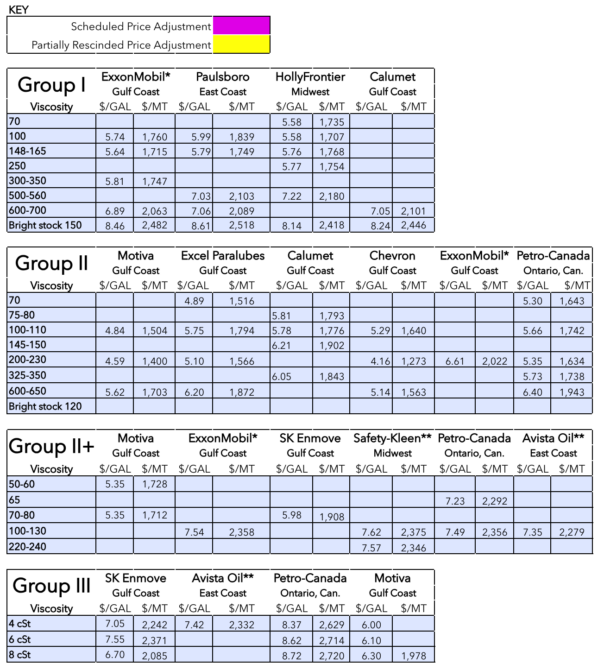

Editor’s note: The price table below initially contained errors, which led us to remove and correct it. The table is now restored in its normal location.

Few significant developments altered the market scenario observed over the week, although there have been increased producer initiatives to clear emergency inventories held during the hurricane season along the United States Gulf Coast. There were mixed reports about demand, with some suppliers noting a definitive slowdown and others maintaining that consumption levels have been steady for the last few weeks despite earlier expectations to the contrary. The contrasting opinions largely depended on what segment of the market these sellers supplied.

Base oil suppliers who sell to automotive lubricant blending operations have seen reduced demand given the end of the summer driving season, but a slight pickup in demand was attributed to manufacturers who needed to replenish stocks after securing only the necessary barrels to run daily production. Many base oil buyers had limited purchases to avoid unexpected price drops while holding inventories purchased at steeper numbers. The agricultural and industrial sectors have seen a reduction in activities largely because of immigration raids on farms and food processing plants and lower demand for some consumer goods. This has likely led to reduced industrial lubricants and metalworking fluids consumption.

In general, most participants agreed that the market was fairly stable. “There doesn’t seem to be a shortage of any grades and we are not seeing any drop-off in demand just yet, but it will be interesting to see how the rest of the month plays out,” a source noted, while another admitted that demand had softened in some segments but had been offset by an uptick in other sectors.

Some lubricant suppliers have received additional orders due to the shutdown of Smitty’s Supply Inc.’s large blending plant in Roseland, Louisiana, following a massive fire and explosion on Aug. 22. It was not clear whether the plant would be rebuilt, but almost all plant employees have been laid off. Media reports noted that $3 million had been spent on firefighting and cleanup efforts within the first hours of the fire alone. Market participants said the company was trying to produce as much as possible at its CAM2 sites in Hammond, Indiana, and Vicksburg, Mississippi.

Nevertheless, it might be challenging for the market to fill in the supply gaps immediately, particularly for greases, and many players also worried that obtaining products at levels similar to Smitty’s prices might prove almost impossible. “I think their customers will be paying higher numbers elsewhere,” a source commented, while another agreed, adding, “Some suppliers are excited to try to seize some of the volume, yet many are also noting they won’t be able to match Smitty’s prices.”

In terms of base oil posted prices, values were unchanged from the previous week and have not seen official adjustments since May, but spot export prices have been under pressure because of competition among suppliers to find buyers for surplus barrels. While there had been talk about temporary value allowances or discounts to attract spot business, most sources polled said they had not heard of these situations yet. Supply and demand were still largely determining price direction, since crude oil and feedstock values have traded within a narrow range and have shown few noteworthy fluctuations.

Meanwhile, some market attention shifted to the latest U.S. tariff news. The U.S. Supreme Court agreed Tuesday to examine the legality of President Donald Trump’s global tariffs. The justices will consider a lower court’s ruling that Trump overstepped his authority in imposing most of his tariffs under a federal law meant for emergencies, Reuters reported.

President Trump spent much of his first seven months in office implementing steep tariff increases that have thrown the world’s trade patterns into disarray, but he seemed to be backtracking on some decisions. On Sept. 5, he signed an executive order offering some tariff exemptions to trading partners who strike deals on industrial exports such as nickel, gold and other metals, as well as pharmaceutical compounds and chemicals.

Despite the Trump administration’s decision to impose heavy import tariffs of 50% on Indian goods, partly as a punishment for its energy purchases from Russia, India’s finance minister said the country will continue to buy Russian oil as it is an economical option.

Group I

The API Group I segment appeared to be tighter than the Group II category given Group I plant rationalizations over the last two decades and no new production coming on stream in North America. While demand for Group I grades has generally tapered off, there was still strong consumption of most grades, with bright stock particularly commanding attention and firm pricing.

Given that plant turnarounds scheduled earlier in the year have been completed and refiners were running units at close to full rates, supplies have started to lengthen, but the overhang was limited, particularly for the heavy-viscosity grades. This resulted in smaller volumes becoming available for spot export transactions, with cargoes being offered into Mexico, Brazil, India and Africa.

Exports to Mexico continued to flow steadily, particularly of the light grades used for diesel blending, although there has been a drop compared to previous months, likely because some buyers are holding off on additional orders until later in the year. Some brokers and distributors were facing delays in getting their import permits renewed, with processing times growing longer.

Buying interest for U.S. exports from Brazil has picked up because availabilities of some grades have been depleted, and some Group II grades that could be used as substitutes were also tight. The main Brazilian base oil producer reduced domestic prices this month, allowing it to compete against imports.

Group II

Spot prices of Group II grades were more exposed to downward pressure than the Group I cuts as Group II supplies appeared to be lengthening faster than their counterparts. However, with Excel Paralubes preparing for a turnaround in October and the plant having been running at reduced rates since earlier in the year, the expected oversupply conditions were more limited, at least for the time being. The Group II 100N was still described as tighter than the 200N and 600N cuts.

Excel Paralubes is planning to shut down its Group II/Group III plant in Louisiana for approximately four to six weeks for a maintenance program and catalyst change. The company has started to build inventories to cover contractual commitments during the outage and has restricted spot availability, according to sources. There was no direct producer confirmation forthcoming about the plant’s operations.

A number of suppliers continued to pursue export opportunities to lower inventories as domestic demand was not expected to improve significantly over the next few months. The export movements, together with reduced production rates at one facility, have allowed refiners to maintain a more balanced supply/demand situation at home despite the expected slowdown in domestic base oils and lubricants consumption as the summer driving season has ended. An exception may be buyers who have depleted inventories and need to purchase fresh cargoes in the coming weeks. Buying interest for U.S. barrels has emerged from countries on the West Coast of South America, Brazil and India, but buyers’ price ideas were sometimes too low to make numbers work.

Group III

Prices for Group III grades were fairly steady, and supply levels were anticipated to improve as additional cargoes from Asia and the Middle East were expected to reach the U.S. over the next couple of weeks. A supplier’s shipments had suffered some delays due to logistical issues, but these appeared to have been resolved. Some buyers had to resort to securing material from other suppliers, particularly in the case of the 4 cSt grade, until supply from this seller had been reestablished. A second supplier was heard to have placed its 4 cSt grade on allocation. Additional Group III supplies may become briefly available following Smitty’s Supply’s plant explosion and fire, but the extra supplies may be absorbed quickly by blenders filling the gap left by the affected lubricants manufacturer.

Excel Paralubes has kept its Group III output at reduced rates since early in the year, but the plant will be shut down in October for a turnaround and is expected to increase production following the maintenance program. The impact on domestic supplies was not anticipated to be significant as the unit produces limited volumes for the company’s internal consumption. Excel Paralubes does not comment on its production status.

Naphthenics

Conditions on the naphthenics side were largely stable, with prices receiving support from a tighter supply and demand ratio given a turnaround at Ergon’s naphthenic base oils plant in Vicksburg, Mississippi. However, more abundant supplies of the heavy-viscosity grades due to lackluster demand from the rubber and tire segment have started to place downward pressure on pricing. The light pale oils were snug compared to the heavier cuts, but some additional base oil volumes might become temporarily available due to the extended shutdown of Smitty’s Supply blending plant.

Ergon started a 45-day maintenance program on Sept. 1. The company announced that various operating units of the ERI refinery would be down as several reliability improvements were implemented. Ergon’s current ratable customers were not expected to see supply disruptions, as product inventory levels were anticipated to be sufficient to support requirements during the planned shutdown, but the company was likely to restrict spot sales. Ergon had started to build inventories ahead of the turnaround.

Naphthenic base oil producers reiterated that they were monitoring crude oil values but would only consider price adjustments if crude oil and feedstock prices changed significantly, and values were maintained over a certain number of weeks.

Crude Oil

Crude oil futures moved up on Wednesday on rising Middle East tensions after Israel attacked Hamas leadership in Qatar and President Trump asked Europe to impose tariffs on buyers of Russian oil. An uncertain market outlook amid an announced production increase by OPEC+ member countries capped further gains.

West Texas Intermediate October 2025 futures settled on the Nymex at $62.63 per barrel on Sept. 9, down from $65.59 per barrel on Sept. 2.

Brent futures for November 2025 delivery were trading on the ICE at $66.99 per barrel on Sept. 9, down from $67.91 per barrel on Sept. 2

Louisiana Light Sweet crude wholesale spot prices were hovering at $64.80 per barrel on Sept. 8, down from $66.93 per barrel on Aug. 29, according to the U.S. Energy Information Administration. (There was no trading on Sept. 1 due to the U.S. Labor Day holiday.)

Diesel

Low-sulfur diesel wholesale, Sept. 8 (Aug. 29), EIA

New York Harbor: $2.37 per gallon ($2.32/gal)

Gulf Coast: $2.25/gal ($2.20/gal)

Los Angeles: $2.58/gal ($2.42/gal)

Gabriela Wheeler can be reached directly at gabriela@LubesnGreases.com.

LNG Publishing Co. Inc./Lubes’n’Greases shall not be liable for commercial decisions based on the contents of this report.

Archived base oil price reports can be found through this link:

https://www.lubesngreases.com/category/base-stocks/other/base-oil-pricing-report/

Historic and current base oil pricing data are available for purchase in Excel format.