With the summer driving season underway and base oil demand beginning to decline as the peak lubricant production cycle winds down, buyers were focused on maintaining sufficient inventories to keep production running, along with securing additional barrels to cover requirements in case severe weather disrupts base oil output along the U.S. Gulf Coast during the current hurricane season.

The 2025 season was forecast to be very active in terms of the number of storms it may bring. Several unexpected weather events have already occurred in the U.S. this summer, placing many participants on high alert. Recent severe events include the flash floods in Texas on July 4, which caused many fatalities and extensive damage. This week, flood watches are in effect across the Northeast and mid-Atlantic, stretching from Massachusetts to Virginia and potentially affecting cities such as New York and Philadelphia.

Base oil supply and demand remained largely balanced and were not expected to significantly affect pricing. Posted prices have held steady since the last downward revision in mid-May. On the crude oil side, futures spiked as the Israel–Iran conflict ignited in mid-June, raising concerns about potential base oil price increases. However, futures have since retreated and remained in bearish territory.

Lubricant manufacturers that import raw materials and components were closely watching the latest round of tariff negotiations. U.S. President Donald Trump has announced plans to impose steep tariffs on imports from many countries if trade agreements are not signed by Aug. 1. The tariffs could potentially increase the cost of inputs, including additives, in the coming months. Trump has also proposed a 50% tariff on copper imports, which could further strain the U.S. auto industry, The New York Times reported. Additional tariffs could make it harder for automakers and suppliers to absorb border taxes and rising costs, according to industry experts. Copper is essential for making cars, as it is used in wire harnesses and electric vehicle motors.

In other industry developments, a fire broke out at Chevron’s Pascagoula, Mississippi, refinery on July 14, injuring four workers. The fire was quickly extinguished, and the company is investigating the cause. According to a statement released by Chevron, the incident occurred in the refinery’s wastewater treatment area, sending three workers to the hospital. The company said the incident posed no danger to the community.

Group I

Market conditions observed in recent weeks persisted, with some API Group I grades showing tighter availability than others. Bright stock remained in high demand globally, with buyers from India and the Middle East inquiring about potential shipments from the U.S. Export negotiations were also ongoing with European and South American importers.

Most Group I plants in the U.S. had restarted following maintenance programs earlier this year, and one producer was expected to resume production this month. Supplies were expected to increase as demand slows, since most summer base oil requirements have already been met. However, at least one supplier was reportedly unable to offer spot volumes due to a backlog of orders.

Mexican buyers were in discussions for U.S. shipments, but railcar transportation issues and difficulties in obtaining or renewing import licenses from the Mexican government posed challenges. Additionally, economic uncertainties and tensions surrounding U.S. tariffs reduced buying interest.

Export activity into Brazil remained subdued, especially compared to the second half of last year and earlier this year. Buyers were relying more on domestic supplies and additional volumes from neighboring countries such as Argentina. Competitive domestic prices reduced interest in importing Group I barrels. Discussions for Group II and Group III grades continued, with U.S. suppliers facing competition from Asian producers. Group III availability in Asia was constrained due to recent plant turnarounds, and tight supplies of the 4 cSt grade supported spot price increases.

Group II

With most U.S. plant turnarounds completed, more product was expected to enter the domestic market. However, light grades were projected to remain tight. Chevron, Motiva and Calumet had resumed operations after scheduled shutdowns and were reported to be running at full capacity. An exception may be the Excel Paralubes plant, which was understood to be operating at reduced rates. Contractual obligations were reportedly being met, but full recovery was not expected until a scheduled turnaround in October. Chevron, Motiva and Excel Paralubes did not comment on their operating statuses.

The increase in supply coincided with slower demand, as most blenders had already built sufficient inventories to meet summer lubricant needs, particularly in the automotive sector. Cautious purchasing persisted as production costs remained high and manufacturers have been unable to raise lubricant prices.

With some Group II grades becoming more available and U.S. demand flattening, one producer was heard to have offered competitively priced spot cargoes to India and the Middle East. South American buyers also showed interest, with up to 12,000 tons expected to ship this month.

Spot rerefined base oil cargoes were limited. One rerefiner reported strong demand and a sold-out position, despite a recent capacity expansion. A second rerefiner also reported sold-out inventories for June and July and expected similar conditions in August.

Avista may conduct a short turnaround at its Peachtree City, Georgia, plant in September.

Group III

Group III supplies remained tight in the U.S., though more import cargoes were expected to arrive soon. Importers were building inventories to protect against potential hurricane-related disruptions and were planning to increase volumes in the coming weeks.

One concern was the proposed 25% tariff on South Korean imports and additional duties on products from other Asian countries, set to take effect Aug. 1. It remained unclear whether energy imports would be included, as President Trump previously suggested they would be exempt. Geopolitical instability in the Middle East also contributed to concerns about potential supply and shipping disruptions, as well as tariffs on imports from the region.

Recent plant turnarounds in regions supplying Group III grades had strained availability and limited shipment volumes. However, maintenance at Petro-Canada’s plant in Canada, SK Enmove’s facility in South Korea and Adnoc’s refinery in the UAE had concluded, with all sites returning to production.

Some U.S. Group III production was curtailed in favor of Group II output due to tightening availability and stronger spot prices in that segment.

Within Group III, 4 cSt grade remained tight, supporting spot prices after a slight upward adjustment last week. Availability of the 6 cSt and 8 cSt grades was more balanced.

Naphthenic Base Oils

Producers of naphthenic base oils monitored crude oil futures but were under less pressure to adjust prices, as oil prices have retreated from last month’s highs. Pale oil prices were stable, but any shifts in supply and demand could prompt changes.

Light-grade demand remained strong, while mid- and heavy-viscosity grades showed weaker interest. Although these heavier grades typically see increased demand during summer for tire and rubber applications, this trend has not materialized this year. Suppliers still expected improvements in the second half of July and August. Some material was exported to India, helping ease oversupply.

Spot availability may tighten in the near term as Ergon begins building inventory ahead of a planned six-week turnaround at its Vicksburg, Mississippi, refinery beginning Sept. 1. Several units will undergo reliability upgrades during the maintenance period. Ergon sources said there would be no supply disruptions for current ratable customers, as inventory levels were sufficient to meet commitments.

Crude Oil and Diesel

Crude oil futures seesawed within a narrow range on Wednesday. Signs of robust seasonal demand from increased travel outweighed concerns that new U.S. tariffs on global trading partners could slow economic growth and reduce fuel consumption.

On July 15, West Texas Intermediate August 2025 futures settled on the Nymex at $66.52 per barrel, down from $68.33 on July 8.

Brent futures for September 2025 delivery traded at $68.40 on the ICE on July 15, compared to $70.01 on July 8.

Louisiana Light Sweet crude wholesale spot prices stood at $70.89/bbl on July 14, compared to $71.51 on July 7, according to the U.S. Energy Information Administration.

Low-sulfur diesel wholesale spot prices on July 14 were $2.40 per gallon at New York Harbor, $2.31/gal on the Gulf Coast and $2.63/gal in Los Angeles, compared to $2.43, $2.37 and $2.62, respectively, on July 7, the EIA reported.

LNG Publishing Co. Inc./Lubes’n’Greases shall not be liable for commercial decisions based on the contents of this report.

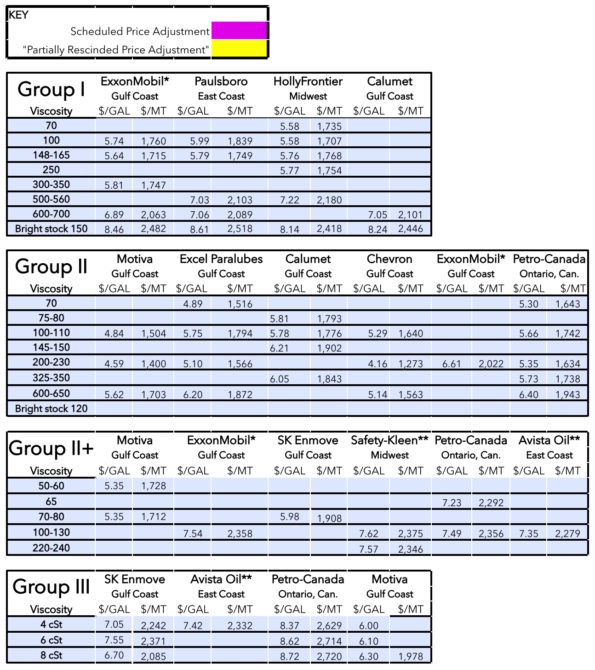

Posted Paraffinic Base Oil Prices

July 16, 2025

(Prices are FOB basis, in U.S. dollars per gallon and U.S. dollars per metric ton).

Archived base oil price reports can be found through this link: https://www.lubesngreases.com/category/base-stocks/other/base-oil-pricing-report/

Historic and current base oil pricing data are available for purchase in Excel format.

*ExxonMobil prices obtained indirectly.

**Rerefiner