Like the Song of a Cicada

In Japan, hearing the sometimes deafening song of the “semi”—the Japanese word for cicada—symbolizes the arrival of summer. There are about thirty different species of cicadas in Japan, and each makes a specific sound, described phonetically through the use of such onomatopoetic words as gingin, washiwashi and tsukutsuku.

The “Tanna japonensis” species, also known as the evening cicada or “kanakana-semi,” is often heard at the end of the summer or early autumn, and its sound is softer and more melancholy than the one produced on a sultry mid-summer afternoon. As the days and nights become cooler, the song of the cicada appears to gradually lose its intensity.

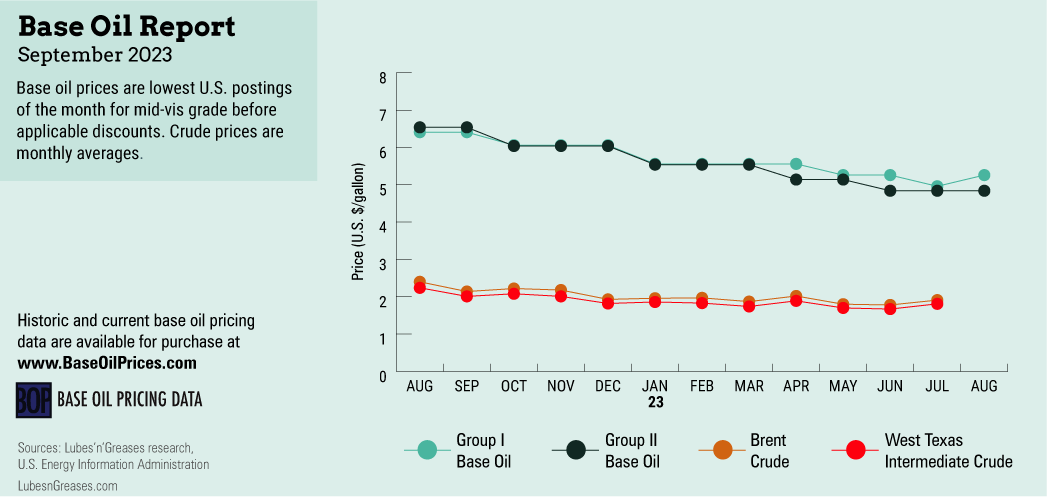

In a similar manner, although less poetically, demand for base oils generally starts to soften in late August and early September as the summer driving season comes to an end in the United States. This is the time when producers generally start to think about ways to promote orders and work on lowering inventories. Prices sometimes come under pressure, too.

That is why some market participants found it as startling as the sudden chirp of a cicada when a base oil producer announced a posted price increase during the first week of August. The increase was thought to be mostly driven by firming crude oil and feedstock prices and a need to justify production. West Texas Intermediate crude futures vaulted over the $80-per-barrel mark in early August; they had been hovering at much lower levels—around $70/barrel—in early June.

According to reports, ExxonMobil increased its posted base oil prices by 20, 25 and 30 cents per gallon, depending on the grade, on August 4. Not long after ExxonMobil’s initiative, most of the other paraffinic base oil producers communicated posted price increases as well, raising postings by similar amounts as ExxonMobil between August 7 and August 16.

Some players noted that base oil demand had not been as robust as expected during the spring and summer given healthy inventories and a cautious buying attitude. There were concerns that the price increases would cripple sales further, and while a few buyers rushed to place orders ahead of the increase implementation dates, it was difficult to assess whether the initiatives would have a long-term effect on consumption levels. Finished lubricant demand had also been less vibrant than expected ahead of the oil changing season this year, likely affected by economic uncertainties and inflationary pressures in the first part of 2023.

Most base oil grades appeared to be readily available in August, with the lighter grades described as balanced-to-tight, although some refiners might start to favor production of diesel to the detriment of base oil output. Group II volumes were expected to see a boost as Chevron completed a turnaround at its Group II plant in Pascagoula, Mississippi, in late July. The producer had covered contractual requirements during the outage but had restricted its spot sales.

Calumet also completed a routine turnaround at its Group I and Group II plant in Shreveport, Louisiana, in early August. The maintenance, which started in late July, only affected the unit that produces the light viscosity grades and was completed as planned, the producer said. Calumet had also built inventories and was able to maintain supply during the turnaround.

HollyFrontier was expected to start a turnaround at its Group I plant in Tulsa, Oklahoma, in September and had therefore limited spot sales during much of July and August, according to sources.

On the naphthenic side of the business, producers monitored market conditions as production costs increased with the steeper crude oil prices. Participants said that they would monitor whether crude oil and feedstock values sustained their firming trend to decide whether any base oil price adjustments were warranted. Those accounts whose contracts are linked to a diesel index saw prices climb due to steeper diesel values.

Pale oil demand remained healthy, lending pricing additional support. The light grade requirements flourished given strong performance of the transformer oil segment. Export requirements from Europe and Asia were drawing cargoes away from the domestic market, allowing for a more balanced supply and demand scenario.

In downstream segments, there had been reports of lubricant manufacturers granting discounts to protect market share and promote new business, but the wave of base oil posted price increases in early August may cause suppliers to reevaluate their pricing strategies.

Additive manufacturers had also implemented discounts in the realm of 3%-4% into select accounts to reflect the June posted base oil price decreases. They might also halt these initiatives as base oil prices embark on an upward trek.

Conditions in all segments of the base oils and lubricants industry seemed to be undergoing changes as the summer drew to an end, just like the song of the cicada becomes gentler with the arrival of cooler days.

Gabriela Wheeler is base oil editor for Lubes’n’Greases. Contact her at Gabriela@LubesnGreases.com