If It’s Not One Thing, It’s Another

Base oil market participants seem to have been pelted with worries over the past few weeks. If it wasn’t a hurricane approaching production areas, it was the dockworkers’ strike at U.S. ports, the escalating conflict in the Middle East that catapulted crude oil prices to new highs, or waning demand because of changing market dynamics.

Just when everyone expected the most active part of the hurricane season in the Atlantic Basin to be over—which technically occurs in late September—not one but three different weather systems threatened to bring significant damage to areas along the U.S. Gulf Coast where there is a concentration of base oil facilities. Hurricanes Francine, Helene and Milton caused massive evacuations and left hundreds of casualties and extensive damage in their wake, but they miraculously did not have a significant impact on base oil production.

Helene left a path of destruction in Florida, South Carolina, Georgia, North Carolina, Virginia and Tennessee in late September, with property and economic losses estimated at $250 billion. But most base oil facilities were spared. A base oil rerefiner in Georgia said that operations had not been disrupted by Helene but explained that the only issue that may have impacted rerefining operations was the difficulty in collecting used oil in those areas most affected by the hurricane, particularly in Florida and the Carolinas, as many roads and businesses had been closed after the storm. Several blending facilities and distribution centers were also affected by flooding and other storm-related problems and were forced to shut down temporarily.

Another key development that participants mentioned as potentially having an impact on base oil, lubricant and additive shipments—particularly those done in flexibags and containers—was the International Longshoremen’s Association’s strike that started on Oct. 1 and saw operations at major East and Gulf Coast ports halted during negotiations. The strike was suspended after three days and had little effect on base oil business, but sources said that it could have had more serious repercussions on import and export activity if it had lasted much longer.

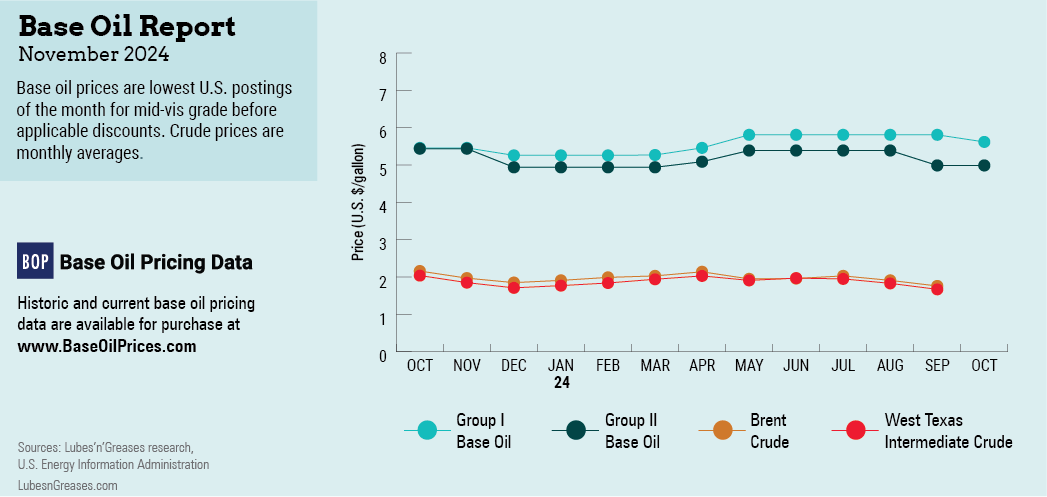

Base oil market players also kept an anxious eye on crude oil and feedstock price fluctuations. Crude oil futures had plummeted between August and September, prompting most base oil suppliers to introduce posted price decreases in the first part of September, as this coincided with a period of slowing demand and lengthening supplies.

In early September, API Group II, Group II+ and Group III producers reduced posted prices between 10 cents and 50 cents per gallon, depending on the grade and the supplier. Group I producers stepped out with 20 cent-per-gallon decreases across the board later in the month, although two refiners abstained from announcing adjustments, as they had granted temporary value allowances (TVAs) that were commesurate with the decreases conceded by the other Group I suppliers.

Naphthenic base oil producers Ergon, Process Oils and Calumet also decreased prices by 20 cents/gal between Sept. 16 and Sept. 19, even though the supply and demand balance was tighter for the pale oils than for paraffinic oils. Most of the downward pressure had come from the crude oil and feedstock side, with several naphthenic accounts having already received decreases because their contracts were tied to a diesel index and diesel prices had slipped along crude oil values. San Joaquin Refining did not announce a general price decrease, but the producer continued to monitor market fundamentals and reported a balanced supply-demand position.

The downward trek of crude oil values was short-lived, however. By early October, the Israel-Hamas conflict in the Middle East appeared to be spreading, as Israel attacked Iran-backed Hezbollah targets in Lebanon and Iran retaliated with a barrage of ballistic missiles on Israel. Observers said that the confrontation could potentially have an impact on crude oil output if Israel struck energy targets in Iran, since the country is one of the major oil producers in the region. It could also affect trading and shipping activity—including the movement of base oils and lubricants amid increased freight rates on account of the risk premium collected by insurance companies and a potential Iranian disruption of oil flows through the Strait of Hormuz. These hazards sent crude prices to fresh multi-month highs, with West Texas Intermediate front-month futures climbing to $77.14 on Oct. 7, compared to $67.67 per barrel on Sept. 6.

Consumers and suppliers alike were also dealing with waning base oils and lubricants demand, as the peak driving season had come to an end, and many producers were eager to release inventories built ahead of the hurricane season. The changing landscape in the automotive industry, with an increased focus on lower emissions and electrification, has led to reduced demand for conventional motor oils and other finished products. Last year, base oil demand showed a staggering 25% decline from 2022, and it seemed poised to finish at similar levels this year, according to data from the Energy Information Administration.

With the U.S. presidential elections scheduled to take place on Nov. 5, participants have yet another unknown to worry about. Perhaps having all these circumstances converge at this time of the year means that some of them may be resolved before year-end, hopefully leading to a less anxiety-inducing phase in business.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com