A Monarch Butterfly Year

Every year in early October, monarch butterflies that live west of the Rocky Mountains in the United States start arriving in California to breed and spend the winter months, then return inland in the early spring. According to an article in The New York Times, monarchs are in serious decline and were classified as endangered last year, but despite hard-to-overcome environmental factors, such as temperature changes and rain patterns that have led to their decimation, the monarch population seems to be recovering.

The base oil and lubricant industry seems to have led a “monarch butterfly year” in 2023, with many different factors impacting its performance and pricing. From the ongoing war in Ukraine to the conflict between Hamas and Israel and the strong crude oil and diesel price fluctuations these events engendered, there have been plenty of circumstances beyond participants’ control that shaped business decisions.

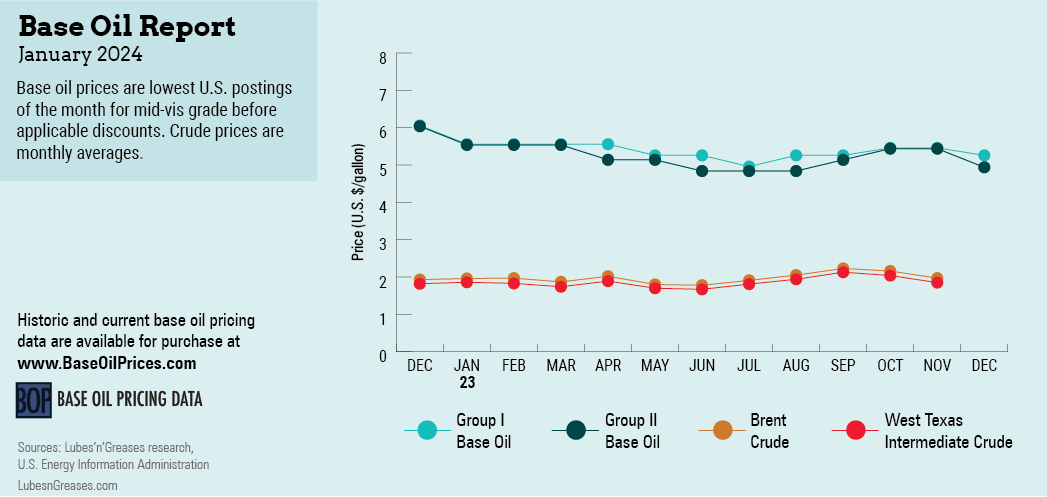

The year ended with a round of base oil posted price decreases, which were not necessarily surprising, as demand tends to slow in the last quarter, and it is not unusual for suppliers to lower prices and motivate buyers to secure additional volumes beyond those specified in contracts. Lubricant manufacturers had been already requesting discounted base oil prices, as they had encountered difficulties in implementing increases meant to offset base oil price increases announced in August and September.

Aside from crude oil and feedstock price fluctuations, base oil and lubricant suppliers also faced generally lackluster demand throughout the year. While it was difficult to pinpoint exactly what caused the weak performance, healthy inventories carried over from the previous year, macroeconomic uncertainties, inflation, and the drive toward lower emissions and more sustainable operations all seemed to impact the market in some way.

Inventory levels were also affected by a reduction in export shipments to Mexico during the fourth quarter. Recently implemented Mexican import regulations that require a special permit to move base oils to Mexico were expected to free additional U.S. volumes, as light grades that were used for fuel blending would likely be blocked from entering the country. Due to the new regulations, business into Mexico—the largest recipient of U.S. base oil exports—was not expected to reach the same levels as in previous years. Suppliers had to seek additional export opportunities to other destinations, like Brazil and India.

By late November, Chevron and Motiva stepped out with posted price decrease announcements on their API Group II grades, and they were soon joined by a majority of producers and rerefiners. After the implementation of these initiatives between Nov. 21 and Dec. 8, most Group I grades saw decreases of 20 cents per gallon. A majority of suppliers decreased Group II grades by 15, 30, 35 and 50 cents per gallon, with the heavier grades showing the larger markdowns. Some Group II+ cuts were reduced by 10, 15 and 30 cents, and Group III cuts by 15 cents.

Aside from rising supplies and softening demand, the fall of crude oil prices also drove base oil decreases, as crude futures plummeted from the steep levels seen in early October. At that time, West Texas Intermediate crude prices had jumped to the high $80s to low $90s per barrel following the start of the Israel-Hamas conflict on Oct. 7.

However, by early December, WTI values had fallen to the mid- to low-$70s per barrel on concerns about lower global oil demand fueled by weak macroeconomic forecasts and discussions at the latest United Nations Climate Change Conference that called for a formal phase-out of fossil fuels.

Lower crude oil and feedstock prices also placed downward pressure on naphthenic base oil values. Formula-based contracts tied to a diesel index saw decreases given lower diesel values, but suppliers did not issue general price announcements in early December, as supply and demand remained balanced-to-tight.

Consumption of the heavier naphthenic grades was softer due to seasonal patterns as some downstream plants shut down for maintenance and holidays. Demand for the lighter grades, on the other hand, was still healthy, particularly from the transformer oil segment.

Naphthenic base oils export business to Europe, Asia and Latin America remained steady, helping support pricing. Shipments into Mexico that had been detained at the border due to the new import regulations were gradually moving to their destinations as new temporary import permits were being processed.

Pale oil supplies had been partly curtailed by a turnaround at San Joaquin Refining’s naphthenic plant in Bakersfield, California, from Nov. 13 until Dec. 8. The producer was able to meet contract obligations during the shutdown but was unlikely to have extra availability of light grades after the maintenance program.

Calumet also planned to have a turnaround at its naphthenic unit in Princeton, Louisiana, in the first quarter of 2024.

Unlike the monarch butterflies that have the option to weather the dark, cold winter months in sunny California, the base oils segment cannot escape the dull, somber conditions that envelop business at the end of the year. But a brighter time usually awaits them in February and March when the market starts to prepare for the busy spring lubricant production season.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com