The lubricants industry faces unprecedented complexity. Three overlapping forces continue to reshape the business landscape:

- Environment. Climate-related disasters including fires, floods, droughts and hurricanes are disrupting logistics. Recent drought conditions in the Panama Canal have slowed shipments and increased costs.

- Geopolitics. During the past two years, over half the global population has voted for changes in leadership direction. Shifting trade policies and deregulation are adding to market instability, while security concerns have rerouted seagoing vessels from the Suez Canal around South Africa.

- Technology. Innovations like artificial intelligence, electrification, smart sensors and autonomous vehicles are transforming industries. The pace and scale of the impact remain uncertain, but the implications for lubricants could be significant.

Fuel economy standards have long shaped lubricant development. The question now is whether these environmental, geopolitical and technological shifts will drive structural or temporary change. Regardless, global demand for affordable, reliable and ever-cleaner energy remains strong.

Figure 1.

Source: Chevron analysis based on S&P Global Commodity Insights data

Passenger vehicles, which are estimated to be responsible for nearly 45% of transport-related greenhouse gas emissions, are a major focus of decarbonization. Some countries are considering phasing out internal combustion engines, mandating electric vehicles and offering low carbon-based tax incentives. Over 75% of nations have fuel economy standards, with 2030 targets in selected major economies ranging from the equivalent of 48 miles per gallon (4.9 liters/kilometer) in India to 59.7 mpg in Japan. Targets in other major economies include 50 mpg in Canada and South Korea, 52 mpg in the United States, 57 mpg in the European Union and 58.8 mpg in China.

Successive emissions and fuel economy regulations have increased the complexity of serving the aftermarket needs of a diverse global car park. Specifically for lubricants, rising uncertainty has made product profile investment decisions – including the types and number of specification approvals to carry – more difficult. EV mandates once seen as inevitable are now being delayed or reversed. For example, the United Kingdom postponed its ICE ban to 2035, and the U.S. paused $3 billion in EV charging infrastructure funding. The level of support for developing and maintaining tests for future industry and original equipment manufacturer specifications has always been a challenge for the lubricant industry and seems even more uncertain today.

Figure 2.

Source: Chevron analysis based on S&P Global Commodity Insights data

Tensions around the globe are also adding possible sources of disruption to supply chains and altering trade dynamics. In this environment, some businesses are opting for a local strategy. Businesses may need to shift from optimizing individual cost centers to investing in flexibility and optionality.

Industry Implications

In the lubricants industry, the drivers for improving performance through cleaner energy remain the same, but the timing and impact on lubricant demand may change. Tightening fuel economy standards are driving the industry to lighter-viscosity lubricants that require formulating with API Group III, Group III+ and polyalphaolefin. However, the demand profile varies significantly from one region to the next, influenced by factors such as vehicle ownership rates, age of fleet and the adoption speed of alternative technologies like EVs.

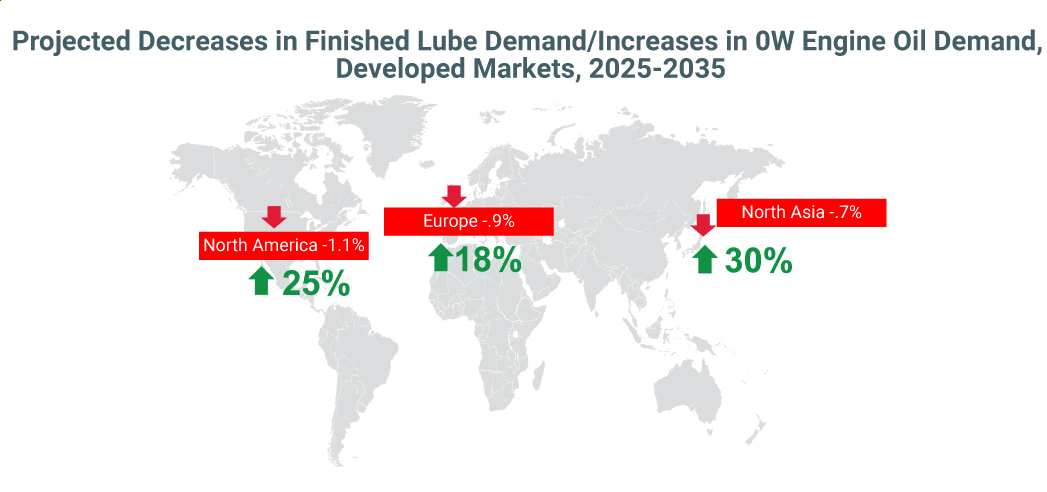

Finished lubricant demand in emerging markets is projected to return to pre-COVID 19 levels by 2031, while total lubricant demand continues to decline in developed markets. However, growth in demand for SAE 0W-XX lubricants is projected to increase from 2025-2035 at approximately 18% in Europe, 25% in North America and 30% in North Asia, according to Chevron analysis of S&P Global Commodity Insights data.

In the future, demand for 0W-XX lubricants is expected to migrate to developing markets, thus increasing demand for Group II+, Group III and Group III+ base oils and PAO.

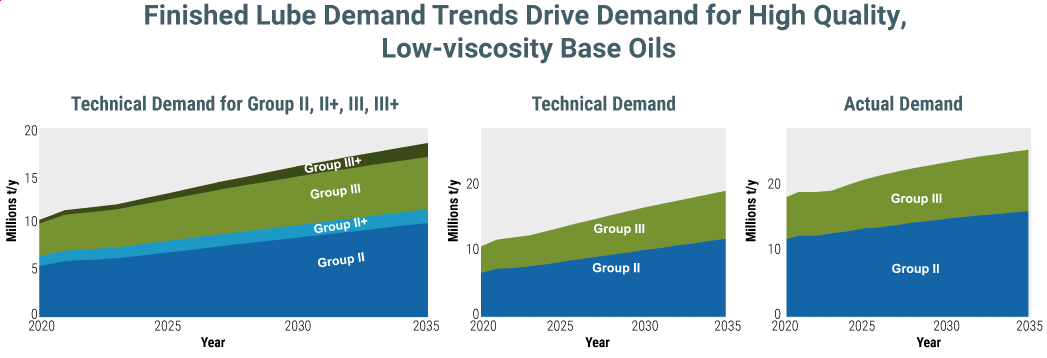

Technical demand for Group II and III oils – including Group II+ and III+, which are not official categories of the American Petroleum Institute but are recognized by industry convention – is driven by the need for better oxidation stability, low pour point and low volatility. Due to tightening specifications, technical demand for Group II, II+, II and III+ is projected to grow up to 80% between 2020 and 2035, from 10.6 million metric tons per year to 18.9 million t/y. On the other hand, market demand will grow 41% over the same period, from 17.7 million t/y to 25.1 million t/y. That’s 6.2 million t/y or 33% more than what is technically needed.

Why does the market demand exceed technical demand? Sourcing considerations for base oil supply extend beyond formulating to meet technical requirements. They may include blending for marketing opportunities, improving storage and handling efficiencies and capturing logistical advantages, such as co-loading opportunities from a multi-line supplier or having local supply of premium base oils that is readily available.

Since the mid-1990s and the introduction of Group II and III base oils produced by an all-hydroprocessing route, base oil quality and production volumes have steadily increased, enabling higher performance engine oil specifications.

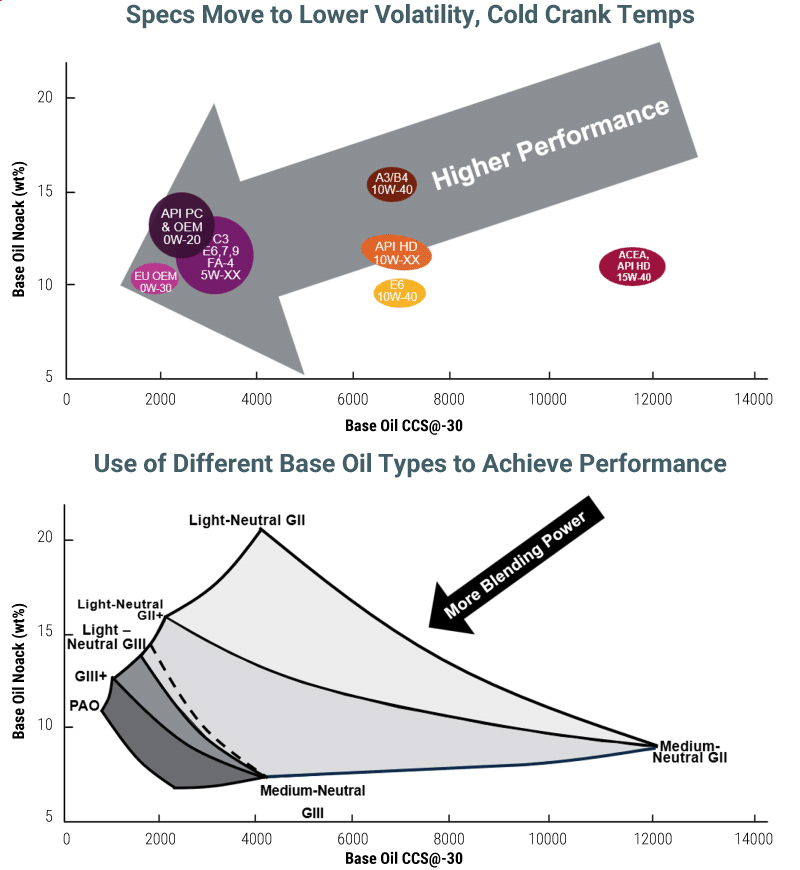

The charts in Figure 3 show various engine oil specs and required cold-crank viscosity and volatility range on the horizontal and vertical axes respectively. The top chart shows specifications in a right-to-left chronology. The chart on the bottom shows the base oil grades that can be blended to meet these product performance targets. The older products on the right still have significant demand. Consequently, sourcing and blending raw materials to serve the entire car park has become much more complex. Adding to the complexity is the reality that within each product bubble, there are multiple product tiers and formulating paths to meet the target. It becomes even more complicated as lubricant marketers assess their material needs for their current product portfolio in conjunction with their growth plans, amidst an uncertain environment.

Figure 3. Automotive Engine Oil Trends

Source: Chevron

Premium Base Oils Expand Optionality

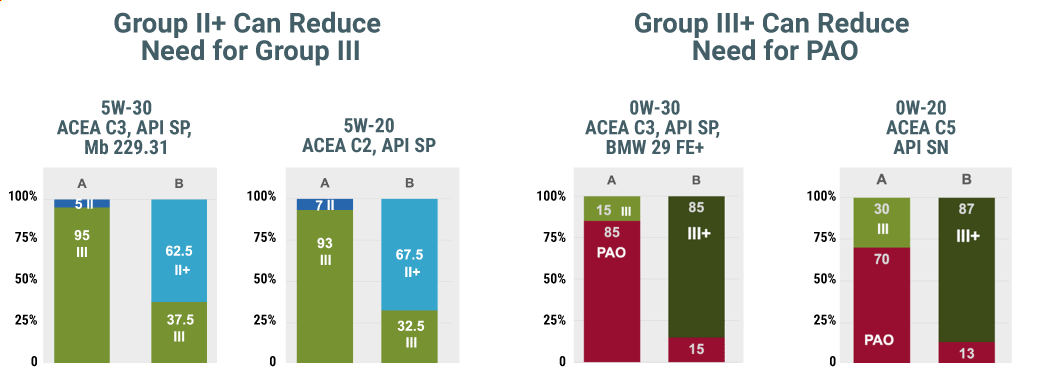

Sourcing base oils that enhance blending flexibility is one way to manage complexity and optimize formulating costs. A combination of different blend components, the additive package, viscosity modifier and base oil can achieve the same product profile. For example, in typical 5W-30 profiles, if Group II is replaced with Group II+, the volume of Group III can be reduced by as much as 60%.

Similarly, leveraging the higher performance of Group III+ base oils in 0W-20/30 formulations can enable more than 80% reduction in PAO volume.

A typical lubricant marketer has approximately 50 automotive engine oil product profiles in its portfolio. As specifications have tightened, integrating formulating and tankage optimization has become more challenging. What blend components warrant storage in bulk, ISO containers, totes, drums or even outsourcing to toll blenders?

Twenty years ago, things were simpler. In Europe practically every product could be blended with Group I and Group III base oil in varying proportions plus additives and viscosity modifier. The introduction of specifications limiting content of sulfated ash, phosphorus and sulfur (collectively known as SAPS) to medium and low levels required low-sulfur base oils, which drove demand for Group II. The move by OEMs to lower viscosity grades and increased Group II production capacity further drove Group II and Group III demand.

Figure 4. Formulation Impacts of Group II+, III+

Source: Chevron blend studies

Today, with premium Group II+ or Group III+ base oils in tank, marketers derive value due to portfolio approvals and blending power optionality that increases product blending flexibility and finished oil cost optimization. Additionally, complexity costs may be reduced when working with a full-line base oil supplier that offers formulating optimization across a marketer’s entire product line.

Push for Supply Chain Reliability

Faced with increasing complexity from tightening specifications, lubricant marketers have evolved their strategies for logistics, storage and blending to optimize business performance. This has especially been the case since the COVID-19 pandemic, which resulted in notable disruptions in supply chain reliability.

The supply chain upheaval caused by the pandemic coincided with specifications moving to 0W-XX lubricant performance. Marketers scrambled for supply, and many turned to dual and triple sourcing to ensure their manufacturing plants would keep running.

When situations break out along key supply chain routes, supply reliability and availability may be compromised, leading to price volatility and increased costs. As demand for 0W-XX lubricants grows, marketers may be confronted with further uncertainty and complexity around supply chain reliability.

Today, the majority of Group III+ is produced in Asia. According to the World Shipping Council, there has been a 90% decrease in cargo vessels transiting the Red Sea since 2023. Shipping via the alternate route around the Cape of Good Hope adds approximately 10-14 days, an extra 3,500 nautical miles and significant expense.

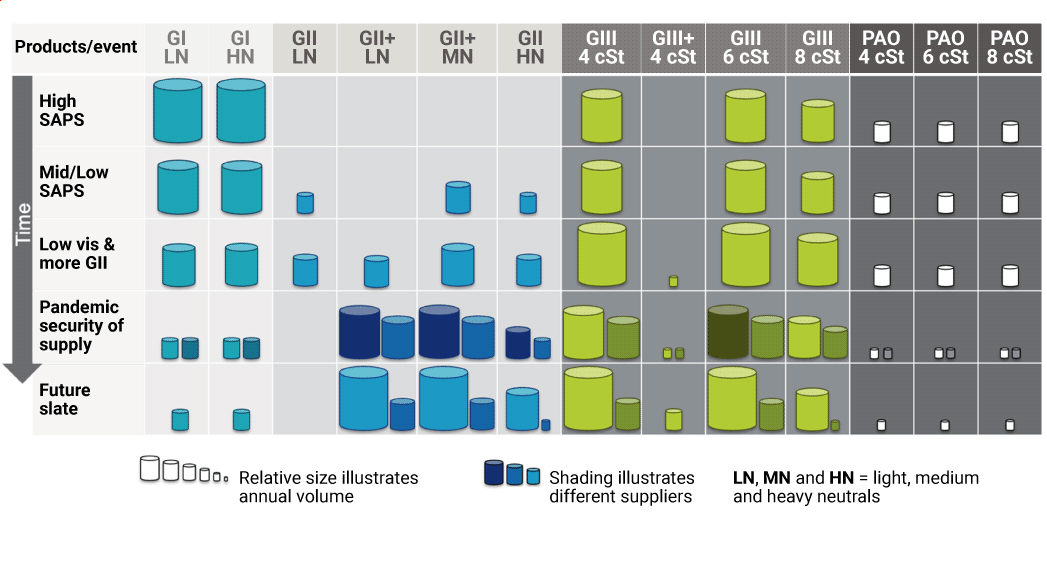

Figure 5. Evolution of European Engine Oil Blending

Source: Chevron

Complexity may be reduced when working with a full line base oil supplier that offers optimization across a marketer’s entire product line supported by supply resilience from multiple supply hubs, co-loading efficiency and Group II+ and III+ base oils to increase formulating flexibility.

To help lubricant marketers plan for change, increasing optionality can help businesses weather volatility and uncertainty. While we can’t control the future, optionality ensures that blenders will have at least one solution available. In the lubricants business, that means selecting components that enhance formulating flexibility and selecting suppliers that bring knowledge and understanding of their business, a cost effective and reliable supply chain, a full-line portfolio for cost optimization, and agility to respond when market conditions shift.

JAMES BOOTH has been with Chevron for 17 years and is the outgoing senior manager for technical sales and business development with Chevron Base Oils. In his tenure, Booth has held various positions across the lubricants value chain, including Chevron Oronite and Chevron Lubricants.

Luyen Vo currently assumes the role of senior manager for technical sales and business development with Chevron Base Oils. With 28 years of experience in the oil and gas industry, Vo has held diverse positions spanning base oil manufacturing and hydroprocessing technology, supply chain, commercial and technical sales and, most recently, served as head of Chevron Lubricants Products & Technology organization.