Russian lubricant manufacturers are slashing investment, staff and marketing projects during the Covid-19 pandemic in favor of digital incentives, according to an industry survey.

The June issue of the Monthly Lubricants Business Monitor also reported that end users are transitioning to online orders, that lube distributors are struggling all segments of lube demand are expected to decline this year.

Published by Moscow consultancy B2X, the report is based on information gathered from key Russian lubricant manufacturers, importers and distributors. It provides general information about sales trends as well as forecasts of company sales, profitability and accounts receivable.

The June issue is based on a survey conducted May 12-22, when respondents were asked to comment on the first four months of 2020. Russia enforced a lockdown on March 30 due to the pandemic, while the gradual reopening across the country started on May 12.

The consultancy contacted 13 Russian lube manufacturers, five importers of foreign brands, four foreign companies with localized production in Russia and 20 distributors. Together these entities account for 64% of volume sales by producers and importers in the country. They are located in six regions of Russia and market a total of 30 lubricant brands.

B2X found that during the pandemic, lubricant sales by Russian online stores have increased. In contrast, 83% of operators of auto parts stores reported sales decreases for the first four months, as did 71% of service stations and 90% of car dealerships.

Various Russian industry sectors experienced huge drops in lubricant demand. The largest drops were in the transportation, machinery and metal processing, construction, metallurgy and forestry sectors, according to B2X.

“The least impacted sectors are food, agriculture and energy,” the June report said.

B2X also found that market participants cut spending on marketing and staff, and slashed investments, though many companies continued to implement digital projects.

Ninety-two percent of distributors reported declines in sales, while 66 percent reported a decline in the number of clients. Asked to assess the health of the distribution business on a scale of 1 to 10, the average response was 5.1.

On average, respondents expected Russian lubricant demand to decrease 12 percent in 2020.

The consultancy also found that respondents believe competition in the Russian lube market will intensify, with 59 percent of the respondents saying they expect the sales to decline over the next three to four months, and 48 percent of them expecting a decline in profitability in the same time.

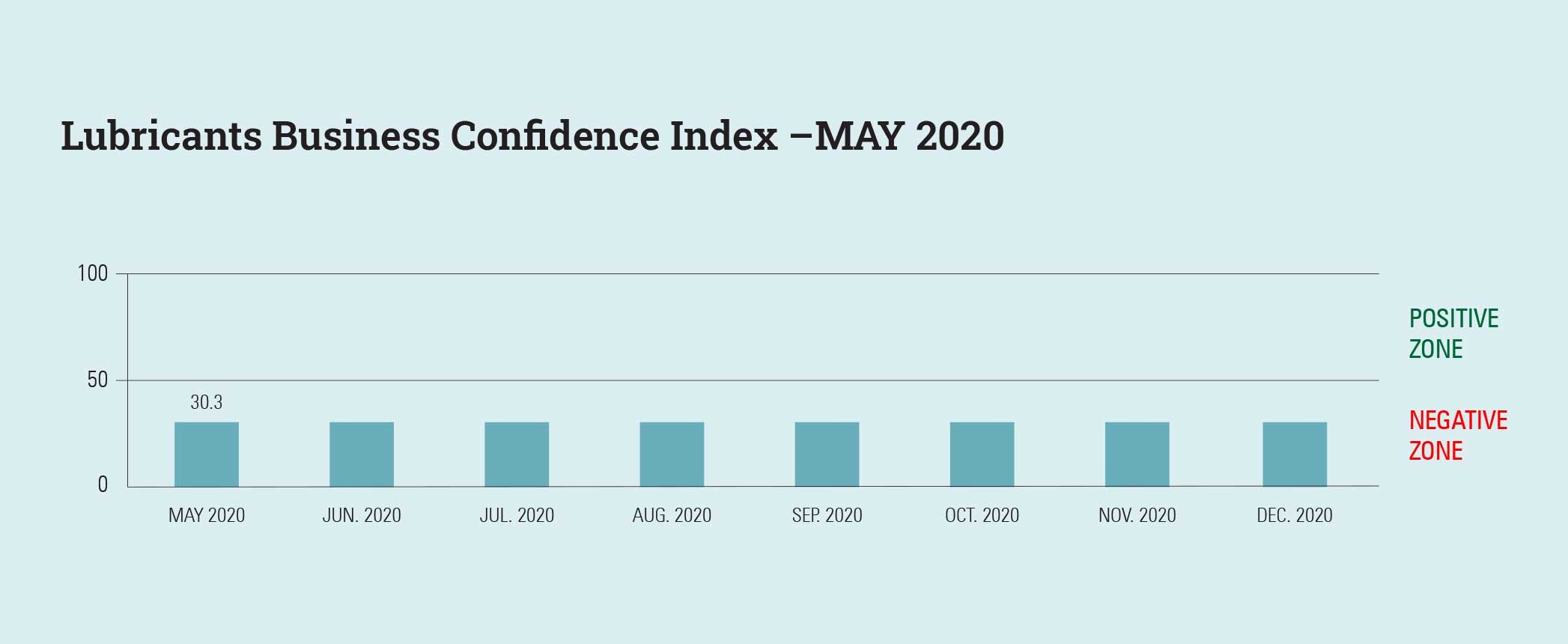

In its report, B2X established the Russian Lubricants Business Consumer Index based on indicators such as consumer, commercial and industrial demand; sales; profitability; costs and receivables. On the scale of 1 to 100, the index for May was 30.3, which reflects declining demand.