With supply and demand conditions showing little change over the week, base oil prices were generally reported as stable. The market was still digesting news that Motiva had announced a posted price decrease of 50 cents per gallon for most of its base oils last week but later rescinded it.

Market sources noted that supply levels have been growing due to a seasonal slowdown in consumption, and there has been talk about select accounts being granted temporary value allowances or special discounts.

Participants said the TVAs were not widespread and that Motiva’s initial price adjustment, which was expected to go into effect Aug. 1, had been surprising. Historically, most price revisions have occurred after the hurricane season ends, as the risk of output disruptions and a sudden tightening of availability diminishes while inventories grow.

Crude oil prices also strengthened since last week on the possibility of additional sanctions on Russian oil exports, with both West Texas Intermediate and Brent rising more than 2%.

Market players hypothesized about the reason for Motiva’s decrease retraction, with some noting that it may have been related to finished lubricant contracts being indexed against posted prices, but no specific explanation was confirmed with the producer. Lubricant manufacturers have been dealing with a challenging price environment as some raw materials and production costs have risen, while lubricant price increases have been difficult to implement given buyers’ resistance, lackluster demand and ongoing competition among suppliers.

Trade negotiations between the U.S. and several international trade partners continued ahead of President Donald Trump’s self-imposed deadline of Aug. 1 to conclude all agreements. The trade tensions had fueled concerns about a global economic slowdown. The International Monetary Fund released its world economic outlook on Tuesday and projected 3% global growth this year, higher than the 2.8% forecast after Trump announced his steep “Liberation Day” tariffs in April but lower than the 3.3% it predicted in 2024, according to The New York Times.

The U.S. has signed preliminary agreements with the United Kingdom, the European Union, Japan, Vietnam, Indonesia and the Philippines, along with a temporary pact with China that paused some high tariffs until Aug. 12. Agreements with key partners such as Canada, Mexico, South Korea, India, Taiwan and Brazil were still pending.

Group I

Spot prices in the API Group I segment were firm because of a balanced supply and demand scenario. Recent plant turnarounds, along with steady domestic demand and export shipments, resulted in limited extra volumes and offered support to prices. Bright stock remained the most sought-after grade, with spot prices inching up by a couple of cents per gallon week on week.

There have been inquiries for Group I spot cargoes from Mexico, Latin America and the Middle East, but transactions appeared difficult to complete. With buying interest from export destinations such as Europe dwindling due to the summer holidays, suppliers were starting to express concern about lengthening supplies.

U.S. suppliers were prioritizing contract shipments to Mexico, as orders remained steady, but faced some railcar transportation disruptions and delays at the border in recent weeks. Economic uncertainties and tensions with the United States, as President Trump has not yet signed a trade agreement with Mexico, dampened some of the buying interest. Mexican buyers were also hoping to delay purchases as part of U.S. inventories are typically released after the peak hurricane period in August and September, when prices come under pressure.

Appetite for U.S. cargoes from Brazil was muted because buyers were holding ample inventories and trying to secure more domestic supplies rather than risk purchasing imports whose value may slip in the coming weeks. Domestic prices for Group I light grades in Brazil were heard to have been adjusted down, but heavy grades remained tight and were holding steady or slightly higher.

Group II

Most base oil plants were heard to be running at high rates, except for Excel Paralubes’ Group II unit in Lake Charles, Louisiana, which has been operating below peak capacity for most of the year. Excel Paralubes has planned a turnaround and catalyst change in October, which should help resolve the plant’s current production issues, sources said. Chevron and Motiva recently completed maintenance at their plants and were said to be running well, with inventories beginning to build. None of the producers commented on the status of their operations.

Domestic demand for Group II base oils was described as lackluster, with some sectors such as agriculture seeing reduced consumption due to recent adverse weather and labor shortages from immigration raids. Many farmworkers, particularly those who are undocumented, have stopped reporting to work, leading to potential crop losses.

To avoid a base oil inventory build, both Group I and Group II suppliers were exploring fresh export opportunities. Spot export price indications for Group II grades edged down by a few cents per gallon as supply was ample and buying interest remained soft, especially from India. India typically attracts U.S. Group II shipments when domestic demand slows and prices ease. However, the monsoon rains in the South Asian nation have dampened industrial and transportation activities, reducing base oil and lubricant requirements.

Group III

Availability in the Group III segment was gradually increasing as regional turnarounds were completed and more product entered the supply system. In addition to domestic production, there were expectations that imports would reach the Americas in the coming weeks. Despite ongoing geopolitical tensions in the Middle East, shipments appeared to remain uninterrupted.

Maintenance programs at several Group II+ and Group III plants, including Petro-Canada’s unit in Canada, SK Enmove’s in South Korea and Adnoc’s in the UAE, have been completed and the plants returned to production, allowing for more spot cargoes to be offered.

The improved availability of Group III grades has started to pressure spot price ideas, particularly for the 4 cSt grade, which faced more competition due to rising volumes and reduced automotive industry demand.

Naphthenics

A mostly balanced supply and demand scenario supported current pricing, with participants monitoring crude oil and feedstock values closely. Any sustained changes could eventually affect pale oil prices.

With Ergon beginning to build inventories ahead of a planned turnaround at its naphthenic base oils plant in September, spot supplies declined slightly. The producer has scheduled a six-week maintenance program at its refinery in Vicksburg, Mississippi, beginning Sept. 1. Several units of the ERI refinery will be down during the period while reliability upgrades are implemented. No supply interruptions were expected for Ergon’s ratable customers, as product inventory levels were expected to be sufficient to support sales during the outage, company sources said.

Following the turnaround, heavy-viscosity grade supplies were anticipated to grow as domestic demand has remained weak, while lighter grades have enjoyed steady requirements, particularly for transformer oils, supporting stable pricing.

Crude and Diesel

Crude oil futures jumped on prospects of President Trump accelerating the imposition of additional sanctions on Russian energy exports as Russia’s war on Ukraine continued. Futures had already moved up by 2.5% last week as OPEC+ maintained its current oil output policy at the Joint Ministerial Monitoring Committee meeting on July 28, with the 548,000 barrels per day production hike scheduled for August still on track.

- West Texas Intermediate September 2025 futures settled on the Nymex at $69.21 per barrel on July 29, up from $65.31/bbl for front-month futures on July 22.

- Brent futures for September 2025 delivery traded on the ICE at $72.19/bbl on July 29, up from $68.47/bbl on July 22.

- Louisiana Light Sweet crude wholesale spot prices hovered at $68.81/bbl on July 28, down from $70.99/bbl on July 21, according to the U.S. Energy Information Administration.

- Low sulfur diesel wholesale spot prices were $2.48 per gallon at New York Harbor, $2.35/gal on the Gulf Coast and $2.49/gal in Los Angeles on July 28, compared with $2.54/gal, $2.44/gal and $2.63/gal, respectively, on July 21, according to the EIA.

Gabriela Wheeler can be reached directly at gabriela@LubesnGreases.com

LNG Publishing Co. Inc./Lubes’n’Greases shall not be liable for commercial decisions based on the contents of this report.

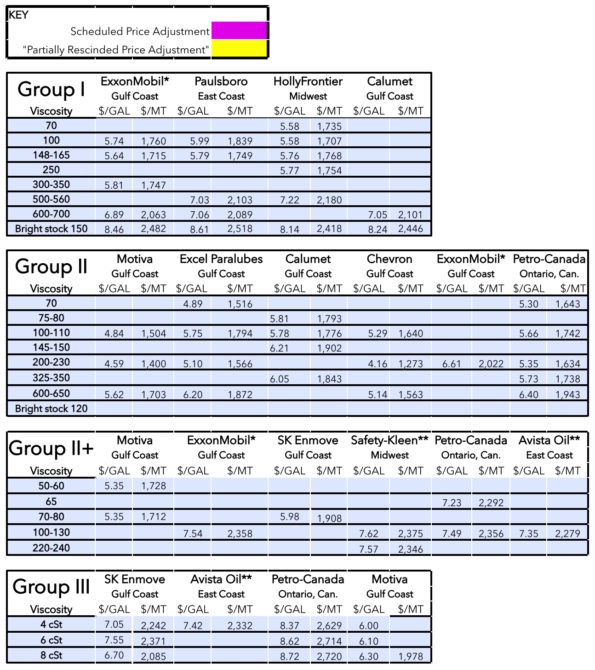

Posted Paraffinic Base Oil Prices

July 30, 2025

(Prices are FOB basis, in U.S. dollars per gallon and U.S. dollars per metric ton).

Archived base oil price reports can be found through this link: https://www.lubesngreases.com/category/base-stocks/other/base-oil-pricing-report/