The United States base oil market was chugging along, faced with many uncertainties as health experts were still trying to decide whether the country was facing a second wave of COVID-19 cases, or dealing with a surge of the original round of infections.

Numerous states and counties have had to retract business openings and have reinstated stay-at-home measures amid a spike in new infections, which could ultimately lead back to reduced utilization of personal vehicles and public transportation, not to mention a further strain on the health system and a deterioration of the economic wellbeing of the country.

Against the background of a wavering market recovery, a naphthenic base oil producer announced a price increase last week, while a vast majority of paraffinic producers implemented 15 to 16 cents-per-gallon posted price hikes between June 15 and July 1.

Naphthenic base oils producer Cross Oil will be increasing its grades 30-300 SUS – or Saybolt Universal Seconds – by 25 cents per gallon, while grades 500-3500 SUS will be lifted by 20 cents/gal as of July 16.

Tightening supply and demand conditions, steeper crude oil and feedstock values, and higher operational costs were said to be behind the increase.

A couple of other naphthenic base oil producers were still evaluating market fundamentals, and had not communicated any price revisions by the time this report was published.

On the paraffinic front, suppliers said that there had been a gradual increase in requirements in June, given the easing of some of the COVID-19 related restrictions, and lubricant manufacturers had also been fairly optimistic that the market would see an upturn.

Some temporary voluntary allowances or value adjustments granted over the last two months have been retained for a select number of accounts, depending on volumes and other terms, but most have been removed as fundamentals have improved.

While nobody expected demand to attain pre-pandemic levels any time soon, there were signs that activity had started to build up. However, some of the lubricant segments that had begun to pick up the pace could be impacted by the setback in business re-openings, sources said. It was also up in the air whether lubricant and additive suppliers would seek any price adjustments on the back of the recent base oil price hikes.

The Fourth of July holiday weekend, which is traditionally a peak driving time during the summer, was much more subdued than in years past as people preferred to stay home, or travel to nearby locations.

Despite precautions taken by manufacturing facilities, the potential spread of the virus among employees could mean renewed shutdowns and reduced output, which is what had originally caused a dialing back of production when the pandemic began earlier in the year.

Demand for United States base oils from Mexico also started to mount, as light grades are used for fuel blending purposes, and increased driving was expected to result in more gasoline and lubricant consumption. However, as Mexico was also treading on tenuous ground in terms of the pandemic, it was not clear whether the increased pace would be sustained.

The state-owned producer in Mexico, Pemex, was heard to have marked up its domestic API Group I prices for July by slightly above 4 percent.

Exports to India and the Middle East had also shown an uptick, but these markets had started to slow down as buyers appeared well-stocked and were also facing demand uncertainties in their own local markets. Prices in India have gone up, but the upward trend may be stalling as immediate needs have been met, and Middle Eastern material appears very attractive, both in terms of pricing and proximity. Additionally, key segments such as the automotive industry in India were still facing a difficult outlook, as car sales have plummeted over the last three months.

In the meantime, base oil supply on the U.S. domestic front was deemed adequate to tight since several producers continued to run plants at reduced operating rates. The recent tightening may help offset the demand downturn during July and requirements may see a revival in August, sources noted.

Upstream, crude oil futures moved within a narrow range on Tuesday and closed slightly down on concerns that a surge in new coronavirus cases, especially in the United States, would delay an economic recovery and hamper fuel demand.

On Tuesday, July 7, August WTI futures settled at $40.62 per barrel on the CME/Nymex, and had closed $39.27/bbl on June 30.

Brent futures for September delivery closed at $43.08/bbl on the CME on July 7, from $41.15/bbl on June 30.

Light Louisiana Sweet crude wholesale spot prices settled at $42.01/bbl on July 6 and had closed at $41.02/bbl on June 29, according to the Energy Information Administration.

Gabriela Wheeler can be reached directly at gabriela@LubesnGreases.com.

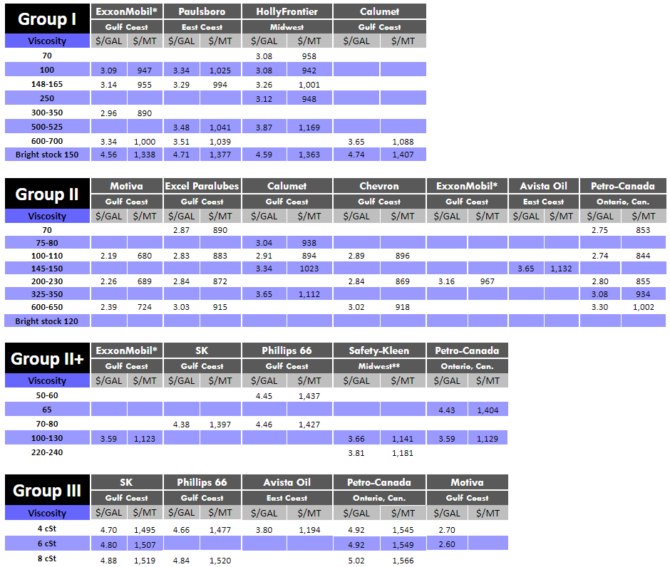

Posted Paraffinic Base Oil Prices

July 8, 2020

PLEASE NOTE: Prices for Excel Paralubes’ Group II 80N grade and SK’s Group II Bright Stock have been removed from the price table as of May 6 per the companies’ requests.

(Prices are FOB basis, in U.S. dollars per gallon and U.S. dollars per metric ton).

Lubes’n’Greases Publications shall not be liable for commercial decisions based on the contents of this report.

Historic and current base oil pricing data are available for purchase in Excel format.