Castrol India Ltd. and Gulf Oil Lubricants India Ltd. both reported lower profits and higher sales for the quarter ending Sept. 30, citing impacts of rising costs during the quarter and the related need to raise prices to manage their margins.

Profits for the quarter also dropped for India’s GP Petroleums Ltd. but rose for Savita Oil Technologies Ltd. and Apar Industries Ltd., while Sri Lanka’s Chevron Lubricants Lanka Plc and Lanka IOC both reported large improvements in profits.

Castrol India

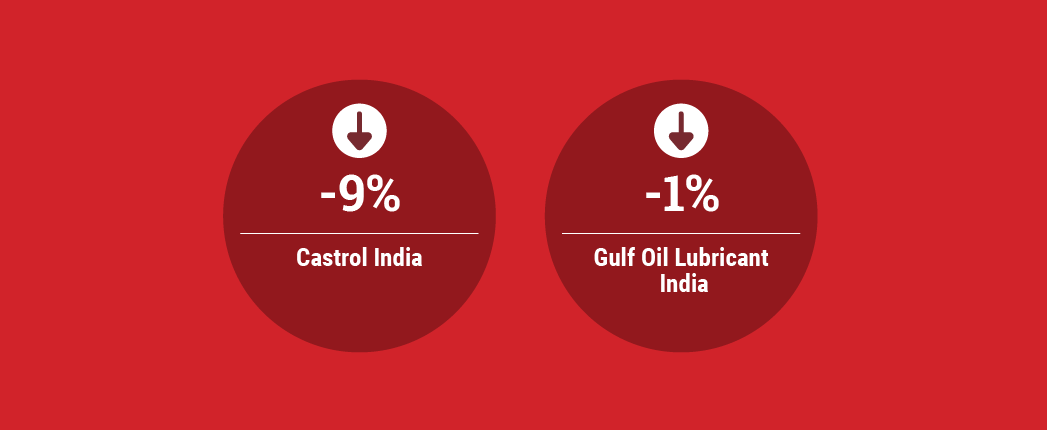

Castrol India reported profits after tax of Rs 185.9 crore (Rs 1.9 billion or U.S. $25.5 million), a 9% decline from Rs 204.6 crore in the same period last year, the lubricant maker said in a regulatory filing.

The company’s revenue increased 22% to Rs 1,073.2 crore, improving from Rs 883.1 crore. “The cost of goods sold environment continued to be very challenging due to a sharp increase in input costs,” Castrol India Managing Director Sandeep Sangwan said in the earnings news release. “We responded through timely pricing interventions and continued investment in our brands’ advertising and marketing spends to support value delivery to customers and reinforce brand salience. These measures helped us to navigate the dynamic market situation.”

Gulf Oil Lubricants India

Gulf Oil Lubricants India, a Hinduja Group company, reported net profit of Rs 58.7 crore for the quarter, 1% lower than Rs 59.1 crore.

Total income for the quarter was Rs 544.2 crore, improving 28% from Rs 425.7 crore. The Mumbai-headquartered company said revenue from operations rose 29% to Rs 533.5 crore, up from Rs 412.7 crore.

In its earnings news release, the company said that after the ebbing of the second wave of the COVID-19 pandemic in India toward the start of the quarter, business returned to near normal levels. This helped the company improve business-to-consumer sales from subdued levels in the previous quarter. Gulf Oil Lubricants India said it continued its strong volumes in the business-to-business segment, reaching an overall double-digit sales volume growth compared to the year-earlier period. “However, rising input costs and consequent margin management remained a key focus area, and the company has taken a series of pricing actions, which has progressively enabled the company to regain its margin per unit of volume sold to a large extent,” the company said in its news release.

Sales in the commercial vehicle oil segment, which benefited from strong marketing initiatives, saw double-digit growth, the company said. The higher margin passenger car motor oil segment also saw double-digit growth as urban centers saw increasing traffic in a return to normality. The company also noted a very strong showing in the industrial segment, with major growth coming from auto ancillary, general engineering, metal, cement and construction segment customers.

GP Petroleums

In another National Stock Exchange filing, GP Petroleums reported net profit of Rs 6.7 crore for the quarter, a 9% decline from Rs 7.4 crore in the same period last year.

The Mumbai-based company’s revenue from operations fell 13% to Rs 146.8 crore, down from Rs 168.4 crore. Other income dropped 85% to 3.1 lakhs. Total expenses declined 13% to Rs 137.8 crore.

The company’s manufacturing segment – which produces and markets lubricating oils and greases – posted revenue of Rs 105.7 crore, up 38% from Rs 76.7 crore. Revenue for its trading segment, which includes base oil trading activities, dropped 55% to Rs 41.1 crore, from Rs 91.7 crore.

Raw material costs doubled in the quarter, compared to the same period last year, GP Petroleums CEO Prashanth Achar noted in the company’s earnings news release, “and in that context, the performance has been heartening, with 90% recovery of the cost escalation through pricing. The environment continues to be hostile, and demand is tepid due to supply chain challenges across industries and B2C bazar trade is yet to recover,” he continued. “The re‐bounce that industry had witnessed in Q2 of last year for pipeline filling did not repeat this year.”

Savita Oil

Savita Oil – supplier of transformer oils, white oils, lubricants and other products – reported net profit of Rs 56.1 crore for the quarter, improving 49% from Rs 37.6 crore in the same quarter in 2020.

Total income for Mumbai-headquartered Savita reached Rs 698.5 crore, up 43% from Rs 489.3 crore.

Apar

Indian transformer oil supplier Apar Industries reported Rs 56 crore net standalone profit for the quarter ending Sept. 30, 23% higher than Rs 45.6 crore in the same quarter last year.

Revenue from Apar’s transformer and specialty oil segment rose 49% to Rs 718.1 crore for the quarter, improving from Rs 482.4 crore.

Chevron Lubricants Lanka

Colombo-based Chevron Lubricants Lanka reported profit of 1 billion Sri Lankan rupees (U.S. $5 million) for the quarter, improving by 27% from Rs 802 million.

Sales revenue for the quarter grew by 44% to Rs 5.2 billion, up from Rs 3.6 billion.

Operating profit increased 16% to Rs 1.2 billion in the quarter, according to its interim financial statements to the Colombo Stock Exchange.

Chevron Lubricants Lanka imports, blends, distributes and markets lubricants and greases. The company operates a blending plant in Sapugaskanda.

Lanka IOC

Lanka IOC PLC reported that its net profit skyrocketed 1,537% to 281.6 million Sri Lankan rupees for the quarter ending Sept. 30, improving from Rs 17.2 million.

Revenue for the quarter increased 10% to Rs 20.6 billion, up from Rs 18.7 billion.

In its interim financial statement to the Colombo Stock Exchange, Lanka IOC reported an Rs 268.3 million operating profit, rebounding from an Rs 146.2 million operating loss in the same period in 2020. Lanka IOC is a subsidiary of India’s public sector utility Indian Oil Corp.