Electrifying

Well, 2021 is well underway, and it looks a lot like 2020, part 2. There are lots of projections, debates, discussing (and cussing) about where we are headed.

The oil industry is fighting to retain its position as one of the major parts of our economy. The auto industry is struggling to develop new technologies to support—and challenge—the push toward electrification of the automotive fleet. That has enormous impact on our little corner of the world, affecting what lubrication will look like when the electric vehicle is the predominant mode of transportation in the United States. Let’s take a look at what’s happening and see what may lie ahead.

The latest thing is now the “tipping point” as it relates to the vehicle marketplace. That’s the point in time when the electric vehicle becomes inevitable. Some say it has already occurred. As many of you know, California has been the canary in the coalmine with regard to vehicle emissions. California seems to think we’re past the tipping point and has passed legislation that mandates an increasing portion of zero-emissions vehicle sales in the state beginning this year, leading up to all-ZEV sales from 2035 on.

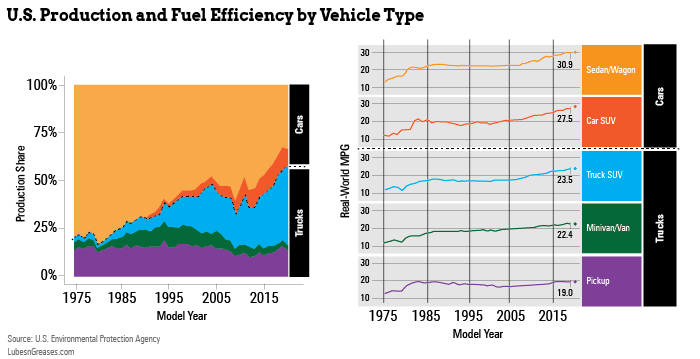

Let’s look at some of the data that surround this EV frenzy. Currently, there are 280.9 million cars and light trucks registered in the United States, which is 97% of the total U.S. vehicle fleet, according to the Auto Care Association’s 2021 Factbook. The fleet size is also called vehicles in operation, or VIO. The number of miles traveled by all vehicles in the U.S. was 3.27 trillion in 2019, or about 11,280 miles per vehicle. The U.S. Department of Transportation’s Federal Highway Administration estimates that cars use about 474 gallons of fuel per year, while light trucks consume about 660 gallons. With cars accounting for around 40% of the VIO and light trucks for 60%, that works out to about 164 billion gallons of fuel consumed each year.

There are about 120,000 British thermal units of energy in a gallon of gasoline. So, approximately 19.7 quadrillion BTUs or 5.8 trillion kilowatt hours of energy would be burned in those 281 million vehicles.

Energy consumption for electric vehicles is measured in kilowatt hours per 100 miles. Let’s say that the average EV uses 30 kWh to travel 100 miles. If all of the vehicles in operation in 2020 were fully electric, they would have used 981 billion kWh of electricity. The U.S. Energy Information Administration says the country produced a total of 4.2 trillion kWh of electricity in 2019. That means we would need 23% more electricity to handle all those electric VIO.

On the face of it, that doesn’t seem like a big deal. However, the cost to build the extra capacity is pretty big. The largest electrical generation plant in the U.S. is the Palo Verde nuclear plant, which produces 32 million kWh per year. It would take a lot more of those plants to match the electrical needs of the marketplace, and the cost would be enormous. The Palo Verde plant cost about $12.8 billion in 2019 dollars.

Now for the good news: About 17 million new light vehicles are sold annually, and the scrappage rate is about 5%. Of course, not all of those new car sales will be EVs. According to a July 2020 study by Deloitte Insights, EVs will hold 27% of the U.S. vehicle market by 2030. It’s going to take a long time to completely displace ICE-powered vehicles in this country, and the pandemic and low oil prices have slowed sales, even if temporarily.

The Deloitte study states, “Consider that, beyond 2030, one of the key factors in sustaining growth will be the implementation of suitable charging infrastructure. This requires multi-billion-dollar capital investments—achievable in some markets through a combination of public and private investment.”

So infrastructure is the bottleneck for EV growth. But not so fast! Many people are installing charging equipment at home, since electricity is delivered nearly everywhere. I’ve seen some upscale apartments that have charging stations. More and more companies are including charging stations in their parking lots. I mentioned in an earlier column on the subject that a restaurant in Napa Valley has a charging station for their employees! We will need a charging station system like our current gas stations, and some fuel stations have already installed charging facilities. The cost of a home-installed 240-volt charging station is around $2,000-$3,000.

One of the more serious drawbacks to EVs has been what is described as “range anxiety.” Not too long ago, the outer limit for range was about 125 miles. Recently, Tesla came out with batteries capable of traveling 400 miles on a single charge, in line with current ICE engines. That will lay to rest the range anxiety issue, but it raises another one: cost. Currently, battery cost is about $140/kWh. The current thinking is that $100/kWh is the price that will allow EVs to reach cost parity with conventional passenger cars, and we’re not too far away from that. The capacity of the Tesla Model S is reported to be 95 kWh—pretty steep for just the battery cost, even at $100/kWh.

Of course, the biggest driver, and one that is not technical per se, is the effect on exhaust emissions. Bjorn Lomborg, “the skeptical environmentalist,” raises a very strong point on the subject. He notes that the International Energy Agency estimates that by 2030 the world will have 140 million electric cars on the road, about 7% of the global vehicle fleet.

He goes on to say that this would not make a significant impact on emissions for two reasons. First, electric cars require large batteries, which are often produced in China using coal power. According to the IEA, just producing the battery for an electric car can emit almost as much as a quarter of the greenhouse gases that a gasoline car emits across its entire lifetime!

Second, the electric car is recharged on electricity that is often generated by fossil fuels. This will continue to be a problem until we have a large-scale changeover to renewable sources of electricity generation.

However, research published this year from the Universities of Exeter and Cambridge in the United Kingdom and the University of Nijmegen in the Netherlands suggests that despite the emissions generated by electric vehicle production and electricity generation, there would still be significant total emissions reduction by switching to EVs. That doesn’t mean it will be an easy transition, though, and plenty of obstacles remain in the way of widespread EV adoption.

I think that one of the most interesting comments being made is that 91% of EV owners say they would not go back to ICE-powered vehicles. I think I can understand that, since EVs are extremely quiet and probably are not subject to the same torque and other operational issues of ICEs. Maintenance costs are also much lower.

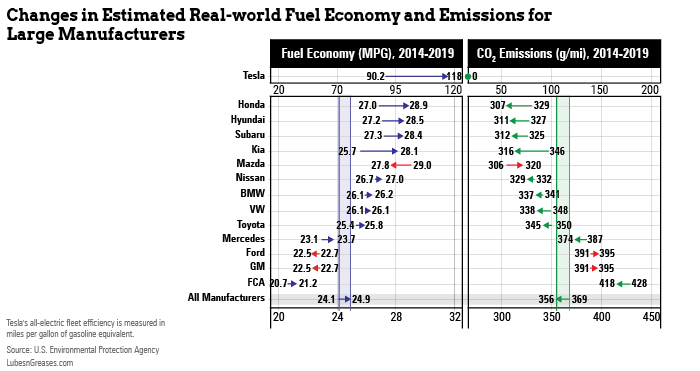

Derrick Morgan, senior vice president of federal & regulatory affairs for the American Fuel & Petrochemical Manufacturers, told F&L Daily that the ICE can be improved in terms of efficiency. If octane in gasoline were to be raised to a minimum of 95 research octane measure, engine compression ratios could be raised, making vehicles far more efficient. Morgan says the change would provide consumers with a choice and an environmental impact equal to nearly three quarters of a million EVs.

However, that calculation represents about 200 million ICE vehicles with the higher compression ratio running on 95 octane fuel—that’s 70% of the entire U.S. fleet. If the fleet goes all-electric, it would have more than 30 times the impact on emissions reduction. Continuing to improve ICEs is certainly a good way to reduce CO2 emissions, but other advances would also be needed to approach the same impact that EVs would have.

So where does that leave us, the oil companies, garages and quick lubes? EVs will need lubrication, but not engine oil. There will be a need for automatic transmission fluid, but in Tesla’s case, for instance, that is only changed every 150,000 miles or 12 years. A ray of hope, however dim, is that a new automatic transmission fluid may be developed. And, if the goal of 95 octane rating number gasoline is achieved for ICEs, new engine oils will undoubtedly be required.

Of course, there are other lubricants (or fluids) that will be required, and they represent an opportunity for some new things to be learned. The battery has a coolant fluid similar to a transformer oil to cool and seal the battery elements. This is not the same as transformer oil as we know it. For one thing, it is essentially sealed for life, so refilling or topping it up isn’t an option. However, as time moves forward, we may see where battery maintenance can be performed outside of the dealers. There will be greases and hydraulic fluids that will be required. There will also be specialty products like door hinge lubes and the like.

For the traditional oil business, there will be business aplenty to cover those ICE dinosaurs as well as the new generation of highly efficient fuel sippers. As always, the business will go to the smartest and most efficient shops and quick lubes. More and more, the best run, cleanest and most cost effective will be the victors. It’ll be a battle, but our industry has risen to the challenge for over a century. There’s no reason to think we can’t do it again.

Steve Swedberg is an industry consultant with over 40 years experience in lubricants, most notably with Pennzoil and Chevron Oronite. He is a longtime member of the American Chemical Society, ASTM International and SAE International, where he was chairman of Technical Committee 1 on automotive engine oils. He can be reached at steveswedberg@cox.net.