Bright Stock Steals the Show

Over the past several years, base oil market participants have repeatedly heard the mantra that API Group I grades were on their way out. Output capacity of these base stocks has shrunk, as many Group I plants have been permanently shut down.

Who would have guessed that in 2021, some of the most sought base stocks would turn out to be the Group I solvent neutral cuts, with bright stock becoming the elusive diva that attracts heaps of attention?

Not only has bright stock become a hot commodity in the United States, but also in other regions such as Asia, where this cut has been hard to locate and prices have sometimes jumped by $50-$100 per metric ton week on week. This was partly the result of refineries having to run at reduced rates since the start of the coronavirus pandemic to adjust for a dramatic slump in fuels consumption.

With a flurry of base oil plant turnarounds starting in February, and a couple more slated in March, any extra barrels in the repertoire were doomed to dry up fast. Paraffinic refiners HollyFrontier and Calumet and naphthenic producer San Joaquin Refining embarked on turnarounds in early February, while Cross Oil was expected to begin a maintenance program in March.

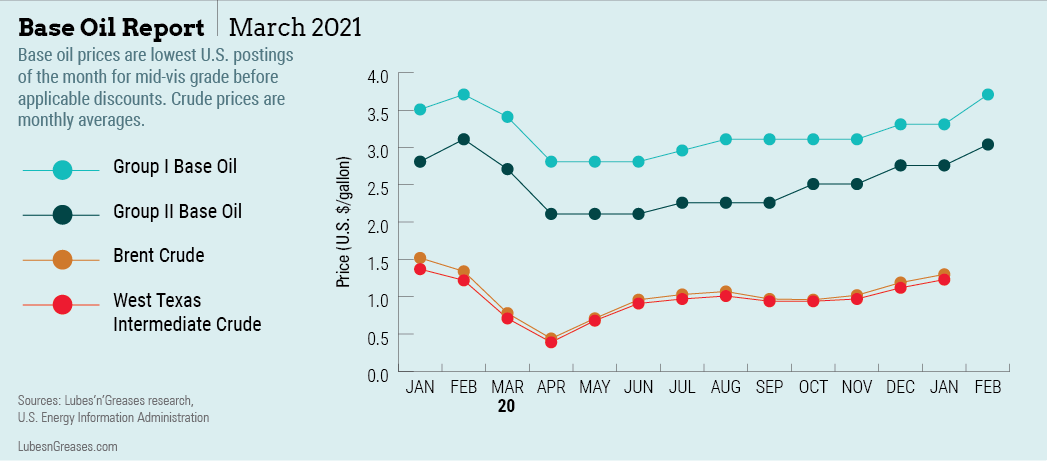

The snug base oil availability, steeper spot prices and rising feedstock and crude oil values motivated producers to enact price increases in late January, with full implementation noted by early February.

Paraffinic producers and rerefiners communicated posted price increases of 40 cents per gallon, although Motiva raised prices by 23, 28 and 30 cents, and Chevron lifted postings by 39, 40 and 42 cents.

On the naphthenic front, Cross Oil, Ergon, Calumet and San Joaquin announced increases of 40 cents per gallon.

A few blenders resorted to securing Group II and naphthenic base oils to replace Group I cuts, but these grades were not particularly easy to locate, either. Many international buyers clamored for U.S. Group I volumes for export and ended up empty-handed.

Once the turnarounds are complete and coronavirus vaccines are more widely distributed—allowing for pandemic-related restrictions to be lifted—refineries are anticipated to increase run rates, and as a result, more base oils are expected to be produced. Until then, however, little relief for the strained conditions appears to be in sight.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com.