billion.