South Korean refiner S-Oil’s base oil business and Hyundai Shell Base Oil both reported large increases in profits and sales revenue for the quarter ending June 30, compared to 2020’s second quarter, reflecting market recovery from COVID-19’s economic impacts last year.

S-Oil

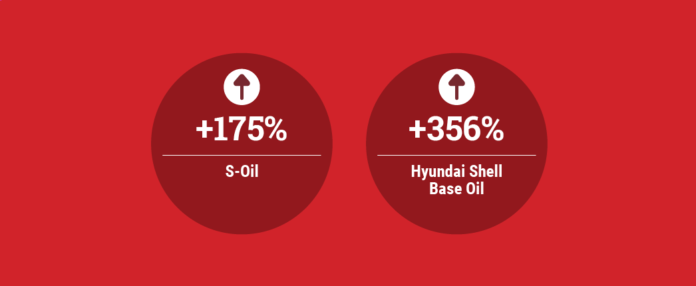

According to S-Oil, its base oil business reported that its second-quarter operating profit grew 175% to ₩284.5 billion (U.S. $249 million), compared with ₩103.3 billion in the same quarter last year. Sales revenue for the quarter jumped 143% to ₩659.5 billion, improving from ₩271.3 billion.

The company noted in its earnings presentation that with the demand recovery in the second quarter, the spreads between base oil and high-sulfur fuel oil were further widened to a record high – averaging $81.90 per barrel during the quarter, compared with $50.50 in 2020’s second quarter – as supply tightness continued, thanks to low utilization rates of global refineries and regular maintenance of base oil plants. Such fuels as high-sulfur fuel oil and diesel are alternative products to base oils. Base oils are almost always higher priced, but they lack the economies of scale that fuels enjoy and incur some additional costs so that refiners may start to shift production away from base oils even when they are priced higher.

S-Oil makes API Group II and Group III base oils at its plant in Onsan, South Korea. The spread that the company cited is an aggregated number that also entails Group I base oils.

In its third-quarter outlook, the company said it anticipated base oil spreads to remain at a high level with strong demand for high-quality Group II and III products continuing, although it noted supply tightness is expected to ease due to the return of base oil plant operations after completion of maintenance.

S-Oil reported that its base oil plants utilization rate rose to 101% during the second quarter, compared with 98.2% in the first quarter. The utilization rate was 88.4% for 2020 and 88.7% for 2019.

Hyundai Shell Base Oil

Hyundai Shell Base Oil, a joint venture between South Korea’s Hyundai Oilbank and Shell, reported net income of ₩69.5 billion for the second quarter, improving 363% from 15 billion in the year-earlier period. Operating profit for the quarter skyrocketed 356% to ₩92.1 billion.

Sequentially, the operating income slid 11% from ₩103 billion in the first quarter, which was attributed to a resurgence of the coronavirus in India, a drop in base oil plant operating rate and a decrease in demand for low viscosity base oil.

Sales grew 128% to ₩281.7 billion in the second quarter, improving from ₩123.7 billion.

The 60-40 joint venture between Hyundai Oilbank and Shell produces only API Group II base oil.

In its earnings presentation, Hyundai Oilbank noted a “bullish” base oil margin in the second quarter, a result of low base oil plant operating rates due to a weak refining margin. Maintenance turnarounds at some base oil plants tightened supply, the company said, while the base oil demand in countries, including China and India, recovered to pre-coronavirus levels during the second quarter. The company’s third-quarter outlook forecast that base oil supply will increase as plant operate rates rise and turnarounds at base oil plants end.