False Start

In late February, base oil market participants continued to hold on to hopes that business would improve in the coming weeks, when lubricant manufacturers typically start to build inventories in preparation for the summer driving season.

However, domestic demand remained generally lackluster, despite a slight ramp-up in orders, while export activity was healthy but had started to fray at the seams.

Amid this uncertain market scenario, it was a bit of a surprise when news circulated that ExxonMobil had communicated a 20-cents-per-gallon posted price increase on its API Group I, Group II and Group II+ base oils for Feb. 23 implementation, followed by a similar initiative by Paulsboro Refining. Paulsboro also called for a 20-cent increase on its Group I base oils, effective Feb. 28. At the time of writing, no other initiatives had emerged.

Some producers believed the initiatives had been premature, as demand had not picked up in earnest and fundamentals were not supportive of the increases. But they also expressed concern about climbing production and transportation costs, and explained that the initiatives would have had an increased chance of success if they had been announced a few weeks later. Sources did admit that the proposed increases helped stem the slide of domestic Group I and Group II spot values, which had been under pressure given oversupply conditions.

As it stood in early March, the posted price increases were still being negotiated, with at least one of the producers granting temporary value allowances for the full amount of the increase—to be reviewed in 30 days—and other customers expecting delayed implementation of the hikes.

There were rumblings that ExxonMobil’s intention had been to discourage additional orders by increasing base oil prices because its supplies had tightened due to a two-month turnaround at its Rotterdam, Netherlands, Group II plant. The producer had ostensibly shipped products from the United States and Singapore to meet requirements in Europe and had little extra material in its system.

Downstream, conditions were described as fairly disappointing for most independent lubricant manufacturers, because demand for finished products remained sluggish and there had been fierce price competition to protect or regain market share. Some participants said they had adjusted finished product prices down to retain accounts, but this meant production costs were barely covered.

Meanwhile, base oil producers expressed concern about increases in production and transportation costs. The ongoing Houthi attacks on commercial vessels in the Red Sea and the need to circumvent the Suez Canal when shipping products from the Middle East and Asia resulted in longer voyages around the Cape of Good Hope in South Africa and increased freight rates. These increases affected Group III shipments in particular, given that most volumes consumed in the Americas are imported from Asia and the Middle East. Recent delays in the Panama Canal also affected Group III cargoes, as many of these shipments cross the Canal to reach the U.S. Gulf or the East Coast of South America.

By early March, prices for Group III grades stabilized because of more limited spot cargo availability. A key South Korean Group III producer scheduled a turnaround from mid-March until the end of April. The supplier will be able to meet requirements, as it has built stocks and has continuous production at other sites, but the shutdown was expected to tighten short-term inventory. Meanwhile, Group I and II grades remained under pressure due to plentiful availability and slow-to-emerge demand.

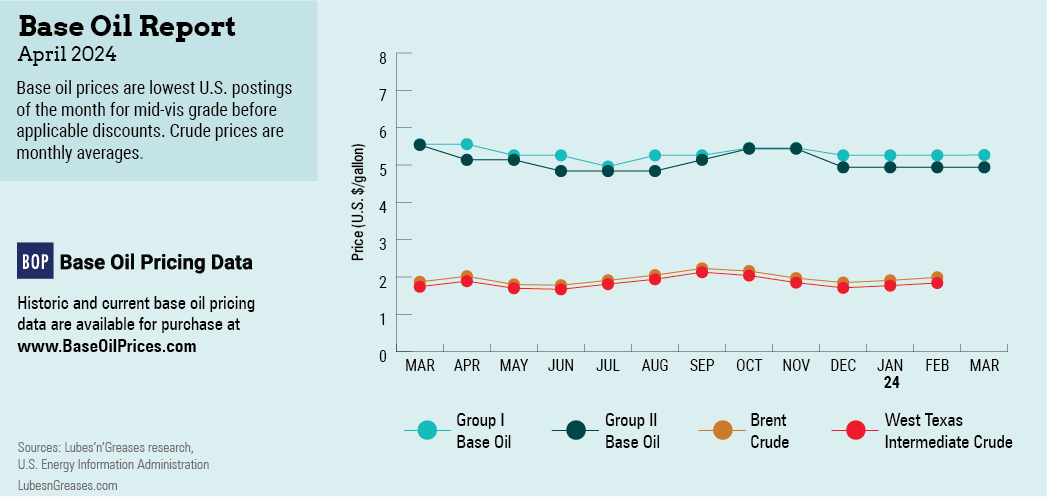

Base oil producers in both the naphthenic and paraffinic camps were keeping a close eye on crude oil and natural gas values, with prices having risen significantly since last December and pressuring production costs. West Texas Intermediate futures were hovering near $78 per barrel during the first week of March and had settled at $68.61 per barrel on Dec. 12, 2023.

Given that domestic base oil demand has not been particularly strong in the first two months of the year, suppliers continued to target exports into India, the Middle East, Europe, Africa and Latin America. News of the permanent shutdown of the ENI Group I plant in Livorno, Italy, triggered speculation that export opportunities for Group I cargoes moving to Europe may emerge in the coming months.

On the naphthenic side, supply and demand were characterized as balanced-to-tight, supporting fairly stable pricing. Suppliers expected high-viscosity pale oil requirements from the tire, asphalt and rubber modifier segments to grow in the spring, while the lighter grades continued to enjoy steady activity. Cross Oil was heard to have scheduled a three-week turnaround at its Smackover, Arkansas, plant in March, which came on the back of recent maintenance programs at two other facilities and a brief shutdown at Cross’ unit in mid-January due to extreme weather, leading to a tightening of pale oil availabilities.

March was expected to be pivotal for the base oils market, likely providing an indication of what business might look like during the traditionally busiest time of the year. While the increase initiatives announced by two producers were not expected to gain much traction, they did foreshadow the conditions that might come into play during the much-awaited spring production season.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com