MUMBAI, India – The global shift to API Group II and III will continue in coming years, but India is one market that will be slower to let go of Group I, an official told an industry conference here earlier this month.

Use of Group I stocks in automotive applications is declining worldwide, and to a lesser extent in India as well, but there are certain advantages that are specific to Group I, which I believe will help sustain it in the long run, Anuj Kumar, of United States-based consultancy Kline & Co., told attendees at the ICIS Indian Base Oils & Lubricants Conference on April 6.

One of the biggest advantages of Group I stocks is that they are produced in a wide range of viscosities, said Kumar, a project manager for Klines energy practice. Group I cuts also have high solvency, which is critical in applications such as metalworking fluids and greases. Group II stocks are good in terms of viscosity index, but have less solvency.

The other factor is that there is always some sort of inertia among blenders, Kumar added. They want to continue with what they have been doing. So that may also help in continuing demand for Group I.

Cost is another significant factor, he said. In India, theres a consistent and significant price gap between Group I and other base stocks. Price remains the most important factor for buyers in India; despite changes in base oil demand patterns, a large portion of the market will remain price sensitive.

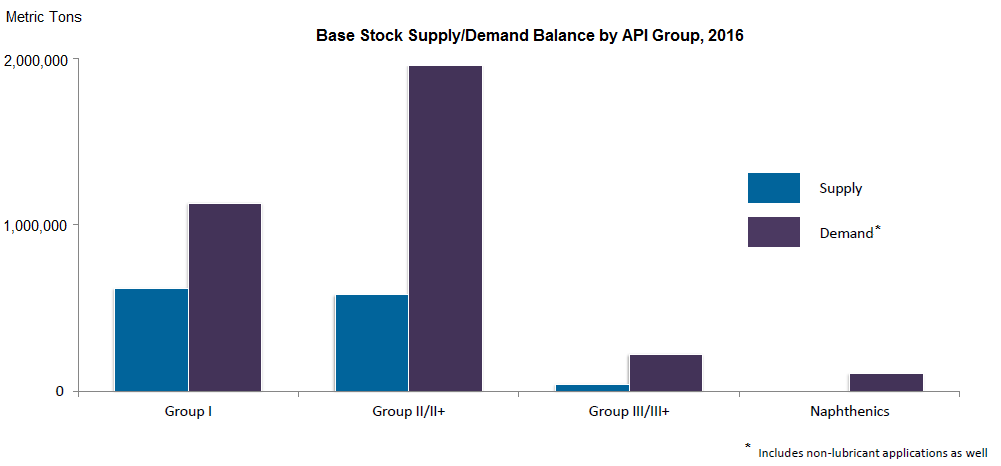

Availability also drives base stock demand in India, where domestic production of all grades of base stocks – Group I, Group II, Group III and naphthenics – is in deficit. India is a big market, he continued. The domestic supply is inadequate to meet the overall demand. So [India] imports high quantities of base stocks.

There are several viable supply options available to the Indian market for Group II and Group III base stocks – from Luberef, Adnoc, ExxonMobil and Pertamina – and these production hubs enjoy a logistical advantage due to Indias geographic location, he added. Some of the plants will have direct supply implications, while a few of them will have indirect supply implications on the Indian market, Kumar said. There is just no shortage of availability from these refineries, which include locations in Europe, the Middle East, China and Southeast Asia.

Indias production capacity for lubricating base stocks was around 1.2 million metric tons in 2016, divided among four plants operated by national oil companies, Hindustan Petroleum Corp., Indian Oil Corp., Bharat Petroleum Corp., and Chennai Petroleum Corp. Group I accounts for over 55 percent of domestic production, and is followed by Group II and a comparatively small volume of Group III.

The country annually imports about 2.5 million tons of base oils – including process oils – primarily from South Korea, the United Arab Emirates, Singapore, Spain, the United States, Bahrain, and Saudi Arabia. South Korea accounted for approximately 50 percent of Indias total base oil imports last year.

Indias bright stock market, including imports, was around 120,000 to 130,000 tons in 2016, according to Kline. The largest portion of that demand went to automotive and industrial gear oils, followed by automotive engine oils, greases, two-stroke motorcycle oils, process oils, marine lubricants and others.

Image: Kline & Co.

Changes in demand will bring about changes in production capacity, he said. Theres a definite downward trend in terms of Group I capacity, as Group II and Group III capacity rises due to higher demand, Kumar said. He noted that a few formulators may come up with alternatives to make up for the shortfall of bright stock.

Kumar projected that India will follow the global trend that sees rising demand for Group II and Group III base stocks, driven by technical demand considerations coupled with a changing supply scenario. The factors that will drive the demand for these base stocks include changing original equipment manufacturers recommendations for finished lubricants, increasingly stringent emission norms and fuel efficiency standards, and blending flexibility granted by advancements in additive technology.

Emission norms are a very big factor in India, as the country tightened emission regulations this month with the implementation of Bharat Stage IV across the country and will be leapfrogging to the BS VI standard by April 2020, Kumar said.

The finished lubricants market in India was around 2.4 million tons in 2016, according to Kline. The industrial segment was the largest category, accounting for more than 50 percent, followed by commercial and consumer segments. Process oil was the largest product category, followed by heavy-duty motor oils, other automotive oils, general industrial oils, motorcycle oils, industrial engine oils, passenger car motor oils and others.

Kumar stated that in India, Group I stocks are in high demand for applications such as heavy-duty motor oils, industrial engine oils, general industrial oils, metalworking fluids, and greases. Their usage remains moderate in PCMOs and process oils. PCMOs, HDMOs and process oils are the biggest applications for Group II stocks. However, their application in industrial engine oils, general industrial oils and greases remains limited. Group III stocks are mainly used in PCMOs, while the market for Group IV and other synthetics is very small. Naphthenics are primarily used in applications such as metalworking fluids, greases and process oils.

Group II will witness moderately high growth rates due to the shift towards better quality lubricants, he continued. Group III will grow the fastest, although from a smaller base.

India is one of the most rapidly growing finished lubricants markets, while most of the rest of the worlds demand is flat or only moderately growing. Growth in Chinas demand has decreased while India continues to grow, Kumar noted.

Indias exports of base oils are limited and confined primarily to white oils and electrical transformer oils. Last year, India exported approximately 205,000 tons of base oil-derived products to regions such as Africa, the Middle East, South America and Southeast Asia.