The summer driving season in the United States is about to reach its denouement, and this dampened motor oil consumption as the peak oil changing period is about to end. As a result, demand for base oils used in automotive applications was expected to continue weakening and inventories were anticipated to grow.

Many market participants were keeping extra barrels on hand to cover potential production disruptions during the hurricane season, with most storms having occurred between August and September in the past. Since there was still potential for a severe weather event to wreak havoc along the U.S. Gulf Coast – where many base oil plants are located – market players were not yet ready to start reducing inventories. Some attention also turned to crude oil prices, with values expected to be affected by the Trump-Putin meeting last Friday and the subsequent Trump-Zelensky gathering on Monday, but the impact was more limited than anticipated.

Crude oil futures ended last week in bearish territory, but traded higher on Wednesday morning after industry data showed a decline in U.S. inventories for the week ending Aug. 15. With crude values moving at fairly steady levels over the last couple of weeks, refiners still saw favorable base oil margins and were expected to keep running plants at top rates.

Tariff discussions seemed to have been placed on the back burner for now, with the exception of tense exchanges between Trump and the heads of state of India and Brazil. Exports from both countries were expected to be subject to 50% tariffs. Meanwhile, Washington D.C. and Beijing have agreed to extend their trade war truce, keeping the current 30% U.S. levy on Chinese imports and a 10% Chinese tariff on American goods in place until Nov. 10, instead of the much steeper 145% and 125% duties, respectively, that each country had threatened to impose.

Even so, U.S. manufacturing continues to face headwinds due to current tariffs and elevated interest rates, according to experts, affecting demand for metalworking fluids and other lubricants used in industrial applications.

Domestic base oil prices were mostly stable, but spot export indications for some grades were exposed to downward pressure due to oversupply conditions and lackluster domestic demand. Given economic uncertainties and high production costs, blenders have turned more conservative in terms of orders and were mainly taking contractual volumes, forcing suppliers to look for alternative outlets.

Group I

The API Group I grades were deemed largely balanced against current demand. This was welcome news for some participants after several months of very tight conditions due to plant turnarounds in various regions and permanent plant closures in recent years, which had pushed prices up.

The heavy grades and bright stock were still snug, curbing availabilities for export transactions, although export prices for bright stock have come under pressure due to lower bids from Latin American buyers, and potential U.S. competition along the West Coast of South America with cargoes from other regions. Nevertheless, U.S. suppliers seemed to have only limited spot availability of flexibag-sized cargoes to offer for export.

Fairly tight Group I fundamentals in the U.S. left fewer options for cargoes moving into Mexico, with Group II cuts deemed more plentiful and some buyers opting for acquiring Group II grades for some applications. A similar situation was affecting trading in Brazil, where Group II grades were ample and being offered at competitive levels, leading consumers to replace Group I cuts with Group II grades whenever possible. At most destinations, buyers who were able to delay purchases were biding their time until more U.S. supplies are placed into the export market after the hurricane season.

Group II

Group II supplies have started to lengthen, as several plants were running at full rates, although the Excel Paralubes unit in Louisiana was not expected to run at peak conditions until after a scheduled turnaround and catalyst change in October. There were also more limited availabilities of rerefined grades because of a turnaround at a rerefining unit. The Group II 100N cut was said to be tighter than the other grades, but the 600N has become more readily available over the last few weeks.

With a number of U.S. suppliers keeping additional inventories to cover potential output disruptions during the peak hurricane months of August and September, spot export supplies were more limited at the moment, but were anticipated to grow once the extra barrels start to be released into the general supply system.

Sellers had also hoped to capture buying interest from India and the Middle East, but fairly soft demand at those destinations meant that buyers were still unwilling to raise their bids to secure U.S. products. Activity in India was expected to pick up in the coming weeks as the monsoon season nears its end and lubricant consumption in the automotive segment was likely to improve. Indian buyers have restricted purchases for several weeks and they were anticipated to replenish stocks.

While there is domestic production of Group II grades in India, it was still not enough to meet all domestic requirements and consumers count on U.S. base oils moving there after the end of the hurricane season along the U.S. Gulf. At the same time, Group II availability in Asia has grown given the completion of plant turnarounds, with additional spot cargoes from South Korea and Taiwan expected to become available in the coming weeks. However, weaker U.S. export prices compared to Northeast Asia export prices may make Asian barrels less attractive.

Group III

A majority of requirements were being met through imports and domestic products, but a brief production hiccup at a U.S. plant may tighten conditions temporarily, although details could not be confirmed. Given that most routine plant maintenance programs, both in the Americas, as well as in Asia and the Middle East, have been completed, additional spot cargoes have become available in Group III-producing regions and a number of cargoes have either arrived or were on their way to the U.S.

Buyers appeared comfortable as they were able to cover contract requirements and expected added Group III base stocks to become available once hurricane-related inventories start to be offered, so they did not feel pressure to acquire more volumes. Tariff uncertainties and manufacturing disruptions at automotive plants have dampened demand for factory-fill lubricants, which require Group III and Group IV base stocks.

Lubricant manufacturers were also concerned about keeping too much inventory produced with pricey base oils as competition among suppliers continued. Many smaller blenders preferred to secure only those raw materials necessary to run day-to-day operations instead of holding hefty inventories.

Naphthenics

There had been expectations of tightening spot supplies and firming price ideas given more limited availability while Ergon builds inventories ahead of a scheduled six-week turnaround at its naphthenic base oils plant in Vicksburg, Mississippi, beginning Sept. 1. However, any upward price pressure appeared to have been partly diluted by lower crude oil and feedstock values, along with weakening demand in some downstream sectors.

While the light naphthenic grades continued to see steady demand, particularly for transformer oils, the heavy grades were affected by sluggish conditions in the rubber and tire industry, as well as some industrial applications. Buying appetite from some export segments has been generally steady, although a slight decline was noted in some regions.

Refiners reiterated that they were monitoring oil and feedstock prices closely. Should crude values be sustained at a certain margin or below a certain level over several weeks, suppliers would then consider pale oil price adjustments.

Crude Oil

Crude oil futures edged up on Wednesday morning on data released by the American Petroleum Institute (API) which showed a bigger drop in U.S. crude oil inventories than expected. Inventories fell by 2.4 million barrels during the week ending Aug. 15, while analysts had expected a 1.2-million-barrel draw.

Meanwhile, there were expectations of increased Venezuelan crude arriving in the U.S., as Chevron dispatched the first two Venezuelan crude cargoes since Washington restored its license to operate in the sanctioned nation last month. While Chevron CEO Mike Wirth has emphasized that the company was initially shipping small volumes, even modest Venezuelan flows could shift trade dynamics in the Gulf Coast heavy crude market, OilPrice.com reported.

- West Texas Intermediate October 2025 futures settled on the Nymex: $61.77 per barrel on Aug. 19, down from $63.17/bbl on Aug. 12.

- Brent futures Oct. 2025 delivery on ICE: $66.60/bbl on Aug. 19, up from $66.12/bbl on Aug. 12.

- Louisiana Light Sweet crude wholesale spot prices: $66.26/bbl on Aug. 18, down from $66.95/bbl on Aug. 11, according to the U.S. Energy Information Administration.

Diesel

Low-sulfur diesel wholesale, Aug. 18 (Aug. 11), EIA

New York Harbor: $2.30 per gallon ($2.34/gal)

Gulf Coast: $2.17/gal ($2.22/gal)

Los Angeles: $2.28/gal ($2.32.gal)

Gabriela Wheeler can be reached directly at gabriela@LubesnGreases.com

Lubes’n’Greases shall not be liable for commercial decisions based on the contents of this report.

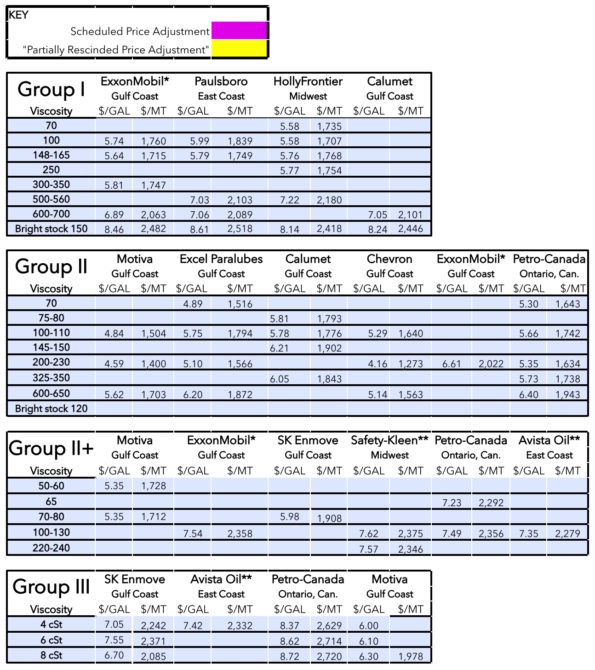

Posted Paraffinic Base Oil Prices August 20, 2025

(Prices are FOB basis, in U.S. dollars per gallon and U.S. dollars per metric ton).

Archived base oil price reports can be found through this link: https://www.lubesngreases.com/category/base-stocks/other/base-oil-pricing-report/

Historic and current base oil pricing data are available for purchase in Excel format.

*ExxonMobil prices obtained indirectly.

**Rerefiner