Strike While the Iron Is Hot

Demand for base oils has been surprisingly healthy, despite the ongoing coronavirus pandemic that continued to claim lives and spread unabated in many countries.

In early October, the global base stock market displayed tight conditions for most grades, and this was attributed to a combination of increased consumption—following a few months of lackluster requirements due to lockdowns and manufacturing disruptions—and reduced availability on the back of ongoing reductions in refinery run rates and unexpected plant outages.

Along the United States Gulf Coast, hurricanes forced several producers to either cut back operating rates or shut down. The Excel Paralubes API Group II base oil plant near Lake Charles, Louisiana, remained off-line for most of September and October as Hurricane Laura damaged both its power source and the nearby Phillips 66 refinery that supplies the plant with feedstock.

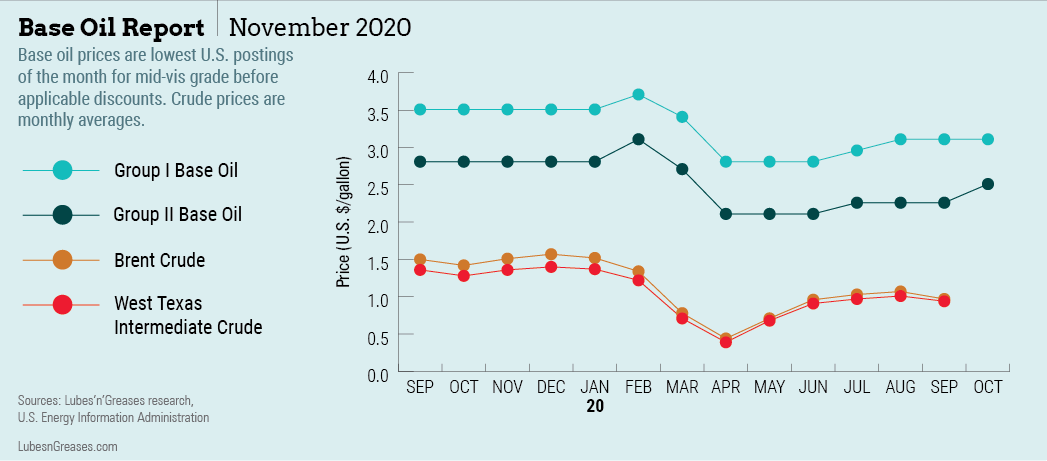

The tight base stock conditions and crude oil and feedstock prices, which remained fairly stable and traded within a very narrow range, prompted paraffinic base oil producers to put forward posted price increases in early September.

Motiva initiated the round of hikes, and was promptly followed by a majority of suppliers, which raised postings by 15, 20, 25 and 30 cents per gallon, depending on the grade and the supplier, implemented between September 7 and October 14.

On the naphthenic side, Cross Oil communicated a price increase of 25 cents per gallon for its low-viscosity base oils and 15 cents for its high-vis oils, effective October 13. Other naphthenic producers had adjusted prices on a case-by-case basis in the previous weeks and were considering a general price revision, but no additional communications had emerged by the time of writing.

The steeper base oil values triggered increase nominations in downstream finished lubricants and additives of 32–40 cents per gallon, or about 8% to 14%, to be implemented in early to mid-October.

Participants concurred that this was probably one of the last chances for producers to achieve increases this year. Demand typically softens in the final quarter, and prospects for base oils and related industries were somewhat cloudy. Developments related to the COVID-19 pandemic and the results of the U.S. presidential election will likely be key factors determining the strength of the market over the coming months.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com.