DUBAI, United Arab Emirates – Seventy-two percent of vessels are projected to use very-low-sulfur fuel oil after the International Maritime Organizations IMO 2020 regulation goes into effect next year, a marine lubricant supplier said recently.

A representative of the company, Lukoil, said the shipping industrys shortage of experience using such fuels increases the level of uncertainty about implications for marine lubricants.

Addressing Aprils Base Oil and Lubes Middle East Conference organized here by Conference Connection, Lukoil Marine Lubricants Technical Manager Sanjiv Wazir said that in a base case scenario, demand for very-low-sulfur fuel oil would be approximately 233 million metric tons in 2020. Vessel owners look set to switch to that fuel, which has a sulfur content between 0.1 and 0.5 percent, after the 2020 introduction of the controversial cap. IMO 2020 will reduce marine fuel sulfur limits from 3.5 percent to 0.5 percent.

The markets limited track record with new fuels, together with concerns over stability and compatibility, add uncertainty about how they will impact engine performance. Wazir said issues around ignition and combustion, as well as levels of catalytic fines, pose a challenge for original equipment manufacturers guidance on lubricant usage. OEMs currently suggest cylinder oils with base number ranging from 15 to 40 for two-stroke engines and trunk piston engine oils with BN of 20 to 40 in four-stroke scenarios.

We expect the market to settle around the 25 to 30 BN area, with no impact on system oil and move to 20 to 25 BN for trunk piston oils, he said. Wazir said OEMs are concerned fuel quality will vary from batch to batch, and that could prompt the use of two varieties of cylinder oil. One could cater to the low distillate fuel market and the other for higher end of the fuel market, he said. Base number is the measure of an engine oils ability to neutralize acidity during use.

Meanwhile, the use of ultra-low-sulfur fuel oil – with a sulfur content less than 0.10 per cent – is expected to reach 39 million metric tons, or roughly 12 per cent of the market. Liquefied natural gas is expected to account for 4 percent of the market.

Lukoil claims 40 BN oils currently available in the market do not produce enough detergency to handle both ultra- and very-low-sulfur fuel oil with one cylinder oil. That may drive demand for both 20 and 40 BN cylinder oils for each of the fuel market. But Lukoil believes there is a market for a versatile cylinder lubricant as the market switches to IMO 2020-compliant fuel oils.

Formulating different grades of cylinder oil on-board requires additional operations, adds complexity and increased costs for lubricant suppliers. In 2017, Lukoil launched Navigo MCL Extra, an SAE 50, 40 BN alkaline marine cylinder lubricant for low-speed, two-stroke diesel engines running on distillate or heavy fuel oil containing up to 0.5 per cent sulfur. The product is designed for use with both ultra- and very-low-sulfur fuel oils, according to Wazir. Lukoil said tests showed the products thermal and oxidation stability kept engine parts clean and that it exhibited good anti-wear properties. OEMs including MAN and Winterthur have approved the product.

Lukoil is not alone in launching so-called regulation-ready marine lubricants ahead of IMO 2020. Last year, ExxonMobil launched Mobilgard 540, which it says complements low-sulfur fuels. Chevron Marine Lubricants is rolling-out Taro Ultra 25 and 40 BN cylinder lubricants for use in two-stroke marine engines using low-sulfur fuels and operating continuously in emission control area zones.

The marine lubricants market may face additional disruption ahead of next year if more countries ban the use of open-loop scrubbers in local waters. Scrubbers allow vessel owners to use fuel with a sulfur content greater that 0.5 percent but require lubricants with a higher BN.

Caroline Huot, Cockett Marine Oils global head, lubricants said such a development will reduce demand for higher BN cylinder oils. A sudden shift to lower BN grades in order to be compliant with IMO regulations could create supply bottlenecks early next year.

With so much of global trade depending on sea freight, the pressure is on both vessel owners and marine lubricant suppliers to ensure a smooth transition. Yet, the run-up to IMO 2020 could see the industry encounter increasingly choppy waters.

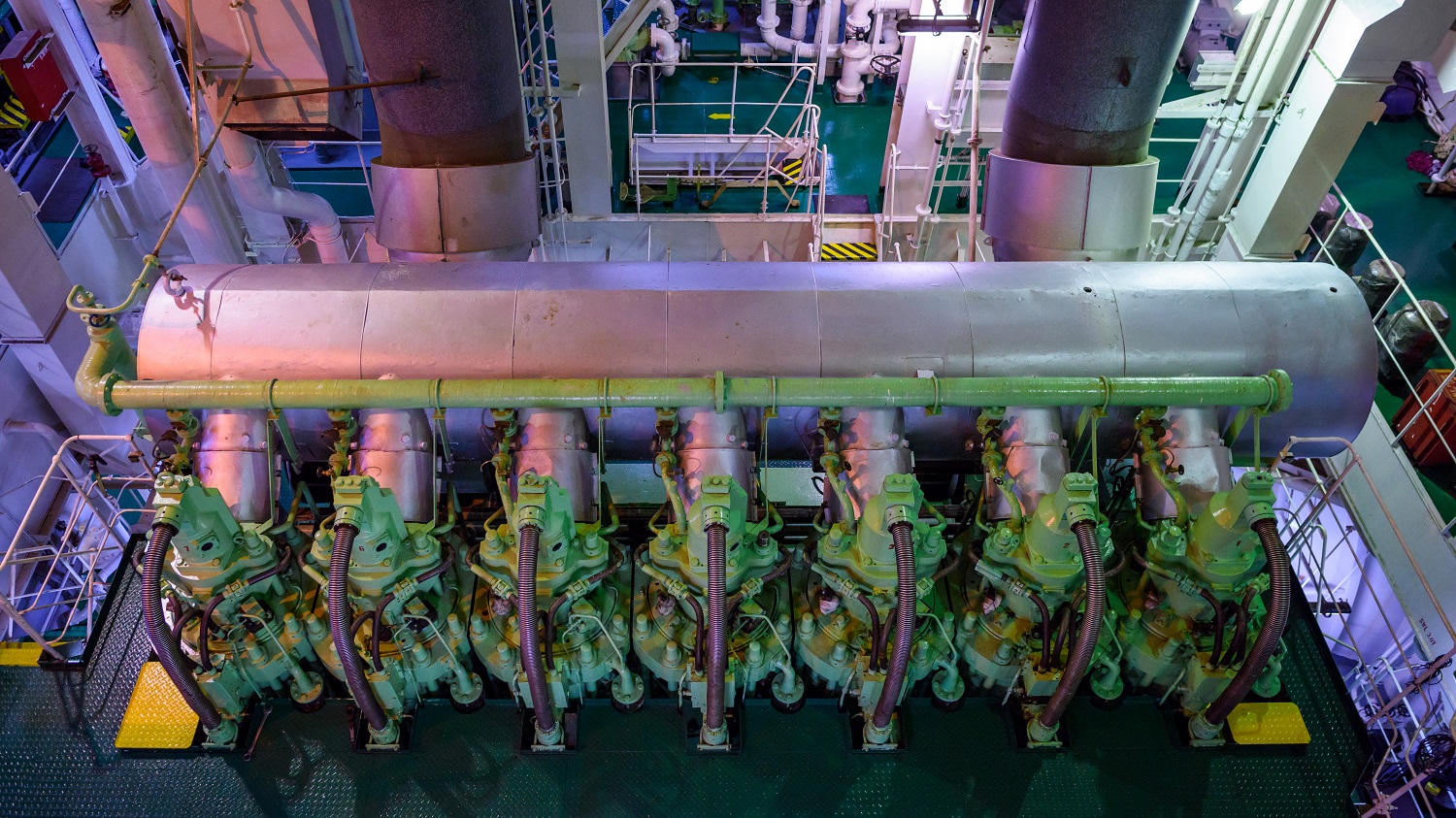

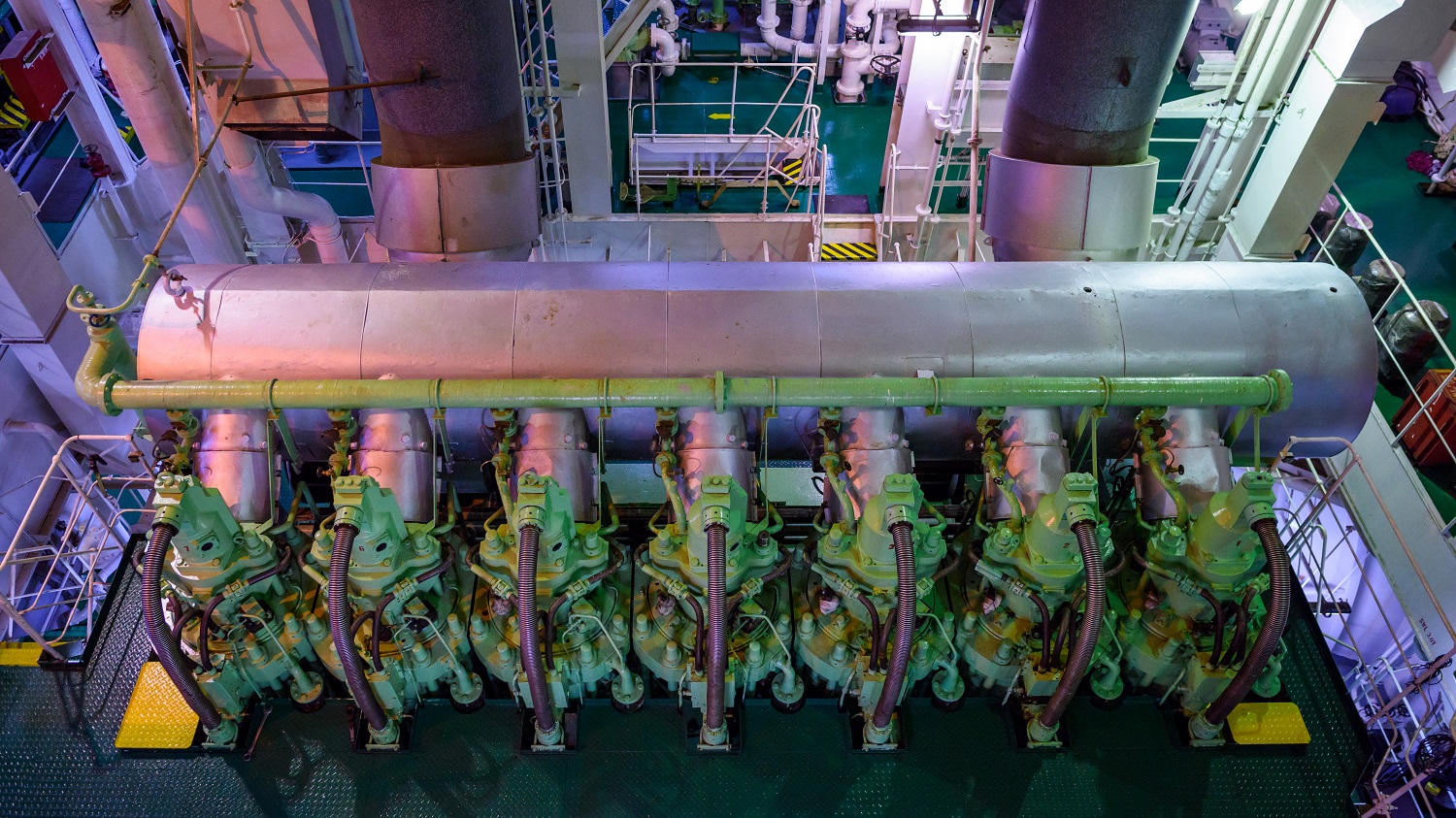

Photo: G-Valeriy/Shutterstock