Fundamentals were relatively stable for base oils and lubricants as the summer driving season unofficially got underway on Memorial Day, May 26 – in the U.S. At the same time, the extended weekend and the beginning of the summer vacation period also meant that many participants were away from the trading scene, putting a damper on market activity. Most lubricant manufacturers have built stocks ahead of the busy oil changing season and were therefore expected to start curbing order volumes, although some have now started to pad inventories ahead of the hurricane season.

Memorial Day weekend is one of the biggest travel weekends of the year in the U.S., and many travelers will move by car, according to the American Automobile Association. The organization expected 39.4 million people will have traveled by car over the weekend this year, an increase of 3% compared with last year. Observers expected an uptick in driving this summer as the retail price for regular-grade gasoline in the U.S. heading into the Memorial Day weekend was hovering at a multi-year low, averaging $3.17 per gallon, 41 cents/gal cheaper than the price a year ago, according to the Energy Information Administration. After adjusting for inflation (real terms), average U.S. retail gasoline prices were 14% lower than last year, largely because crude oil prices have fallen.

Base oil producers and consumers alike were keeping an eye on crude oil values, as they have dropped significantly since March on concerns about a potential global economic downturn triggered by U.S. President Donald Trump’s tariff announcements and other countries’ reciprocal tariff actions.

At the same time, many manufacturers’ production costs were expected to rise, particularly for those producers who import raw materials and other inputs from China. While the tariffs on Chinese imports have been temporarily lowered to 30%, from an initial 145%, many manufacturers warned that they would be forced to raise prices of finished products in the coming weeks as inventories built earlier in the year were dwindling, while replacement and shipping costs were rising. Imports from many other countries are subject to at least 10% duties as well.

A white oils and wax producer plans to raise prices by up to 10% as of June 2. The company said that the hike was “in response to ongoing geopolitical disruptions and uncertainties that have weakened global supply chains,” causing shortages of materials, shipping delays and cost surges.

Additive suppliers were also heard to be planning to increase prices or add a surcharge to pricing in May/June, but they may be postponing their implementation, or rescinding it altogether as blenders are unable to absorb the added costs, according to reports.

Several blenders were facing resistance to proposed lubricant increases that were expected to offset the higher cost of additives, raw materials and components. These suppliers also faced headwinds from competition with other manufacturers as they sought to preserve their customer base.

Group II

Chevron’s recently implemented API Group II posted price decrease did not seem to impact many contract orders, and Group II prices were reported as steady. Participants commented that contracts are indexed against a number of different prices, and these prices had not decreased. As a result, lubricant manufacturers said that they had not seen much relief from high production costs and were not able to lower the price of finished products.

There were expectations that downward pressure would be building on Group II grades as Chevron’s turnaround has been completed and more product was anticipated to come to the market. The company was heard to have restarted its unit in Pascagoula, Mississippi, and was building inventories.

Motiva was also expected to complete a turnaround at its hydrocracker by the first week of June. The shutdown was anticipated to affect mainly the Group II 220N grade. The three-week maintenance program had been postponed by a couple of weeks because of a delay in the delivery of the catalyst, according to sources.

At the same time, Excel Paralubes was heard to be running its Lake Charles, Louisiana, plant at reduced rates since late last year reportedly due to technical issues related to Group III production at the facility, but contractual obligations continued to be met. However, sources indicated that the producer was abstaining from offering spot volumes this month, and might not be able to supply spot cargoes in June, depending on whether it can build enough stocks ahead of the hurricane season. The production issues were not expected to be resolved until the plant’s scheduled turnaround in October. Chevron, Motiva and Excel Paralubes did not comment on the status of their operations.

Ergon just completed a seven-week turnaround at its Group I/Group II base oil unit in Newell, West Virginia, that started on March 31, after perfoming maintenance and implementing several reliability improvements.

Additional rerefined products were also expected to become available in the coming weeks as most plants have restarted and were running well.

Some discussions of possible Group II exports to India have started to emerge, but it was not clear whether the arbitrage would work at current price levels. India will also be entering the monsoon season in June, when base oil and lubricant demand tends to decline due to disruptions in industrial and transportation activities.

Group I

Ongoing tightness of most Group I grades continued to support stable pricing. Plant turnarounds in the U.S. and other regions, together with permanent closures of Group I units have resulted in sporadic shortages of the Group I grades, particularly bright stock. Orders have been consistent, with suppliers heard to be sold out of some grades. “Demand seems good and we are getting plenty of inquiries for Group I products,” a supplier conceded.

The supply/demand fundamentals were expected to change slightly once refineries restart, but the Group I segment is regularly reported to be on the snug side due to the plant rationalizations that have been taking place over the last twenty years. A number of additional plants were also expected to be shuttered in different regions in the future because of environmental concerns, lack of interest in Group I investments and sliding profitability.

Calumet will be starting a turnaround at its Group I/Group II unit in Shreveport, Louisiana, in June, which will only affect the Group I heavy grades. The company completed maintenance on the lighter viscosity base oil lines last March.

American Refining Group was also heard to be preparing for a turnaround at its Group I plant in Bradford, Pennsylvania, but further details could not be obtained.

As mentioned above, Ergon was heard to be rebuilding inventories following a turnaround at its Group I/Group II unit from the end of March until mid May. The producer expected no supply interruptions for current ratable customers as the company had built inventories ahead of the shutdown.

Suppliers have also been fielding export opportunities for Group I cargoes due to strained conditions elsewhere. Discussions for shipments to Europe and the Middle East were ongoing, but there was also buying appetite for Group I base stocks from Africa and Latin America, although curbed availability in the U.S. hampered the conclusion of some transactions.

Mexican buyers were watching developments in the U.S. market and had high hopes for lower pricing, particularly following Chevron’s recent posted price decrease, and the restart of some plants following turnarounds. However, over the last couple of weeks, base oil prices have actually inched up in Mexico because of limited supplies of some grades in the U.S. There continued to be Group I and Group II cargoes being moved to Mexico, but some importers were facing difficulties in obtaining or renewing import licenses.

In Brazil, buying appetite for most grades was robust, with local production and recent imports expected to be sufficient to meet most Group I and Group II demand, although some buyers were on the lookout for fresh imports. Some cargoes continued to move to Brazil from Argentina, helping close a heavy-vis base oil supply gap.

Group III

Group III prices were firm, propped up by decreased Group III production at some U.S. facilities as Group II output has been favored, and there were fewer import volumes in the previous months. Prices were also supported by reduced global production as plant turnarounds were being completed in North America, Asia and the Middle East.

However, the restart of production at Petro-Canada’s Group III plant in Mississauga, Canada, earlier this month following a turnaround that began in April should allow for additional product to be reintroduced into the market. The company had built contingency inventory to avoid any supply impacts to customers. The Group II unit at the same location continued to operate during the Group III turnaround.

In South Korea, SK Enmove will be undergoing a partial turnaround at its Group III plant in Ulsan for two months, starting this month, but the shutdown was not expected to have a significant impact on supplies because of uninterrupted production on the facility’s other trains, company sources said.

In the Middle East, ADNOC started a two to three-week turnaround at its Group II/Group III plant in Ruwais, Abu Dhabi, United Arab Emirates, earlier this month.

Bapco was heard to have scheduled a 10-week turnaround at its Group III facilities in Sitra, Bahrain, which was originally scheduled to start in late March or early April, but was reportedly postponed to late May or early June.

Naphthenics

Naphthenic prices were steady but continued to be exposed to downward pressure due to falling crude oil prices. Producers implemented a 20 cents/gal price decrease between May 9-16. The decrease applied to most grades, although San Joaquin Refining left the price of its pale oil 60 and transformer oils intact because of the current tight conditions for these grades. The general downward price adjustment was mostly driven by lower crude oil and feedstock prices since March.

Demand for a majority of pale oils was described as healthy, even though the light grades seemed to attract more buying interest than the high-viscosity grades. This was partly because consumption levels for the heavier grades had been weaker from the rubber and tire industry, but have shown a gradual increase over the last few weeks due to the start of the summer driving season. Nevertheless, automotive production disruptions on the back of the new U.S. tariffs have dampened some of the business.

Crude Oil and Diesel

Crude oil futures were largely range-bound on Wednesday as the prospect of further sanctions against Russia offset expectations of increased crude output by OPEC+ members and non-members. Participants awaited Saturday’s OPEC+ meeting, where members were anticipated to agree on July output levels.

On May 27, West Texas Intermediate July 2025 futures settled on the Nymex at $60.89 per barrel, compared with $62.03/bbl on May 20.

Brent futures for July 2025 delivery were trading on the ICE at $64.17/bbl on May 27, down from $66.38/bbl on May 20.

Louisiana Light Sweet crude wholesale spot prices were hovering at $65.39/bbl on May 23, compared to $66.28/bbl on May 19, according to the U.S. Energy Information Administration. (There was no trading on May 26 due to the Memorial Day holiday).

Low sulfur diesel wholesale spot prices were at $2.11 per gallon at New York Harbor, $2.05/gal on the Gulf Coast and $2.19/gal in Los Angeles on May 23, compared to $2.13/gal, $2.05/gal and $2.16/gal, respectively, on May 19, according to the EIA.

Gabriela Wheeler can be reached directly at gabriela@LubesnGreases.com

LNG Publishing Co. Inc./Lubes’n’Greases shall not be liable for commercial decisions based on the contents of this report.

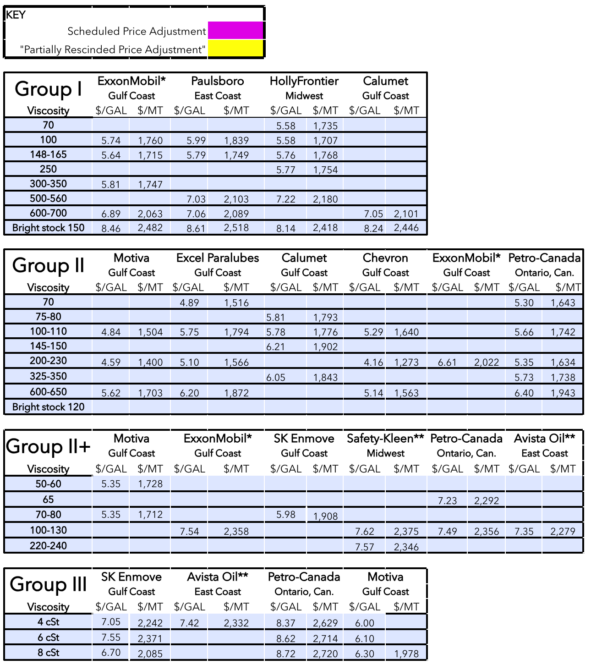

Posted Paraffinic Base Oil Prices

May 28, 2025

(Prices are FOB basis, in U.S. dollars per gallon and U.S. dollars per metric ton).

Archived base oil price reports can be found through this link: https://www.lubesngreases.com/category/base-stocks/other/base-oil-pricing-report/

Historic and current base oil pricing data are available for purchase in Excel format.

*ExxonMobil prices obtained indirectly.

**Rerefiner