May the Autumn Moon Light the Way

The fall season ushers in a time of reflection and gratitude in many parts of the world, such as the traditional autumn moon viewing in Japan (known as “Tsukimi”), which represents a moment to express gratefulness for the harvest, contemplate nature’s beauty, and pray for future prosperity. In the United States, Thanksgiving is similarly a holiday to celebrate the blessings received during the year, although it is also a National Day of Mourning for Native Americans, who associate the holiday’s origins with the trials and tribulations of European settlement.

This year, participants in the base oils industry were grateful and relieved that, despite earlier predictions of a potentially very active hurricane season, there were no major storms to cause production and supply chain disruptions along the U.S. Gulf Coast.

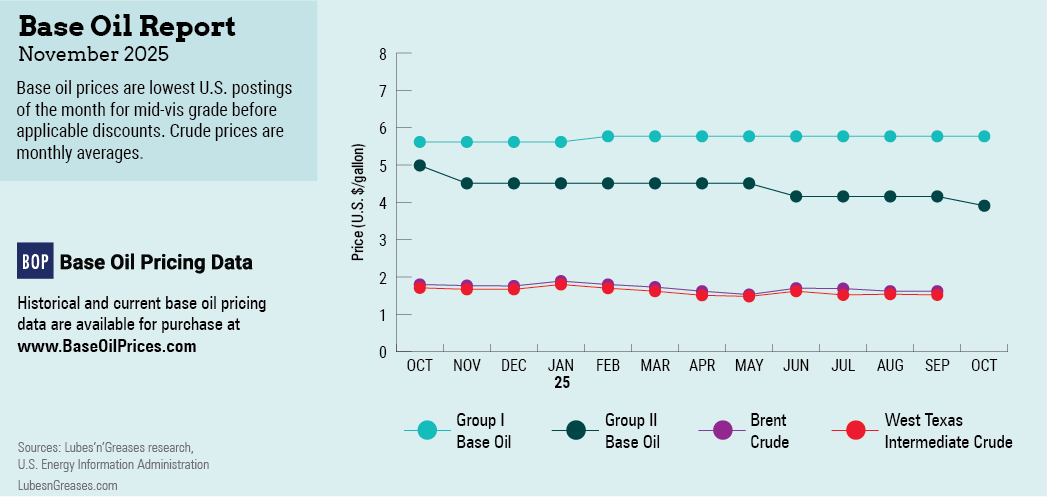

As is the case every year, once the peak months for severe weather came to an end, most suppliers started to release the emergency inventories that they had kept to cover potential supply disruptions. The onset of the inventory drawdown coincided with declining demand at the end of the driving season in early September. Most base oil grades began to reflect softer conditions and downward price pressure, although API Group I bright stock and Group II light grades were generally tighter and sustained more stable pricing.

It was at this juncture that Chevron stepped out with a 25 cent-per-gallon Group II posted price decrease announcement for Sept. 30 implementation. The price adjustment — the company’s first price revision since May — took some participants by surprise as a second Group II producer was preparing to take its plant offline for a turnaround, and this was expected to tighten spot supply and support pricing. Some observers believed the decrease would bring the Chevron’s posted prices more in line with actual market prices, as posted prices in general were said to be unrealistic.

Other suppliers continued to assess the situation but acknowledged that some pockets of the market were slightly oversupplied, and this weighed on prices. The fact that a number of producers, mainly in the Group II segment, had pursued spot export opportunities was considered a clear indicator of market softness.

Regular Group I and Group II export shipments to Mexico were ongoing, but spot movements appeared to slow down, reflecting lackluster consumption in other regions as economic uncertainties dampened buying interest. A similar situation applied to transactions into Brazil, where buyers were relying more heavily on domestic production to avoid the risk of acquiring foreign products that may have lost some of their value by the time they arrived.

Several Group II cargoes were reported concluded to India in August and September, but spot availability in the U.S. was anticipated to become more limited in October as the Excel Paralubes Group II/Group III plant in Lake Charles, Louisiana, was taken offline for a four- to six-week turnaround. The unit had been running at reduced rates for most of the year but was expected to attain top production rates following the maintenance program.

Participants that actively participate in import and export business said they were keeping an eye on the proposed fees that the Trump administration planned to impose on Chinese owned and manufactured ships as of October 14. The suggested fees have prompted ship operators to shuffle their vessel line-ups and move vessels built in China off U.S. routes. The reduced number of vessels on transpacific routes has tightened cargo space and pushed freight rates up, according to industry sources, with some emphasizing that freight rates from Asia to the U.S. and Latin America had increased significantly.

On the naphthenic base oils side, prices were reported as largely stable, supported by a balanced-to-tight supply and demand scenario. A turnaround at Ergon’s naphthenic base oils plant in Vicksburg, Mississippi, which started on Sept. 1 and was expected to be completed in mid-October, would likely keep spot supplies on the tight side, although reduced requirements for grease production linked to the shutdown of Smitty’s Supply’s blending plant following an explosion and fire in August had temporarily freed up some base oil barrels.

Domestic naphthenics production was considered adequate to meet demand, particularly as consumption of the heavy pale oils from the rubber and tire segment was weak compared to the lighter grades moving into the transformer oil segment.

Despite generally softer market conditions, most refiners preferred to keep running plants at close to top rates as base stock margins remained reasonable against competing fuel values, and this exacerbated the lengthening supply conditions. Sentiment in crude oil circles was rather bearish as OPEC+ members decided to increase oil output in November, deepening concerns about oversupply.

West Texas Intermediate was hovering near $64 per barrel the first week of September and had fallen to $61/bbl by early October. If crude prices fall further and remain at reduced levels for several weeks, there was a chance that they would prompt base oil suppliers to reassess their price positions. Blenders would certainly be grateful for any price relief they might receive as production costs have crept up and competition among suppliers prevented most manufacturers from increasing finished product prices to improve their margins.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com