While domestic base oil prices were mostly stable, spot export indications for some grades have slipped on account of growing supplies and producers’ need to find a home for extra barrels. A few suppliers were keeping additional volumes on hand to cover potential production disruptions during the peak months of the hurricane season and were not participating in export business. Uncertain prospects for a number of lubricant segments have turned blenders more cautious in terms of how much product to secure beyond those volumes specified in contracts. Lower feedstock prices and falling fuel values incentivized refiners to continue running base oil plants at top rates.

Industry participants were keeping an anxious eye on the changing tariff landscape and downstream activities. United States manufacturing continues to struggle amid downbeat sentiment and elevated interest rates, economists said. This was affecting demand for metalworking fluids and other lubricants used in industrial applications. The U.S. summer driving season was also past its peak and motor oil demand was expected to decline after the Labor Day weekend on Sep. 1, impacting demand for base oils used in automotive applications.

The Institute for Supply Management (ISM) Manufacturing PMI, a closely watched indicator, fell to 48 in July from 49 in the prior month – the fifth straight month in contraction territory as any reading below 50 signifies a decline – likely because of the impact of tariffs, according to an article in Market Watch.com. Manufacturers are questioning their sourcing strategies and are starting to think about passing the higher costs from tariffs to their customers, the article said.

Sweeping tariffs announced by U.S. President Donald Trump went into effect on Aug. 7, including heftier ones imposed on major trading partners such as Canada and India, with whom the administration had not been able to reach trade agreements. President Trump also signed an executive order extending a tariff truce between the U.S. and China for another 90 days on Aug. 11, the White House said. The new levies raise the U.S.’s effective tariff rate above 17%, the highest tax since the Great Depression.

In related market news, ExxonMobil announced in a press release that the company’s Strathcona Renewable Diesel project, Canada’s largest renewable diesel facility, has commenced operations, contributing to the growth of higher value products by adding 20,000 barrels per day of capacity. ExxonMobil has also started up its Singapore Resid Upgrade project. The project entails the expansion of the company’s existing Group II plant capacity and adds around 20,000 bbl/d per day output of light, heavy and extra-heavy Group II base stocks, of which 6,000 bbl/d will be extra-heavy base stocks, including a new product with similar characteristics to bright stock that will be marketed under the EHC 340 MAX brand name.

Group I

Most API Group I grades were described as balanced against current demand levels, following several months of strained conditions due to plant turnarounds in various regions and permanent plant closures in recent years. The heavy grades and bright stock were still teetering on the tight side given steady demand and more limited availability, supporting firm prices and restricting the number of cargoes that can be offered for spot export transactions. A producer was heard to have been rebuilding inventories after maintenance work and had therefore been unable to participate in spot business for several weeks.

With downstream segments such as manufacturing, agriculture and heavy-duty transportation seeing sluggish conditions, demand for Group I grades has started to weaken. Some Group I and Group II suppliers were hoping to conclude export transactions to keep a supply overhang in check, but buying interest from countries in Latin America and Europe was also lackluster.

Lower domestic prices in Brazil were encouraging buyers to secure product from the local producer and distributors and this was inhibiting appetite for imports. Lubricant demand in Brazil has also been sluggish due to seasonal factors and macroeconomic uncertainties, coupled with expectations of lengthening supplies in the U.S. which could exert downward pressure on export prices and offer attractive import opportunities further down the road.

U.S. suppliers reported relatively steady demand from Mexico but also acknowledged that buying interest had started to sag as U.S. prices were deemed too high and there were expectations of additional product becoming available after the hurricane season, when suppliers release the reserves they have been holding for potential weather-related disruptions. Since Group I base oils were balanced-to-tight in the U.S., there were fewer offers into Mexico than for Group II grades.

Group II

Market participants described the Group II segment as showing more plentiful supplies than the Group I category, with the return to production of a number of plants in the previous months contributing to the growing availability of most grades, although the Group II 100N was still deemed snug. Participants said that despite the fact that some grades had started to lengthen, overall supply was largely balanced.

With the exception of the Excel Paralubes’ Group II unit in Lake Charles, Louisiana, which has been operating at slightly reduced rates for most of the year, plants were running well, and Excel Paralubes was anticipated to return to full production following a scheduled turnaround in October.

A number of suppliers were heard to be keeping extra inventory to cover potential output disruptions during the peak hurricane months of August and September, while others were looking for export opportunities to place additional spot cargoes. Spot export indications for Group II grades were under pressure as suppliers were eager to entice buyers in a generally soft market, with negotiations for shipments to India and the Middle East said to be ongoing. Indian buyers were seeking imported base oils because lubricant demand has been stronger than expected in July and early August and domestic production is insufficient to meet domestic requirements.

Meanwhile, rerefiners were heard to have offered up some availability of Group II/Group II+ light grades for spot business at largely unchanged prices from the previous weeks.

Group III

While domestic Group III production was deemed steady to slightly weaker, several import cargoes were due to arrive in the U.S. in the coming weeks and were anticipated to be more than sufficient to meet current requirements. Some of these cargoes may have suffered slight delays due to turnarounds and transportation disruptions caused by geopolitical conflicts in the Middle East a couple of months ago.

Since most plant maintenance programs have been completed, both in the Americas and in Asia and the Middle East, additional spot cargoes were expected to become available and this has started to exert downward pressure on spot pricing, while prices for products moving under contract were reported as stable. Uncertainties over tariffs and supply chain disruptions in industries such as the automotive segment continued to dampen demand for lubricants requiring Group III grades.

Naphthenics

The light naphthenic grades continued to see steady demand, but availability of the heavy grades has started to lengthen due to sluggish demand from the rubber and tire industry. However, the upcoming turnaround at Ergon’s naphthenic base oils plant was expected to take some spot barrels out of circulation and offer support to prices at a time when crude oil has edged down and was exerting downward pressure on price ideas.

Ergon has started to build inventories ahead of a scheduled six-week turnaround at its naphthenic base oils plant in Vicksburg, Mississippi, beginning September 1. Various operating units of the ERI refinery will be down as several reliability improvements will be implemented. No supply interruptions were expected for Ergon’s current ratable customers during the planned shutdown.

Crude oil values have retreated to the low-to-mid $60s per barrel range, withdrawing some of the upward price pressure observed in previous weeks when futures had moved up on expectations of secondary sanctions on Russian crude exports. Refiners were monitoring oil and feedstock prices closely, since these values have a direct impact on base oils and refinery operations when they are sustained at a certain level over several weeks.

Crude

Crude oil futures dipped on Tuesday as the U.S. extended a tariff pause on Chinese imports for 90 days and the oil outlook was hazy ahead of the U.S.-Russia talks in Alaska, U.S., on Friday pertaining an end to the war on Ukraine. Analysts were also waiting for an inventory report from the U.S. Energy Information Administration as a period of declining demand approached with the end of the summer driving season in early September.

West Texas Intermediate September 2025 futures, Aug 5, settled on the Nymex: $63.17 per barrel on Aug. 12, down from $65.16/bbl

Brent futures Oct 2025 delivery on ICE: $66.12/bbl on Aug. 12, down from $68.75/bbl on Aug. 5.

Louisiana Light Sweet crude wholesale spot prices were hovering at $66.95/bbl on Aug. 11, down from $69.31/bbl on Aug. 4, according to the U.S. Energy Information Administration.

Diesel

Low-sulfur diesel wholesale, Aug. 11 (Aug. 4), EIA

New York Harbor: $2.34 per gallon ($2.36)

Gulf Coast: $2.22/gal ($2.23)

Los Angeles: $2.32/gal ($2.40)

Gabriela Wheeler can be reached directly at gabriela@LubesnGreases.com

LNG Publishing Co. Inc./Lubes’n’Greases shall not be liable for commercial decisions based on the contents of this report.

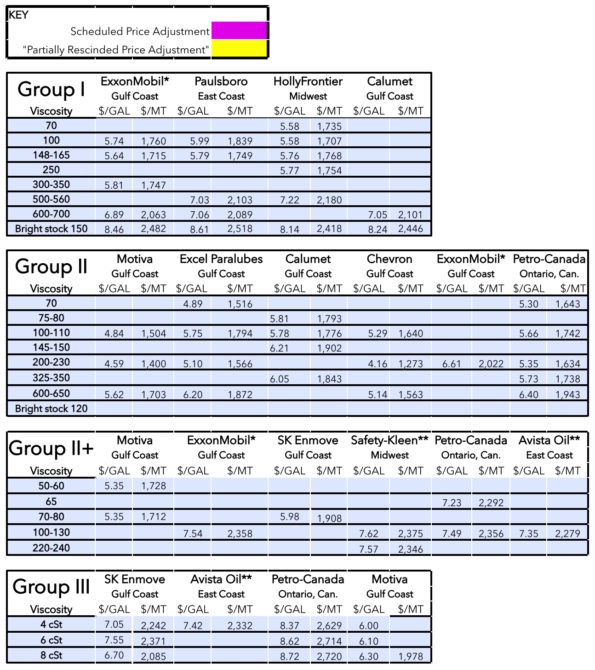

Posted Paraffinic Base Oil Prices August 13, 2025

(Prices are FOB basis, in U.S. dollars per gallon and U.S. dollars per metric ton).

Archived base oil price reports can be found through this link: https://www.lubesngreases.com/category/base-stocks/other/base-oil-pricing-report/

Historic and current base oil pricing data are available for purchase in Excel format.

*ExxonMobil prices obtained indirectly.

**Rerefiner