Earlier talk about potential base oil price increases appeared to have subsided as crude oil futures have retreated. While most segments of the market were described as balanced to slightly tight, suppliers expressed concern about any price adjustments that might precipitate a slowdown in demand. Buying activity was steady for many applications, but others have already started to see signs of a seasonal decline. The devastating flash floods in Texas last week triggered anxiety about unexpected weather events that might cause output disruptions, particularly as the hurricane season along the U.S. Gulf Coast was forecast to bring an above-normal number of storms. As a result, some buyers have placed orders for additional volumes intended for emergency inventory building.

With recent geopolitical developments such as the Israel-Iran conflict having been put to rest – at least for the time being – attention in the United States turned to the tariff negotiations that president Donald Trump had hoped to wrap up with all trade partners by July 9. However, only two agreements have been achieved so far–one with the U.K. and another with Vietnam–and the White House has therefore postponed the deadline for the tariff implementation. President Trump informed Japan, South Korea and 12 other countries that they would face steep tariffs on Aug. 1 if they did not reach agreements by then. Negotiations with Japan and South Korea – two of the U.S.’ closest allies – remained strained, as Trump intended to impose 25% tariffs on all imports from both countries, including automobiles, parts and machinery, which are their largest exports to the U.S.

Crude oil futures have shown some volatility since the beginning of the week, but largely hovered at lower levels than three weeks ago. Oil prices slipped at the start of the week after OPEC+ announced that the group would increase output by 548,000 barrels per day in August, raising concerns about oversupply.

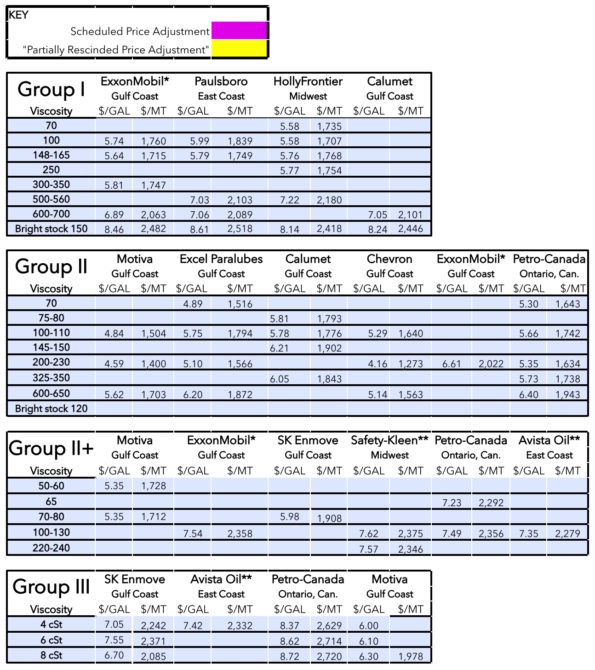

Group I

While most API Group I grades were still slightly tight, the snug conditions observed in this segment over the last several months have started to ease as most domestic base oil units have resumed production, following plant turnarounds, and demand has started to weaken. However, other regions were still showing limited supply levels, impacting global fundamentals and offering support to firm pricing of most Group I grades.

A number of plant maintenance programs have been completed at domestic base oil units in recent weeks, including those of Calumet, American Refining Group and Ergon. The turnarounds had strained spot supplies, but contract commitments continued to be met as the producers had built inventories to cover requirements during the outages.

The return to production is taking place at the same time that the busy lubricant production season starts to wind down. “Demand has been pretty good, but likely heading towards a slight slowdown coinciding with the end of summer,” a source noted. As a result, suppliers have been evaluating export opportunities, with attractive prices in Europe and South America expected to attract U.S. cargoes.

Mexican buyers were still very much interested in U.S. Group I and Group II base stocks, but given tight supply of most grades in the U.S., prices remained at higher levels than expected, making deals more difficult to conclude. Reports of railcar transportation issues also caused concerns to prospective buyers.

Buying appetite from Brazil has remained lackluster as buyers were relying more heavily on domestic supplies and exports from neighboring countries such as Argentina. Domestic prices have also come down, making imports less competitive. Given a lack of domestic Group III production, however, there was interest in Asian supplies, but export availability in Asia was also limited because of plant turnarounds.

Group II

Group II supplies have started to show some length, particularly of the heavy-viscosity grades, because plants have resumed output following maintenance programs. Recent turnarounds at Chevron’s, Motiva’s and Calumet’s units, along with reduced operating rates at Excel Paralubes’ Group II plant, had curbed spot supplies, but as most units have restarted and ramped up operating rates, additional spot volumes were expected to be reintroduced into the domestic supply system. However, spot supply of the Group II 220N remained more limited, and spot prices for this grade have inched up as a result.

Excel Paralubes was heard to continue running its Lake Charles, Louisiana, plant at reduced rates, but contractual obligations were being met. The supplier was heard to have restricted its spot sales to build inventories for the hurricane season. The production issues were not expected to be resolved until the plant’s scheduled turnaround in October, according to sources. Chevron, Motiva and Excel Paralubes did not directly comment on the status of their operations.

Spot rerefined base oil cargoes were also in thin supply, with one rerefiner reporting a sold-out position for the next 4-5 weeks given healthy demand and additional orders from buyers who were eager to pad inventories during hurricane season.

A second rerefiner, Safety-Kleen, said that contrary to rumors, its rerefinery in Breslau, Canada, had not suffered any production problems, and that the unit was running full out, although it had taken slightly longer to return to production than expected following a turnaround in April. The company’s rerefinery in East Chicago, Indiana, came out of a turnaround right on time and has been producing well. The company also reported a sold-out inventory position in June and into July and expected a similar trend to continue in August.

Avista may be embarking on a short turnaround in September. The company was heard to be running its rerefining plant in Georgia at record rates and has recently completed an expansion, bringing its capacity up to 1.15 million barrels per year.

Group III

Participants reported a tight supply situation in the Group III segment, as recent and ongoing turnarounds have restricted spot volumes. These fundamentals did not only affect the U.S. market, but also other regions. Since the U.S. imports most of its requirements from Canada, Asia and the Middle East, global conditions were also affecting pricing at home.

Recent turnarounds—including those of Petro-Canada in the neighboring country, SK Enmove in South Korea, and ADNOC’s in the United Arab Emirates–have been completed and plants have returned to production, the strained fundamentals were expected to ease. However, the 4 cSt grade was still reported in limited supply, prompting a small increase in spot prices of about 2 cents per metric ton from a week ago.

Importers were expected to make sure they had enough inventory in storage in the U.S. to cover requirements, should a hurricane impact production and transportation, so they were planning to increase their import volumes over the next few weeks. A volatile geopolitical situation in the Middle East also fed concerns about potential supply and shipping disruptions.

Naphthenic base oils

With crude oil prices coming down and then inching up again this week, naphthenic base oil producers were paying attention to market developments, as oil price fluctuations have a more direct impact on naphthenic base oil refining than on paraffinic base stocks. For the time being, naphthenic base oil prices were reported as stable, with upward price pressure subsiding as crude oil values also softened from levels seen in mid June. However, suppliers said that feedstocks were still volatile, “so we will need to keep a close eye,” a source emphasized. Ongoing balanced-to-tight conditions were also exerting pressure on prices.

Sources reiterated that the light grades were in high demand from the transformer oil segment, while consumption of the mid-vis grades was “fair,” and weaker for the heavier viscosities, which are used in the tire and rubber segment. “It seems like the tire and rubber market is running behind,” a source commented. Suppliers remained optimistic that this segment would show improved conditions in July.

Spot supply of most grades may be experiencing strained conditions as Ergon has started to build inventories ahead of its turnaround in September. Ergon has scheduled a maintenance program at its naphthenic refinery in Vicksburg, Mississippi, beginning September 1. Various operating units of the ERI refinery will be down for approximately six weeks as several reliability improvements will be implemented. No supply interruptions were expected for Ergon’s current ratable customers, as product inventory levels were anticipated to be sufficient to support sales during the planned shutdown, company sources said.

Crude Oil and Diesel

Crude oil futures rose on Tuesday to near two-week highs as analysts downplayed the impact of president Trump’s threat of imposing steep tariffs on 14 countries, which raised concerns about global economic growth and oil demand. The decision by OPEC+ to increase output in August amid worries of an oversupplied oil market limited the upward momentum.

On July 8, West Texas Intermediate August 2025 futures settled on the Nymex at $68.33 per barrel, compared to $65.45/bbl on July 1.

Brent futures for September 2025 delivery were trading on the ICE at $70.01/bbl on July 8, from $67.15/bbl on July 1.

Louisiana Light Sweet crude wholesale spot prices were hovering at $71.51/bbl on July 7, compared to $68.60/bbl on June 30, according to the U.S. Energy Information Administration.

Low sulfur diesel wholesale spot prices were at $2.43 per gallon at New York Harbor, $2.37/gal on the Gulf Coast and $2.62/gal in Los Angeles on July 7, compared to $2.37/gal, $2.30/gal and $2.54/gal, respectively, on June 30, according to the EIA.

Gabriela Wheeler can be reached directly at gabriela@LubesnGreases.com

LNG Publishing Co. Inc./Lubes’n’Greases shall not be liable for commercial decisions based on the contents of this report.

Posted Paraffinic Base Oil Prices

July 9, 2025

(Prices are FOB basis, in U.S. dollars per gallon and U.S. dollars per metric ton).

Archived base oil price reports can be found through this link: https://www.lubesngreases.com/category/base-stocks/other/base-oil-pricing-report/

Historic and current base oil pricing data are available for purchase in Excel format.

*ExxonMobil prices obtained indirectly.

**Rerefiner