At last June’s ASTM meeting in Seattle, Washington, we learned that ILSAC would soon request the next passenger car engine oil upgrade for introduction in the first half of 2028. As promised, the official request came in August, signed by Mike Deegan of Ford on behalf of ILSAC members.

A parallel request by the American Petroleum Institute to add the licensing of new low-viscosity grades was presented at the same meeting as part of an ILSAC GF-6B supplement. API announced the reactivation of the Auto Oil Advisory Panel in August, with the first meetings taking place in late October and early December. (Figure 1 summarizes the initial request by ILSAC versus the current standard.) Although no concrete progress has been made to develop the next ILSAC category, serious discussion concerning next steps is now underway.

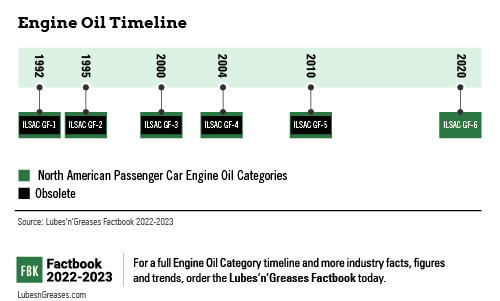

Looking back, ILSAC GF-6 was introduced on May 1, 2020, and ILSAC GF-5 became obsolete on May 1, 2021. ILSAC GF-5 was the longest-serving ILSAC category since the system was introduced in the early 1990s and the first to exceed a six-year life, lasting nearly 10 years. (See Figure 2.) For some original equipment manufacturers, upgrades have not come fast enough, leading to some OEMs being dissatisfied with the system and introducing their own specifications, such as GM dexos1 or the recently formed International Fluids Consortium. Oil companies counter that test development is the key reason new industry specifications are delayed, and many are skeptical of having yet another set of specifications or licensee fees to pay with more new specifications. There does not appear to be any expectation that the ILSAC and API licensing system will be replaced.

ILSAC GF-7 Request, August 2022

Brent Calcut Sr., Afton’s OEM relationship manager, was the first to propose a path forward. “The Auto Oil Advisory Panel is considering three category upgrades based on industry requests: API SP Plus, expansion of ILSAC GF-6B to SAE 0W-08 and 0W-12 viscosity grades, and ILSAC GF-7,” he said. “Rather than handling each of these requests independently, we feel strongly that they should be consolidated into more meaningful and manageable steps. We support all three requests and welcome the performance improvements that, if implemented efficiently, will provide consumer value.”

Calcut continued: “The automakers are facing significant pressure to improve fuel economy and reduce emissions in the 2025 timeframe, and our proposal to streamline the introduction of ILSAC GF-7 is aligned with these regulations. It is critical to advance lubricant technology with ILSAC GF-7 by measurably improving fuel economy to assist OEMs. The automotive industry is undergoing dramatic change, and we must be responsive to OEM needs and act with a sense of urgency to realize the benefits required by OEMs and vehicle owners.”

At the December meeting, Robert Stockwell, Chevron Oronite’s industry liaison leader, made a second proposal. “Oronite offered a proposal to help get the process moving and in order to deliver some key needs to the end users and OEMs a little faster,” he said. “Specifically, the addition of used oil LSPI [low-speed pre-ignition] performance for additional TGDI [turbocharged gasoline direct injection] protection, which Ford has been requesting for some time, along with improved fresh oil low-temperature protection. Completing the aged oil LSPI precision matrix took about 10 months longer than expected, but it is ready now and can be quickly implemented via a supplement to API SP, like how fresh oil LSPI was introduced ahead of ILSAC GF-6.”

PCMO Specification Evolution

He added that there is a chance that GF-7 could be pulled forward from ILSAC’s proposed date in the second quarter of 2028. “But test development would need to be trouble-free for that to happen, so the ILSAC second quarter 2028 may be more likely.”

Of course, the industry is concerned with how to specify future oils. But are current oils a concern? Is an upgrade needed?

Angela Willis of Willis Advanced Consulting explained the needs of the OEMs going forward: “Today’s lubricants provide excellent protection, but further improvement in fuel economy or the ability to protect hardware that improves fuel efficiency is always desired. For example, a lower SASH limit which may impact additives that would help ensure efficient operation for vehicles that may be equipped with gasoline particulate filters due to new EPA regulations or modifications that may better protect hybrids.”

Regarding the used oil LSPI test, Willis said that it “should be getting close and should be ready to formally approve during the second half of 2023. Assuming BOI/VGRA [base oil interchange and viscosity grade read-across] rules are like the current LSPI test, additive companies could implement this test quickly for a supplement, and it would be ready for a potential early upgrade to ILSAC GF-7.”

Calcut agreed. “Ford and the Aged Oil LSPI Task Force have been diligently working on the test procedure and completed all precision matrix testing. Details are being finalized by the Task Force and are nearly ready for review by the API Lubricant Standards Group. API’s BOI/VGRA Task Force hasn’t decided whether a BOI/VGRA matrix is needed. Most likely, the existing read-across rules will be adopted, since only the aging portion is new and the Sequence IX LSPI test remains the same.”

API also requested early introduction of SAE 0W-8 and 0W-12 as a supplement to GF-6B. These oils are currently used in Japan and were part of ILSAC’s request for GF-7, but they were not deemed an immediate need.

“The need for these grades may be less urgent, but it is more complex than just making the grades official,” Willis said. “The current JASO-approved oils do not completely align with GF-6, and the fuel economy test may not meet lubricant test monitoring system or American Chemistry Council code of practice requirements that would be indicative of an ASTM test. Given these grades have lower base oil viscosities and are different than even the current GF-6B SAE 0W-16, we would also need agreement on the certification symbol. Bottom line is it’s not as easy as one would think!”

How might this challenge be overcome?

“The fastest and easiest way to meet this need with API licensed products is to substantially align it with the JASO GLV-1 requirements,” Stockwell said. “Although this addition does not carry the same urgency as API SP Plus, aligning with an existing specification may ease the need for a tech demo period, and finalizing the specification may allow for licensed products as early as 2023.”

Calcut offered a slightly different perspective: “API requested to introduce SAE 0W-8 and 0W-12 viscosity grades into ILSAC GF-6B to fill an identified gap for licensing of low-viscosity oils globally. We are supportive of responsibly adding these grades. Combining API SP Plus, expansion to SAE 0W-8 and 0W-12, and many aspects of ILSAC GF-7 represents one meaningful change to the ILSAC specification rather than minor, incremental upgrades that admittedly are more difficult to justify.

“Combining these specification upgrades also creates an opportunity for new technologies to provide more significant fuel economy benefits. These viscosity grades could be added efficiently without requiring lengthy BOI and VGRA matrices. The practical necessity for BOI and VGRA for these ultra-low-viscosity grades is limited and far outweighed by the positive impact of their accelerated introduction.”

Readers may remember that some in the industry were also concerned about misapplication of ultra-low-viscosity grades when ILSAC GF-6B was introduced, hence the new service symbol. It should be noted that there are larger formulating differences going to SAE 0W-8 or 0W-12 than there were going from SAE 0W-20 to 0W-16.

One challenge to the Afton proposal concerned the impact on the life of current engine tests and the time it takes to introduce new ones. Key concerns include the life of the Sequence VH sludge test and the fuel economy test, the Sequence VIE/F.

“Test hardware availability is one of the challenges raised with our proposal,” Calcut said. “After closer review, the test laboratories believe they have sufficient hardware to cover the increased demand. The Sequence VH and VIE/F tests will not need to last all the way to ILSAC GF-8—only until their replacement tests are ready, which could be introduced during ILSAC GF-7’s lifetime as was done with several engine tests during ILSAC GF-5. This approach provides the added benefit of decoupling new test development from new category development, allowing the industry to avoid category delays if test development is delayed, as we saw during GF-6 development.”

By taking this approach, ILSAC GF-7 can be introduced at the right time rather than waiting until all new tests are ready. “This concept was already being discussed within API after ILSAC GF-6 to improve category development,” Calcut said. “The Sequence IIIH is another critical test, and the industry has sufficient hardware supply to continue using the same test throughout GF-7’s lifetime. Since no new tests will be introduced, there is no need to run precision or BOI/VGRA matrixes, as read-across rules already exist. Formulators are already familiar with these engine tests and their appetite. These advantages should result in a smoother new category introduction and reduce the spike of test hardware consumption typical with a new category introduction.”

The good news for the industry is that GM and Ford have already publicly noted they will support the development of replacement engine tests. This was a concern given all the resources that have been reallocated to battery electric vehicles.

Introducing new categories is never easy and comes with lots of hard work from all stakeholders. Several marketers were asked about the best path forward but felt it was early in the process and were not ready to support any specific proposal.

“It’s complex, but a supplement with just the addition of used oil LSPI likely does not provide significant benefits for consumers or marketers,” Willis said. “An upgrade that may provide some additional fuel economy as part of an earlier GF-7 would be welcomed by OEMs and would probably be easier for the oil marketers to market or differentiate to customers, versus an API SP Plus. An ILSAC GF-8 might then not be required until 2029 or 2030 when replacement engine tests will also be required.”

She added that timing is still critical. “If we cannot get most of the work done in the next two years, we will be on a collision course with PC-12 and industry resources would really be strained.”

Calcut agreed: “Introducing ILSAC GF-7 at the end of 2024 allows sufficient separation between GF-7 and PC-12. It’s another benefit of our proposal.”

On January 31, a short AOAP Telecom was held. At this meeting, ILSAC revised its timeline for ILSAC GF-7 to mostly align with the Afton proposal. There was no objection to this at the meeting, but stakeholders still need to evaluate revised requests and validate that the timeline is feasible.

API also revised its proposal to align SAE 0W-8 and 0W-12 to the JASO GLV-1 specification. There was significant discussion about the need to include these grades in ILSAC, as some OEMs felt that JASO GLV1 met their needs in the near term. There was also discussion concerning the use of the JASO M366 test and its alignment with ASTM and ACC protocols. API felt these issues were manageable, and a ballot will be issued to move forward with this prior to ILSAC GF-7.

The industry needs to move quickly on the preferred pathway for ILSAC GF-7, or it could be too late to manage a new PCMO specification along with the launch of a major diesel specification. This did happen for ILSAC GF-6 and PC-11 (API CK-4/FA-4), but new GF-6 engine tests were not ready, so GF-6 was delayed. But for PCMO, a supplement or early introduction of GF-7 with some OEM needs met appears to be a real possibility. Managing development and deployment of two new categories would have been a major challenge in 2016, and it did not happen. It would be even more difficult today due to reductions in staff and experience.

“There will be significant resource challenges with GF-7/PC-12 and dexos1 Gen4 all happening in close succession,” Stockwell said. “All dexos1 products will likely carry API licensing, so it would streamline the process if API ‘SQ’ happened at about the same time or slightly earlier than GM dexos1 Gen4.”

Steve Haffner is president of SGH Consulting LLC. He has over 40 years of experience in the chemical industry, primarily with Exxon Chemicals Paramins and Infineum USA. Contact him at sghaffn2015@gmail.com or 908-672-8012.