HollyFrontier announced a posted price decrease for most of its API Group I base stocks this week, in the wake of similar initiatives by Chevron, ExxonMobil and Paulsboro. The decreases were likely prompted by slowing demand, rising inventories, a need to stimulate purchases to lower inventories, and to bring posted prices more in line with actual transaction prices. Suppliers typically prefer to end the year with lean inventories to avoid tax repercussions on existing stocks and it is not uncommon to see posted price initiatives emerge in the last quarter. Aside from the price announcements, market activity was fairly muted ahead of the Christmas holidays and was not expected to pick up until after New Year’s Day. Crude oil and diesel prices were trading at multi-month lows, but edged up on Monday on escalating tensions between the United States and Venezuela, which raised concerns about oil supply disruptions.

HollyFrontier (HF Sinclair) communicated a posting decrease of 30 cents per gallon on all Group I grades, with the exception of bright stock. The adjustment will go into effect on Dec. 24. The producer also noted that there were no other posting changes at this time.

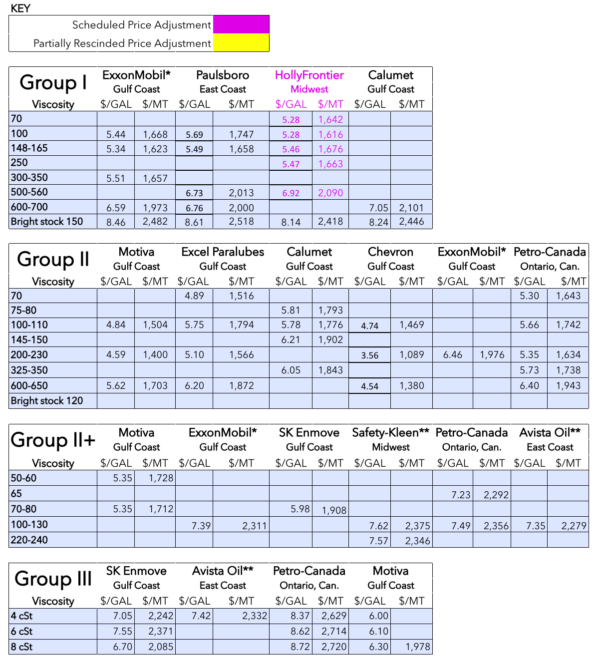

Chevron, ExxonMobil and Paulsboro Refining Co. have also decreased posted prices since the beginning of the month. Chevron lowered its Group II posted prices by 30 and 35 cents/gal on Dec. 2. ExxonMobil and Paulsboro decreased all of their Group I postings, with the exception of bright stock, by 30 cents/gal on Dec. 16 and Dec. 19, respectively. ExxonMobil also marked down its Group II and Group II+ grades by 15 cents/gal.

Aside from hoping to finalize domestic transactions before the year-end holidays, U.S. suppliers were discussing export business, as buying interest from Brazil and West Coast South America has shown an uptick, although negotiations were also winding down. Economic uncertainties and adequate inventories dampened spot business in Mexico, with buyers receiving regular contract shipments of U.S. products and plentiful supplies reported at the border.

Looking ahead of the new year, base oil consumption levels were expected to be affected by receding demand from the automotive industry, U.S. manufacturing rates, tariffs, growing availability of rerefined base oils and developing applications such as cooling fluids for data centers. While U.S. tariffs on imports are not applicable on base oils because they fall under the energy imports category, which are largely exempt from duties, many industries that consume lubricants have seen an impact from tariffs on raw materials such as steel amid increasing production costs.

Group I

The Group I segment displayed pockets of lengthening supply, which placed downward pressure on spot pricing, but bright stock was able to hold its own as demand remained fairly steady and availability was snug. Group I demand for the manufacture of industrial oils and metalworking fluids has slowed down on lower manufacturing rates in the United States, but marine and heavy-duty applications remained robust, according to sources.

There has been increased buying appetite for U.S. base oils in Brazil due to the unplanned shutdown of key producer Petrobras’ base oils plant since October. The outage appeared to last longer than anticipated. The producer was heard to have met a large portion of its contract commitments, but a number of customers saw lower volumes than originally agreed. The tightening of local spot supplies – with demand for bright stock particularly robust – led to climbing domestic prices. Some buyers were using Group II cuts instead of Group I cuts whenever possible, but bright stock still remains a difficult cut to replace. Discussions involving U.S. products were wrapping up as participants were hoping to finalize transactions before the holidays.

Base oil demand from Mexico was weaker than earlier in the year, although regular contract cargoes continued unabated, except that some shipments had been affected by railway and trucking disruptions at the border. These disruptions appeared to be mostly linked to protests by Mexican farmers and truckers in northern Mexico. Mexican consumers had delayed purchases in hopes of achieving more discounts from U.S. suppliers who were expected to offer incentives to capture orders and reduce inventories. The approach of the year-end holidays dampened discussions.

Group II

Both Chevron and ExxonMobil have lowered Group II posted prices this month, reflecting market fundamentals, with plentiful supplies, waning demand and softer crude oil prices being the main drivers. While some producers resort to decreasing posted prices to reflect market conditions and general price direction, others prefer to keep prices unchanged because they maintain that demand will not be revitalized through lower pricing.

The lighter Group II grades were in a tighter position because of slightly healthier demand than the heavy grades during the previous weeks, with prices holding steady, but there was also ongoing competition from rerefined base oils. Domestic demand was not anticipated to improve substantially until February or March, when blenders start to prepare inventories for the busier spring production season.

U.S. producers have also finalized export transactions into Latin America, Europe and Africa. India had typically received large quantities of U.S. Group II base oils during the last quarter of the year, but this year, demand remained sluggish in most regions and Indian buyers were also able to purchase Asian cargoes at competitive levels.

Meanwhile, rerefiners continued to report fairly steady domestic demand and sold-out positions for a number of cuts, with some cargoes also moving to Mexico. An upcoming maintenance program in the first part of 2026 was also expected to strain availability since the rerefiner plans to build inventories to meet contract obligations during the shutdown.

Group III

Group III prices were largely unchanged, but continued to be exposed to downward pressure because additional import cargoes arrived in the U.S. during December, and demand was not anticipated to increase until early next year.

Domestic production of Group III grades and rerefining was steady, but most producers were using their Group III base oils for downstream lubricant production. Domestic Group III capacity is still not adequate to cover all requirements, and imports from Canada, Asia and the Middle East were therefore expected to continue playing a key role within the U.S. market.

In related news, Luberef (Saudi Aramco Base Oil Company) has secured a new feedstock supply agreement for the company’s Jeddah facility. The facility had been expected to close by mid-2026, but the new supply agreement will allow it to continue operations beyond 2026. As a result, the company will maintain its current production capacity of 275,000 metric tons per year of Group I base oils. With the completion of the Growth-II Project in Yanbu, Luberef’s total production capacity will reach 1.53 million metric tons per year, making it the only supplier in the region able to offer Group I, Group II, and Group III base oils.

Naphthenics

Naphthenic base oil prices were largely holding, although some accounts may have seen reduced pricing because some contracts are indexed against diesel prices. Demand for the heavy grades from the rubber, tire, grease and process oil segments has sagged, exerting pressure on prices, while buying appetite for the light grades was slightly less buoyant than a few weeks ago, but was still fairly healthy.

Export activity has also weakened, as is expected for this time of the year, reducing the possibility of U.S. suppliers to place their extra volumes into other regions. Additional downward price pressure came from the paraffinic side as plentiful paraffinic supplies competed in some applications with naphthenic oils.

Spot availability may experience some tightening in the coming weeks because San Joaquin Refining plans to have a three-week routine turnaround at its refinery in California in mid-January and was expected to start building inventories to keep customers supplied during the shutdown.

Crude Oil

Crude oil futures slipped in early trading on Tuesday after jumping by more than 2% in the previous session, as the U.S. said it may sell the Venezuelan crude it has seized, but increased Ukrainian attacks on Russian ships and ports fanned concerns about potential supply disruptions.

- West Texas Intermediate February 2026 futures settled on the Nymex at $58.01 per barrel on Dec. 22, up from $55.27/bbl for front-month futures on Dec. 16.

- Brent futures for February 2026 delivery were trading on the ICE at $62.14/bbl on Dec. 24, up from $59.63/bbl for front-month futures on Dec. 17.

- Louisiana Light Sweet crude wholesale spot prices were hovering at $59.40/bbl on Dec. 22. Spot prices had settled at $58.52/bbl on Dec. 15, according to the U.S. Energy Information Administration.

Diesel

Low-sulfur diesel wholesale, Dec. 22 (Dec. 15), EIA

New York Harbor: $2.18 per gallon ($2.23/gal)

Gulf Coast: $1.97/gal ($2.02/gal)

Los Angeles: $2.06/gal ($2.06/gal)

Gabriela Wheeler can be reached directly at gabriela@LubesnGreases.com

LNG Publishing Co. Inc./Lubes’n’Greases shall not be liable for commercial decisions based on the contents of this report.

Posted Paraffinic Base Oil Prices December 24, 2025

(Prices are FOB basis, in U.S. dollars per gallon and U.S. dollars per metric ton).

Archived base oil price reports can be found through this link: https://www.lubesngreases.com/category/base-stocks/other/base-oil-pricing-report/

Historic and current base oil pricing data are available for purchase in Excel format. *ExxonMobil prices obtained indirectly.

**Rerefiner