South Korea’s Hyundai Shell Base Oil, the GS Caltex lube division and Thai Oil’s lube base oil business all reported much higher operating profit and sales for the third quarter, compared to the same period last year.

Meanwhile, Indian grease supplier Balmer Lawrie & Co.’s grease and lubricants segment posted higher revenue and profits for the quarter.

Hyundai Shell Base Oil

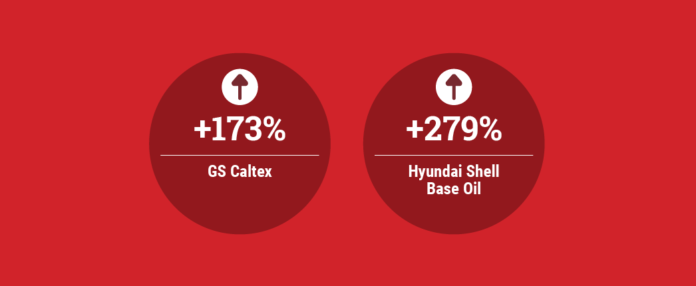

The joint venture between Hyundai and Royal Dutch Shell reported that operating profit for its base oil segment leaped 279% to 59.9 billion South Korean won (U.S. $50.8 million), improving from ₩15.8 billion in the same period last year. Sequentially, operating profit fell 35% from ₩92.1 billion in this year’s second quarter.

Third-quarter sales totaled ₩231.1 billion, improving 84% over ₩125.8 billion in the year-earlier period.

The 60-40 joint venture between Hyundai Oilbank and Shell produces only API Group II base oil at its plant in Daesan, South Korea.

Hyundai Oilbank said in its earnings presentation that the spread in the third quarter for its API Group II 150 neutral climbed around 135% to near $200 per metric ton in the third quarter, compared with $85/t in 2020’s third quarter. The spread for its Group II 500 neutral base oil reached more than $600 in the third quarter, up by about 174% from $219 in the same period in 2020.

The company attributed sequential drop in operating income to a decrease in base oil price margin, which it attributed to a refinery run rate increase, ample base oil supply to the end of its plant maintenance period and a rise in raw material prices. The company expects the base oil margin situation to remain bearish in the fourth quarter due to a strong raw materials market and seasonal impacts.

GS Caltex

South Korea-based GS Caltex’s lube division reported that operating profit grew 173% to ₩174.7 billion in the third quarter, improving from ₩64 billion in the same period in 2020.

Sales increased 60% to 481.3 billion won, up from ₩300.4 billion.

The 50-50 joint venture of GS and Chevron has capacity to produce 1.3 million metric tons per year of API Group II and Group III base oil at its plant in Yeosu and 9,000 b/d of finished lubricants at its blending plant in Incheon.

Thai Oil

State-owned Thai’s lube base oil business reported 1 billion Thai baht (U.S. $30.5 million) in net profit for the third quarter, a 177% increase from 375 million baht in the same period last year.

Lube base oil sales revenue increased 86% to 6.4 billion baht, up from 3.4 billion baht.

Sequentially, the price for its 500 solvent neutral base oil and its spread over the price for high sulfur fuel oil fell in the third quarter, compared to the second quarter, owing to higher supply since regional refineries increased their production and due to fewer annual maintenance shutdowns of regional refiners than in the second quarter of this year, Thai Oil said in its earnings presentation. However, the company noted, the base oil price for 500SN and its spread over fuel prices significantly increased compared to 2020’s third quarter, “thanks to a continuous tightness in regional supply as a result of production cut of regional refineries in response to the COVID-19 pandemic as well as annual maintenance shutdowns of regional refineries.”

According to its presentation, Thai Oil’s price for its Group I base oil – based on ex-tank Singapore price – averaged $1,329 per metric ton for 500 solvent neutral in the third quarter. That exceeded its $596/t average in 2020’s third quarter by 123% and was a slight 7% decline from $1,425/t in this year’s second quarter.

The production rate for the company’s plant in Si Racha, Thailand, slipped to 88% of nameplate capacity in the third quarter, down from 89% in the same quarter last year. Base Oil production edged down to 59,000 tons, down from 60,000.

The company operates a base oil plant with 267,000 metric tons per year of Group I production capacity. The base oils are mainly used in industrial and marine lubricants and in engine oils for older engines.

Balmer Lawrie

Grease supplier Balmer Lawrie & Co. reported that profits for its greases and lubricants segment climbed 8% to Rs 10.6 crore, improving from Rs 9.8 crore in the year-earlier period.

The Kolkata-based supplier of Balmerol-branded products said that revenue for its greases and lubricants segment jumped 44% to Rs 130.4 crore, up from Rs 90.6 crore.