For the quarter ending June 30, Cosan’s Moove reported increases in profit, revenue and sales volume and Vertex Energy’s black oil segment – including its rerefineries and used oil collection business – posted improvements in gross profit, income from operations and revenues.

Moove

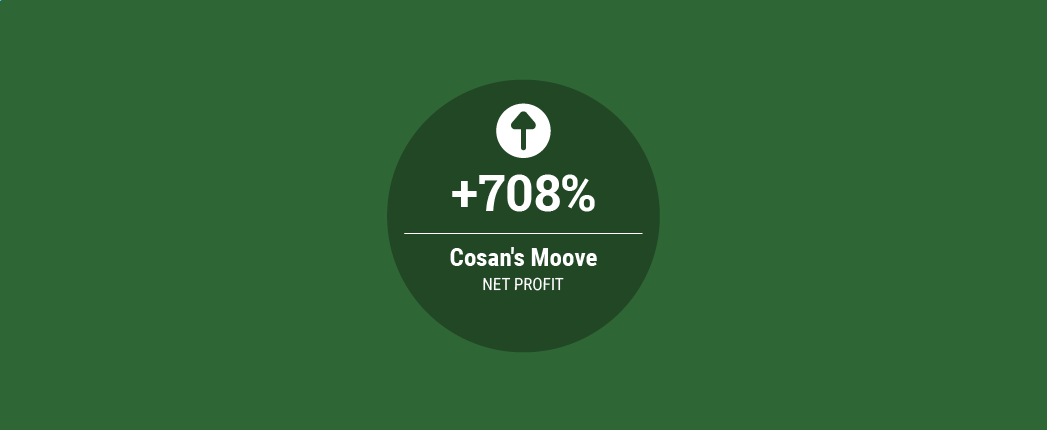

Moove, Cosan’s lubricant production and distribution arm, reported an 86.9 million Brazilian reais (U.S. $16.4 million) net profit for the second quarter, rebounding from a 14.3 million net loss in the same quarter last year. This also surpassed its 51.9 million net income in 2019’s second quarter by 67%.

Net revenue for Moove climbed about 85% to R$1.5 billion, compared with R$796.9 million in 2020’s second quarter. This also topped by 47% its $1 billion in net revenue in the second quarter of 2019.

Moove’s finished lubricant sales volume rose 54% to 101.8 million liters (92,000 metric tons), up from 66 million liters in the same quarter in 2020 and identical to 101.8 million liters in 2019’s second quarter. Cosan said sales volume grew in all the countries where Moove operates. “The commercial strategy adopted and the focus on supply chain management allowed the company to overcome the challenges of the strong pressures in raw material costs in the global market,” the company, based in São Paulo, Brazil, said in its earnings news release.

Cosan, a producer of sugar and ethanol products since 1936, expanded through acquisitions beginning in 2008 to become a distributor of fuels and lubricants

Vertex Energy

In a filing with the U.S. Securities and Exchange Commission, Vertex Energy Inc. said that its black oil segment reported $9.1 million in gross profit in the second quarter, improving from a $1.3 million gross loss in the same period last year. Income from operations reached $1.2 million for the second quarter, rebounding from a $6.5 million loss.

The company attributed the year-over-year improvement in income to “improvements in commodity prices, which resulted in improved margins, as well as reductions in operating expenses through our various facilities, as well as by diligent management of our street collections and pricing.”

Total revenue for the black oil segment jumped 199% to $34.4 million for the second quarter, compared with $11.5 million in the same period of 2020. The segment’s revenue is made up primarily of product sales from Vertex’s rerefineries and feedstock sales – used motor oil – which are purchased from such generators of used motor oil as oil change shops and garages, as well as a network of local and regional suppliers. Base oil revenue grew 163% to $12.9 million in the second quarter, up from $4.9 million.

The company said the black oil division’s used oil collection volumes increased approximately 50% year over year in the second quarter. “This increase was largely due to continued impacts of the change in shelter-in-place orders in the locations in which we collect used motor oil as a result of the COVID-19 pandemic compared to 2020, which directly impacted the generation of used oil, which caused a reduction in volumes during the prior period,” the company stated.

Vertex operates a rerefinery in Columbus, Ohio, which can produce 1,500 barrels per day of API Group II base stocks and a rerefinery in Marrero, Louisiana, that produces finished vacuum gas oil.

Clean Harbors will pay $140 million in cash to acquire Vertex Energy’s Heartland base oil rerefinery in Ohio, a second rerefinery in Louisiana and its used oil collections businesses, the two companies announced in late June. The acquisition is expected to close in the third quarter, subject to approvals and conditions.

“Safety-Kleen’s unsolicited offer to acquire our [used motor oil] collections and recycling assets for $140 million was both fair and timely, helping to further accelerate a full recapitalization of our balance sheet,” Vertex President and CEO Ben Cowart said in the company’s earnings news release. “After retiring costly term debt and other financial obligations, we expect to bring approximately $90 million of cash into our business at the close of this transaction, subject to shareholder approval. By year-end 2021, Vertex is positioned to become a pure-play refiner and marketer of renewable and conventional feedstocks.”