What Happens to a Dream Deferred?

While the words of the poet Langston Hughes in this column’s title certainly did not refer to the base oils industry, they do seem to describe the price initiatives that first surfaced in February but only gained traction about a month later.

In early February, only two base oil producers—ExxonMobil and Paulsboro Energy—communicated 20 cents-per-gallon posted price increases on the back of climbing crude oil and feedstock values. Tightening conditions in ExxonMobil’s global supply system given a turnaround at its Rotterdam, Netherlands, base oils plant also offered an incentive for the hikes. However, downstream fundamentals were not particularly robust at the time of the announcement and demand remained below expected levels, leading buyers to request temporary value allowances (TVAs). The producers were heard to have acquiesced and granted a TVA equal to the amount of the increase into most accounts, to be reviewed in 30 days.

Fast forward to March and several producers stepped out with a similar price increase announcement. But this time, there appeared to be more support to the initiative, as demand had ramped up on heightened activity during the spring production cycle. Since additional producers announced increases in March, there seemed to be a tacit understanding that the February initiatives had a better chance of being implemented at this time.

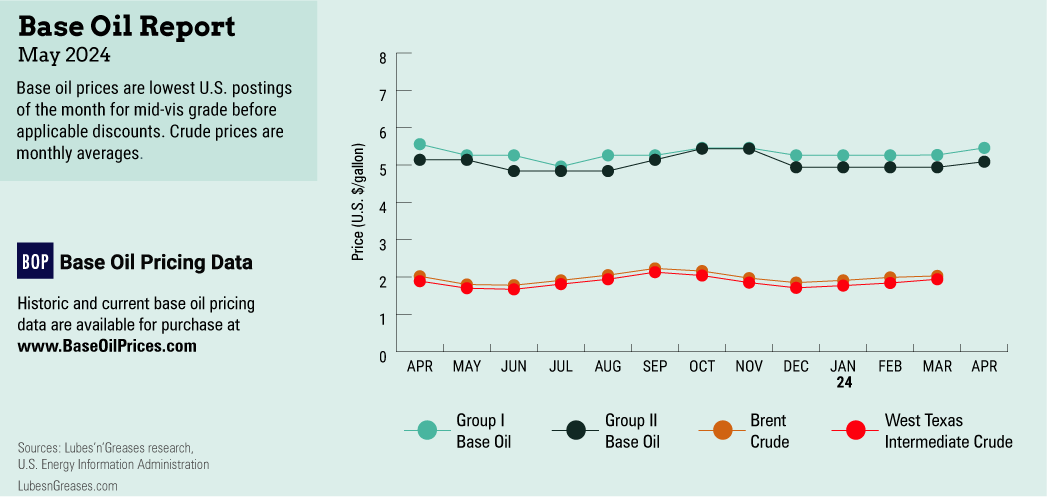

The March increases were meant to lift API Group I postings by 20 cents per gallon, Group II prices by 10-15 cents, Group II+ by 15-20 cents, and Group III values by 10-15 cents per gallon. The effective dates were peppered between March 15 and April 1. Excel Paralubes announced both a 10 cents-per-gallon increase on most of its Group II grades and a 15-cent decrease on its 70 neutral grade. A U.S. producer and a South Korean supplier did not communicate any price adjustments in early March.

Base oil producers were expected to face some resistance to the hikes because of sluggish downstream demand in a few segments, along with competitive price adjustments for lubricants and finished products that had chipped away at margins and would make it difficult to offset the base oil price increases. However, base oil producers appeared to be standing firm by their initiatives and were reluctant to grant TVAs or discounts because of feedstock price pressure.

Blenders therefore indicated that they would raise finished product prices to transfer the higher raw material costs on expectations that demand would perk up ahead of the summer driving season. Whether they are successful or not remained to be seen, as inventories were still plentiful and demand of finished products had not particularly shown a jump by early April. Some blenders were heard to be running operations at reduced rates to control inventory levels.

No sooner were the initiatives expected to go into effect than a fresh round of posted price increases emerged. Several producers communicated price increases of 30, 35 and 40 cents per gallon on their base oils, which were expected to go into effect between April 11 and the end of the month. Once again, steep crude oil and feedstock prices as well as improved base oil demand were thought to be the drivers.

Crude oil and vacuum gas oil prices had been on an upward trend since December and continued to trade at elevated levels due to ongoing geopolitical tensions in several parts of the world. Expectations that economic growth in the United States and China would translate into increased oil demand while OPEC+ members would uphold production curbs boosted prices as well. West Texas Intermediate futures hovered near $86 per barrel on April 8 and had settled at $68.61 per barrel on the CME on December 12.

April export activity was less buoyant than in February and early March because many Group I and Group II suppliers felt less pressure to find a home for their cargoes. A number of parcels were expected to be shipped to India, South Africa and the West Coast of South America. Buying appetite from Brazil ebbed slightly, but Mexican buyers continued to show interest in U.S. base oils, although volumes of the light grades flowing to Mexico have generally diminished due to stricter import rules.

Group III supplies were balanced against demand but were anticipated to become more plentiful once a South Korean producer completed a turnaround in mid-April and more Middle East cargoes arrived in the Americas. Spot prices were therefore exposed to downward pressure.

On the naphthenic side, producers communicated base oil price increases of 30 and 35 cents per gallon, with effective dates spread over the second half of April. Prices were supported by steep crude oil and feedstock prices and a snug supply-demand balance, especially of the light grades used for transformer oils and metalworking fluids.

Pale oil suppliers had talked about the need to improve margins for some time, and market conditions in April offered the right opportunity to make this deferred objective a reality.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com