January is generally considered a transitional month in that both buyers and sellers assess inventories and product needs for the coming months, with fresh business starting to be discussed in earnest in the second half of the month. Buying needs varied among blenders, as some had depleted stocks by the end of the year and others showed less of a need for immediate replenishment.

Base oil prices remained stable, but producers monitored developments on the crude oil side, with futures showing some volatility linked to the United States seizing control of Venezuelan crude shipments and ongoing geopolitical tensions in the Middle East. No further base oil price revisions were reported following several producers’ posted price decreases in December, although there were rumors that API Group II suppliers were evaluating market conditions carefully in consideration of posting decreases by two Group II producers.

Crude oil futures traded lower immediately following the U.S.’ military incursion into Venezuela and the capture of the country’s president, Nicolás Maduro, on Jan. 3, as analysts expected additional Venezuelan crude shipments to become available to U.S. refiners. However, futures moved up this week on increased tensions between the U.S. and Iran amid deadly protests and a potential disruption of Iranian oil production.

Spot base oil prices were steady this week as several suppliers had been able to lower their inventories by concluding export transactions in the last quarter, easing the pressure on pricing. The posted base oil price decreases implemented in December were driven by lackluster domestic demand—which is not atypical at the end of the year, along with plentiful inventories and a push to bring prices more in line with actual transaction prices.

While some players argued that posted prices had lost relevance and suppliers had therefore given up on posting revisions, other insiders predicted that there may be a return to more regular posted price adjustments in the new year. Posted prices are widely used as a crucial pricing tool in the industry and serve as an initial benchmark for negotiations and contracts, rather than the exact final transaction price. It is a well-known fact that buyers and suppliers negotiate discounts over posted prices for their supply contracts. While the size of the discounts varies, depending on terms and conditions, publicly announced posted prices still enhance market transparency by providing a common reference point known to all buyers and sellers. This shared information helps participants understand market trends and price direction.

Group I

Group I base oil prices were steady, despite sluggish demand from several sectors, including the industrial oil segment. However, there were expectations that blenders would start to place orders for the spring season over the coming weeks and suppliers were therefore reluctant to change prices before they could assess actual demand levels. Some buyers had already placed orders in December and were less active as a result, but others had depleted stocks and delayed purchases for as long as possible in hopes of lower pricing. These consumers were expected to resume negotiations in the next few weeks.

The Group I light grades were still showing tighter supply than the heavy grades, which see reduced consumption during the cold winter months in the Northern Hemisphere. However, bright stock was still described as snug because demand had stayed fairly robust throughout the year, and some export opportunities into Brazil had emerged as well.

Brazilian producer Petrobras’ base oils plant was heard to have suffered an unexpected and extended shutdown in October and some of its customers had not been able to receive their previously agreed volumes. A few importers had therefore tried to secure Group I grades from the U.S., and bright stock stood out as the most sought-after grade. The tight conditions of bright stock in Brazil were evidenced in steeper domestic prices for this cut, while the rest of the Group I grades underwent downward adjustments in January. Several cargoes of Group II grades had also been available in Brazil and those blenders who were able to replace Group I cuts with Group II base oils opted for doing so as prices were competitive. But this outlet for U.S. supplies could weaken as demand for base oils typically declines in January and February during the summer holidays and Carnival in Brazil.

Aside from exports to Brazil, U.S. suppliers were also able to lower inventories by concluding transactions to various destinations in Latin America, Africa, and the Middle East. In Mexico, buying interest has started to pick up and there were expectations of several cargoes becoming available at attractive prices to meet this demand, especially of rerefined grades, which competed with virgin base oils. Most Mexican importers have been able to receive or renew their import licenses, while the process was slightly delayed for some participants as government agencies were closed during the holidays.

In related market news, HF Sinclair Corp. announced on Jan. 8 that it had acquired Industrial Oils Unlimited, which will allow the company to expand its offerings in the lubricants and specialties segment. Industrial Oils Unlimited has been manufacturing high-performance lubricants for the industrial, manufacturing, metalworking, heavy equipment, and energy industries since 1970 and has seven offices in four states, according to information posted on the company’s website.

Group II

Along similar lines to what was observed in the Group I segment, the Group II heavy-viscosity grades were more readily available as demand tends to wane during the colder months.

Despite a lengthening of supplies of most grades, spot prices held at similar levels as last week because producers had been able to conclude several export transactions before the holidays and this partly relieved their inventory pressure. Cargoes moved or were slated to move to Latin America, Europe and India, although volumes shipped to the South Asian country were lower than in years past because of ample availability of most grades in Asia, competitive prices and buyers preferring to secure cargoes in closer proximity to avoid possible logistical issues, particularly as there were geopolitical issues still impacting trade routes and freight rates.

U.S. producers were also competing with rerefiners at some destinations such as Mexico. Rerefiners reported steady activity and tightening supplies as an upcoming maintenance program at a rerefinery in the first part of 2026 was anticipated to strain supplies. The producer was expected to start building inventories ahead of the shutdown and this would reduce spot availability.

Group II producers continued to monitor crude oil market developments because the U.S. military intervention in Venezuela and the seizing of Venezuelan oil tankers have led to volatility in oil prices. This came on the back of growing concerns about global oversupply conditions and declining demand, which exerted pressure on crude futures. If crude prices remained at softer levels, then it would help refiners improve base oil margins, if they are able to maintain prices steady. However, it was heard that some Group II producers had acquiesced to temporary base oil discounts to promote sales and help blenders remain more competitive.

Group III

Spot prices in the Group III segment were reported as steady, but a dark cloud still hovered over this segment of the market as it continues to teeter on the verge of oversupply. The heavy grades in particular were exposed to downward pressure because of ample supplies, with market transactions recently heard concluded at lower levels for the 6 cSt and 8 cSt grades. There were reports of 6cSt and 8 cSt spot volumes sold below the $3.00 per gallon mark. While some buyers may take advantage of these offers, others were delaying purchases in hopes of additional low offers emerging in the coming weeks, in particular if feedstock prices remain under pressure. However, there are many buyers who are not able to change suppliers because of additive compatibility issues, formulations and specifications compliance.

Domestic production of Group III grades and rerefining output were not impacting current spot prices directly as producers were using their Group III base oils as correction fluids or for downstream lubricant production. However, this domestic production has reduced the need for imports for a number of refiners who used to import more Group III for their internal lubricant production. This situation, together with increased shipments from South Korea and the Middle East in the last couple of months of 2025 led to a supply imbalance and placed downward pressure on prices. Oversupply conditions were not only present in the U.S., but in other regions as well given the start-up of new capacity.

The imported volumes in the U.S. are largely absorbed by blenders who serve the PCMO segment given the growing need for high-performance base oils. But some setbacks in the auto industry during 2025 and the trend towards electrification had also impacted demand from this segment. Group III suppliers remained hopeful that a strong spring production season would result in an increased call for Group III grades.

Naphthenics

There were no price changes reported on the naphthenic base oils front, but producers were evaluating market fundamentals as crude oil prices had been hovering at lower levels than early last year, and were even lower a week ago than when the last naphthenic price decrease took place in May 2025.

Suppliers pinned their hopes on light-grade demand increasing from the transformer oil segment ahead of the spring season, but appeared less optimistic for the heavy cuts as requirements from the rubber and tire, grease and process oil segments have been lackluster for some time. There was also much competition taking place on the export front, which limited the options for domestic producers to lower inventories by shipping cargoes outside the U.S.

However, a slight supply tightening may occur this month as San Joaquin Refining plans to embark on a three-week routine turnaround at its refinery in California in mid-January and was expected to have started to build inventories to cover contractual obligations during the outage.

Crude Oil

Crude oil futures slipped on Wednesday after moving steadily up for four days as Venezuela resumed exports and U.S. crude and product inventories rose. However, fears of Iranian supply disruptions due to deadly civil unrest and the threat of additional sanctions offered some support to oil futures.

- West Texas Intermediate February 2026 futures settled on the Nymex at $61.15 per barrel on Jan. 13, up from $57.13/bbl for front-month futures on Jan. 6.

- Brent futures for March 2026 delivery were trading on the ICE at $65.08/bbl on Jan. 14, up from $60.21/bbl for front-month futures on Jan. 7.

- Louisiana Light Sweet crude wholesale spot prices were hovering at $60.34/bbl on Jan. 12. Spot prices had settled at $59.55/bbl on Jan. 5, according to the U.S. Energy Information Administration.

Diesel

Low-sulfur diesel wholesale, Jan. 12 (Jan. 5), EIA

New York Harbor: $2.18 per gallon ($2.15/gal)

Gulf Coast: $2.04/gal ($2.00/gal)

Los Angeles: $2.06/gal ($2.15/gal)

Gabriela Wheeler can be reached directly at gabriela@LubesnGreases.com

LNG Publishing Co. Inc./Lubes’n’Greases shall not be liable for commercial decisions based on the contents of this report.

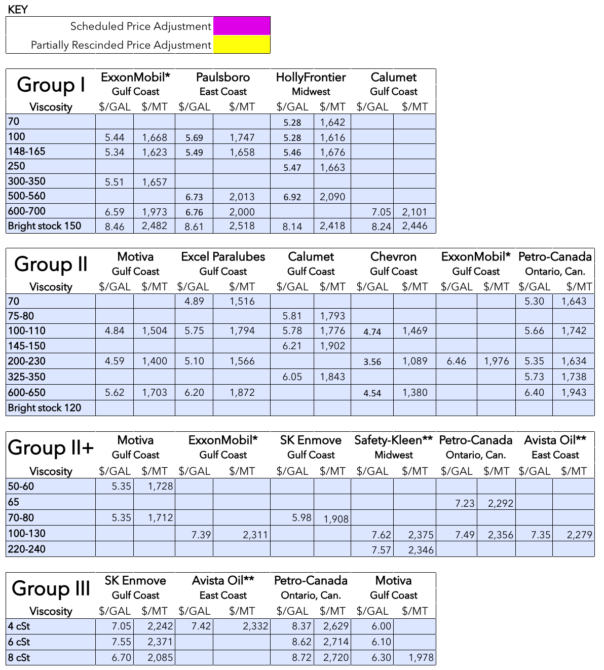

Posted Paraffinic Base Oil Prices January 14, 2025

(Prices are FOB basis, in U.S. dollars per gallon and U.S. dollars per metric ton).

Archived base oil price reports can be found through this link: https://www.lubesngreases.com/category/base-stocks/other/base-oil-pricing-report/

Historic and current base oil pricing data are available for purchase in Excel format.