The base oils market moseyed its way through the last weeks of the year, with participants reporting business at predicted levels amid expectations that demand would remain fairly muted until the spring. Prices remained under downward pressure because of ample supplies against a backdrop of slowing consumption, not only in the United States, but in other regions as well, limiting the possibility of finding a home for the extra barrels that producers were trying to clear. Crude oil prices offered little direction, with Brent and West Texas Intermediate trading within a narrow range and being stuck on their longest runs below their 100-day moving average in more than a year. Diesel prices have slipped in the U.S., signifying less of an incentive for refiners to stream feedstocks into diesel production versus base oils.

Aside from conditions directly related to the industry, such as reduced motor oil consumption due to longer drain intervals and vehicle electrification, market fundamentals have been affected by economic uncertainties linked to the trade turmoil caused by the tariffs imposed by U.S. president Donald Trump. While the levies have not yet yielded the results that the president had hoped for – such as boosting American manufacturing and jobs – they have led to steeper consumer prices and a need to subsidize farmers who have been unable to export their production. On Dec. 8, the Trump Administration announced a new U.S.$12 billion farm aid package, funded by tariff revenues, to provide one-time payments to farmers impacted by trade disputes, especially with China.

Despite the steep U.S. tariffs on Chinese imports, China, the world’s second-largest economy and the U.S.’ main economic and technological competitor, posted a record trade surplus that it achieved through exports to the rest of the world, even though its overall trade with the U.S. has declined, Reuters reported.

While 2025 proved to be a challenging year for the base oils and lubricants industry, most market players remained optimistic about the future. At the ICIS Pan American Base Oils and Lubricants conference in Jersey City last week, several presenters talked about the rerefining segment, which has gained importance in recent years because of global sustainability goals, and about developing technologies such as AI and dielectric cooling fluids required at bourgeoning data centers that might absorb a large portion of API Group III base oils supply in the coming years.

Group I

Similar conditions to those observed in recent weeks prevailed in the Group I segment, with most grades showing fairly consistent availability, and overall supplies considered more than adequate to meet domestic requirements. The heavy grades have started to show some length, but suppliers were expected to look for opportunities on the export front to reduce their stocks. Despite inventory pressure, some suppliers were reluctant to lower pricing as they did not believe this would necessarily encourage additional orders from downstream segments since fundamentals have weakened.

Buying interest was expected to remain robust in Brazil over the next few weeks as key producer Petrobras has shut down its main base oils plant for an unplanned turnaround which may last longer than anticipated. The producer appeared to be able to meet contract obligations for the time being. Despite the fact that supplies have tightened in Brazil, domestic prices were heard to have edged down, except for bright stock, which saw a small upward adjustment.

Brazilian lubricant manufacturers were hoping that additional base oil barrels would become available in the U.S. in the next few weeks, accompanied by more competitive prices as suppliers strive to reduce inventories at home. Buyers were therefore delaying commitments, but discussions were ongoing with the aim of finalizing business before the year-end holidays. There were expectations that Group III import demand in Brazil would continue to grow, as there are no domestic sources and most products need to be imported from Asia, but shipments are typically exposed to freight rate fluctuations.

Economic woes continued to impact buying appetite in Mexico, both for base oils and lubricants, and there have also been some rail and truck transportation disruptions that had affected border crossings, according to sources. Some of the disruptions appeared to be linked to protests by Mexican farmers and truckers in northern Mexico, which caused highway blockades, paralyzing major crossings, stranding thousands of railcars and trucks, disrupting trade, and highlighting ongoing instability in the area. Railroads faced massive backlogs and the inability to move goods efficiently, leading to delays that affected many industries, from agriculture to automotive.

Meanwhile, U.S. tariffs on imports have also led to economic hardship and reduced foreign direct investment in Mexico’s manufacturing sector, although many products such as base oils are exempt from duties if they are USMCA-compliant. As was the case with Brazilian buyers, Mexican market players delayed purchases in hopes of attaining more discounts from U.S. suppliers as the year comes to an end.

Group II

Last week, Chevron decreased its posted Group II prices, a move which seemed to reflect the general market conditions since growing supply levels against weaker demand exerted downward pressure on prices. It has been quite common in years past for base oil producers to lower prices during the last few days of the year or in the new year to encourage orders and release the extra inventories that had been retained during hurricane season. Availability of the light-viscosity Group II base oils has started to lengthen, but these grades were still in a tighter position than the 600N cut.

Chevron lowered the posted price of its Group II 100R base oil by 30 cents per gallon, and its 220R and 600R by 35 cents/gal with an effective date of December 2, bringing posted prices more in line with actual market levels. While other producers did not follow suit, there were reports that some suppliers were offering discounts on a case-by-case basis. Blenders, on their part, worried that buyers would be under the impression that base oil values were falling, which was not the case for the vast majority of accounts, and that this would encourage buyers to request reduced pricing.

Meanwhile, U.S. producers continued to pursue export opportunities to Latin America and Africa. India had always been a target for U.S. exports in the last quarter of the year, especially for Group II oils, but this year, buying interest from most destinations in Asia/South Asia, Europe and the Middle East has been disappointing, although some negotiations were still taking place. The sluggish demand in export markets fanned buyers’ hopes of achieving lower pricing for domestic transactions.

Rerefiners commented that domestic demand has been steady, and some even reported sold-out positions for a number of cuts. This was partly caused by a recent turnaround, while an upcoming maintenance program in the first part of 2026 was also expected to strain availability since the rerefiner plans to build inventories to meet contract orders during the shutdown. However, the reduced supply levels might be offset by weaker demand and increased domestic production during the first few weeks of the year.

Group III

Group III prices have slipped as several import cargoes were slated to arrive in the coming weeks. Suppliers were heard to have granted discounts in order to move existing stocks before the fresh arrivals.

Group III base oils consumption from the PCMO segment declined at the end of the driving season in the U.S. and has been generally down because of longer drain intervals in newer passenger car models, stricter emission standards, and fewer drivers on the road ever since the pandemic prompted people to work from home. At the same time, experts believe that the manufacture of dielectric fluids for immersion cooling at data centers would start to absorb a large part of Group III production.

U.S. refiners are also producing Group III base oils for their own downstream lubricant operations, and a couple of domestic rerefiners are producing Group III base oils as well. The start-up of Group III production at the Vertex rerefinery in Mobile, Alabama, could also meet some of the domestic Group III demand. Vertex acquired and converted a conventional fuels refinery from Shell in 2022 and started to produce rerefined Group III 4 cst base oil last November.

Even so, imports will continue to play a key role in the U.S. as domestic production is not sufficient to meet Group III and Group III+ demand. Most imports originate in Canada, Asia and the Middle East.

Naphthenics

Naphthenic base oil prices remained steady, but there have been downward price adjustments for some accounts in response to a need to incentivize sales. Demand has slowed down, and the heavy grades, in particular, have seen waning consumption from the rubber, tire, grease and process oil segments because of a general economic slowdown in the U.S. and reduced automotive and industrial activities. A supplier noted that orders from the tire segment were down by approximately 15% from last year and the trend was expected to continue into 2026. The light grades experienced healthier demand, but it has also started to slow down. Export activity has been less robust than anticipated, with Mexico reducing its pale 2000 consumption levels, leaving suppliers with fewer options to place their surplus volumes.

Demand for naphthenic cuts has been softer than usual throughout most of 2025 and was expected to remain lackluster into 2026, at least until the spring season. There was additional price pressure as plentiful paraffinic supplies were competing in some applications with naphthenic oils.

San Joaquin Refining plans to start a three-week routine turnaround at its refinery in California in mid-January and was expected to start building inventories to keep customers supplied during the shutdown, which could limit short-term spot availability.

Crude Oil

Crude oil futures showed their biggest decline in three weeks on Tuesday as analysts worried about a potential supply glut brought about by weaker global demand and increased output, but values ticked up after reports showing that U.S. crude inventories had dropped from the previous week. The API estimated that U.S. crude oil inventories underwent a large draw of 4.8 million barrels in the week ending Dec. 5.

- West Texas Intermediate January 2026 futures settled on the Nymex at $58.25 per barrel on Dec. 9, down from $58.64/bbl for front-month futures on Dec. 2.

- Brent futures for February 2026 delivery were trading on the ICE at $62.01/bbl on Dec. 10, down from $62.36/bbl for front-month futures on Dec. 3.

- Louisiana Light Sweet crude wholesale spot prices were hovering at $60.69/bbl on Dec. 8. Spot prices had settled at $61.34/bbl on Dec. 1, according to the U.S. Energy Information Administration.

Diesel

Low-sulfur diesel wholesale, Dec. 8 (Dec. 1), EIA

New York Harbor: $2.35 per gallon ($2.39/gal)

Gulf Coast: $2.16/gal ($2.22/gal)

Los Angeles: $2.22/gal ($2.32/gal)

Gabriela Wheeler can be reached directly at gabriela@LubesnGreases.com

Lubes’n’Greases shall not be liable for commercial decisions based on the contents of this report.

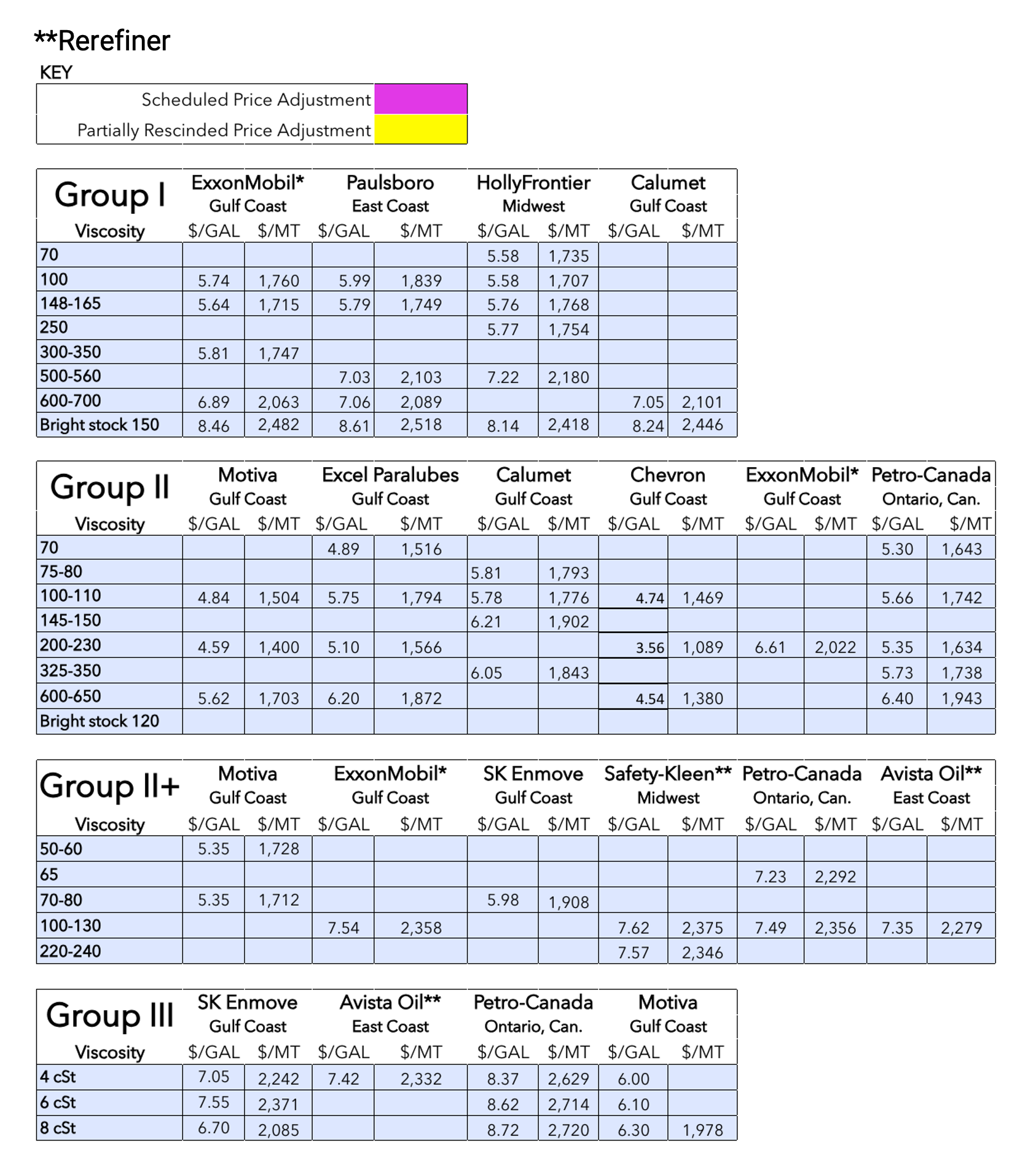

Posted Paraffinic Base Oil Prices December 10, 2025

(Prices are FOB basis, in U.S. dollars per gallon and U.S. dollars per metric ton).

Archived base oil price reports can be found through this link: https://www.lubesngreases.com/category/base-stocks/other/base-oil-pricing-report/

Historic and current base oil pricing data are available for purchase in Excel format.

*ExxonMobil prices obtained indirectly.