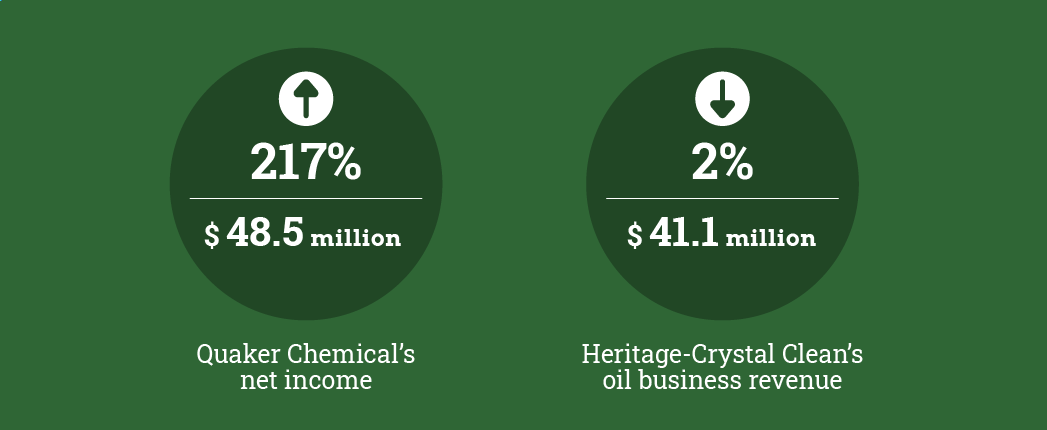

Quaker Chemical’s net income more than tripled during the fourth quarter despite a small decrease in sales revenue, while rerefiner Heritage-Crystal Clean also reported declines in revenue for its oil business.

Quaker Chemical

Quaker Chemical – also known as Quaker Houghton – reported net income of $48.5 million for the fourth quarter, up 217%, while net income for the year increased 25% to $39.8 million.

Net sales decreased 1% to $385.9 million for the fourth quarter. The company attributed the decrease primarily to a 2% decrease from price and product mix, partially offset by a 1% positive impact from foreign currency translation.

“Despite the ongoing negative impact of COVID-19, current quarter sales volumes were relatively consistent with the prior year fourth quarter, primarily due to market share gains in the current quarter and lower demand in Europe in the prior year fourth quarter,” the Conshohocken, Pennsylvania-based company explained.

“We continued to see our sales and volumes increase from the second and third quarter levels, with sequential growth in each business segment,” Chairman, CEO and President Michael Barry said in the company’s earnings news release. “We also continued to gain new business in the current quarter with net market share gains of approximately 4%. This is one of the main reasons our fourth quarter revenues were nearly flat with last year despite the continuing impacts of COVID-19. We did begin to experience some raw material increases in the current quarter, which we anticipate will continue into the first half of 2021.”

Net sales for the year climbed 25% to $1.4 billion. The net sales increase includes additional net sales from acquisitions, primarily Houghton and Norman Hay, which were completed in the second half of 2019. Excluding net sales from acquisitions, 2020 net sales would have declined 11% due to a 9% decrease in sales volumes associated with COVID-19’s negative impacts on global production levels, as well as a 1% negative impact from foreign currency translation and a 1% decrease from price and product mix.

Heritage-Crystal Clean

Heritage-Crystal Clean reported that revenue for its oil business declined 2% to $41.1 million for the fourth quarter that ended Jan. 2. The company attributed the decreased in revenue mainly to lower selling prices of its rerefined base oil, partially offset by higher base oil gallons sold during the quarter, compared to the year-earlier quarter.

The oil business segment’s operating margin improved 5.6 percentage points to 9.1% in the fourth quarter. The increase in margin was mainly due to lower fleet repairs, lower worker’s compensation expense and lower shutdown maintenance, the company said, partially offset by higher catalyst costs, compared to the year-earlier quarter.

President and CEO Brian Recatto noted the fourth quarter operating margin percentage was a record high. “Because of this strong finish to the year, we were able to produce near breakeven operating margin for the full fiscal year 2020 despite the fact that we were forced to idle our rerefinery for most of the month of May due to the negative impacts on the economy from the COVID-19 pandemic,” Recatto said.

Full year fiscal 2020 revenue was down 19% at $115.4 million. Elgin, Illinois-based Heritage-Crystal Clean’s oil business segment includes used oil collection activities, sales of recycled fuel oil and rerefining activities.