At a Crossroads

The summer driving season in the United States reached its denouement in early September, dampening fuel and motor oil consumption as the peak oil changing period ended. As a result, demand for base oils used in automotive applications was expected to decline through the end of the year, and inventories were anticipated to grow.

While many consumers and suppliers had kept extra stocks on hand to cover potential production disruptions during the Atlantic hurricane season — most storms have historically occurred between August and September — some started to release a few of these barrels at the end of August since no major weather events had taken place. This move exacerbated the supply and demand imbalance that had already started to emerge.

A massive explosion and fire at Smitty’s Supply Inc.’s large blending and packaging plant in Roseland, Louisiana, on Aug. 22 were expected to free up additional base oil barrels in the short term, because there was speculation that the facilities would be shut down for a prolonged period and would have to be rebuilt given the extent of the damage. Industry participants wondered what kind of repercussions the output disruptions would have on the general lubricant, base oils and additives market, with potentially reduced base oil requirements from Smitty’s likely to exacerbate the nascent oversupply conditions. Smitty’s Supply is a large independent U.S. lubricant manufacturer and secures base oils and additives from a number of different suppliers.

However, some participants did not expect significant impact, reasoning that base oil demand will shift from one supplier to another as other blenders tried to fill in the finished products supply gap left by the accident. Additionally, Smitty’s also operates plants in Vicksburg, Mississippi; Hammond, Indiana; and Jasper, Texas, and these units could potentially increase production to compensate for part of the lost output at Roseland.

Some lubricant and grease suppliers received inquiries from Smitty’s customers looking for product. While other blenders would likely benefit from capturing part of Smitty’s business, participants admitted it would be difficult for most manufacturers to match Smitty’s prices, possibly leading to an increase in finished products pricing — especially as lubricant and grease supplies were expected to tighten due to the extended plant shutdown.

Concerned about mounting supplies and weakening domestic demand, base oil producers started to look for fresh export opportunities, but this appeared to be challenging as buying appetite in other regions had turned lackluster as well, and the arbitrage into some destinations remained difficult to work. Buyers at destinations such as Mexico, Brazil and India delayed purchases in hopes of achieving lower prices for U.S. cargoes once producers released the extra inventories held during hurricane season.

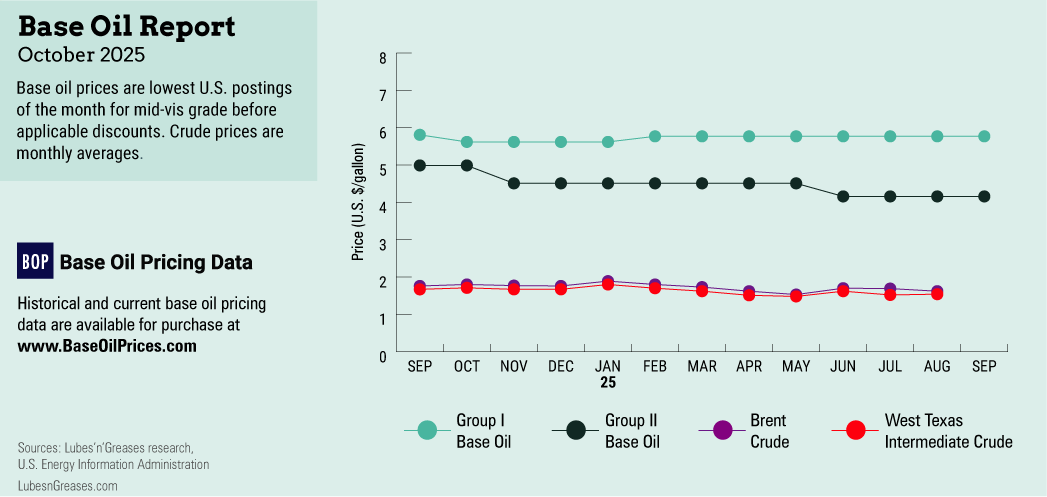

While paraffinic base oil posted prices remained on a steady course, some spot prices started to lose territory, with the light viscosity API Group I and Group II grades showing weekly losses of 1 cent per gallon to 5 cents/gal by early September. Meanwhile, naphthenic base oil prices were reported as largely stable.

Supply and demand were still the main conditions influencing prices, given that crude oil and feedstock values showed few noteworthy fluctuations since late July. West Texas Intermediate settled at $65.16 per barrel on Aug. 5 and hovered near $64/bbl the first week of September. Sentiment in crude oil circles was bearish as OPEC+ was expected to announce another round of production increases, adding more barrels to an already oversupplied market. Analysts also worried about demand at the end of the summer driving season and about China’s manufacturing activity, which contracted for a fifth consecutive month, suggesting a global economic slowdown.

Uncertainty lingered about U.S. tariffs and their effect on manufacturing operations and industrial lubricant demand. Many of the tariffs that U.S. President Donald Trump had imposed earlier in the year appeared to be in limbo, as a federal appeals court ruled that most of his reciprocal tariffs against numerous countries were illegal. President Trump on Sept. 2 said that he would seek an immediate hearing from the Supreme Court in hopes of overturning the appeals court’s ruling, media sources reported.

Base oil operating rates were high at most plants, but a one-month turnaround at the Excel Paralubes Group II/Group III plant in Lake Charles, Louisiana, in October was anticipated to curtail spot availability. The unit had been running at reduced rates for most of the year, but was expected to attain top production following the maintenance program.

On the naphthenics side, Ergon started a six-week turnaround at its refinery in Vicksburg, Mississippi, on Sept. 1. Various operating units of the ERI refinery were scheduled to be down for the implementation of several reliability improvements. No supply interruptions were expected for Excel’s or Ergon’s customers, as product inventory levels were anticipated to be sufficient to meet contractual requirements during the planned shutdowns.

With domestic demand not likely to pick up significantly for several months, and export activity expected to remain sluggish given adequate to ample base oil availability in most regions, refiners might have to make some key decisions in the next few weeks, including whether to trim base oil plant operating rates to avoid oversupply conditions and downward price pressure.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com