In 2013, a clear issue arose in the United Kingdom lubricants industry. Reputable lubricant producers witnessed products being promoted in the marketplace with unrealistic claims. Either these companies didn’t understand the claims they were making, or they were intentionally attempting to gain a market advantage by expanding the number of claims made beyond those that could reasonably be supported.

Market standards like the ACEA and API specifications did exist at the time, but no one was policing them. This disadvantaged responsible manufacturers and put end users at risk of buying products that couldn’t deliver what was claimed.

The United Kingdom Lubricants Association (UKLA) stepped in to take action and support the industry. This wasn’t about naming and shaming companies but about encouraging compliance through better education. The organization’s goal was to reach out to these companies to see if they needed help understanding the complex lubricants market they were working in and to ensure a level playing field for all participants. A new organization was created as a subsidiary of UKLA: the Verification of Lubricant Specifications (UK) Ltd, or simply VLS.

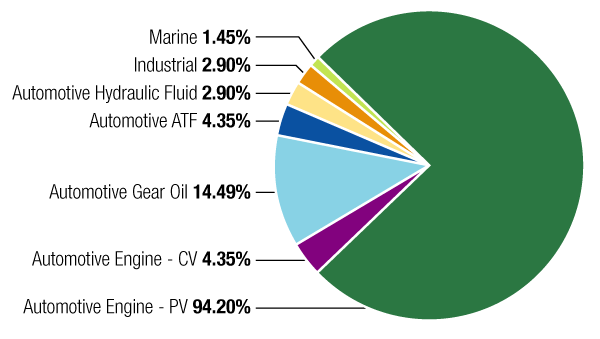

To date, VLS has investigated 86 complaints regarding lubricants. The vast majority of these cases were related to passenger vehicle engine oils. This indicates not only the size of the passenger car market in comparison to other sectors but also the level of complexity required to accurately serve this consumer-orientated market.

It is important to note that VLS has investigated cases in industrial and marine products as well as automotive products. Although the demand has been far lower, the fact that the demand exists demonstrates the need for an independent trade body that can cover all these different aspects of the lubricants industry.

Types of Complaints

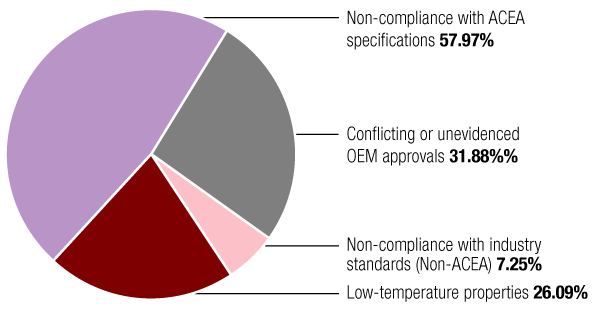

Non-compliance with stated specifications is the most frequent cause of complaint.

In the first few years of its existence, VLS dealt with a large number of cases that resolved long-standing performance claims as the market adjusted to becoming more open and more accountable. The very first case was a complaint about the low-temperature properties of an automotive gear oil. It claimed to be viable in temperatures as low as minus 40 degrees centigrade, but upon testing it turned solid at minus 15 degrees. The company concerned argued that the U.K.’s temperature never reached minus 40 degrees, so the product was still suitable for use. That wasn’t the point. A specification cannot be claimed if a product cannot meet it, as it is misleading to the end user.

VLS Case Summary by Product Type

Whether it be compliance with ACEA and other standards or conflicting or unevidenced OEM approvals, most cases have involved marketing claims. It is vital that any end user can be confident that a product can deliver what it claims and is suitable for use in a given application. In several cases, VLS has investigated products that have been found to claim mutually exclusive claims due to the chemical properties required. Equally, cases have investigated companies using the term “manufacturer approved” for which no evidence could be found or making generalized claims for which no substantiation was provided.

VLS Case Summary by Complaint Type

Five of the 86 cases investigated were found to have no case to answer, being either compliant from the start or being unavailable for sale in the U.K. market. This reinforces the importance of the rigorous nature of the VLS process, allowing only genuine complaints to be investigated.

Of the 86 cases, 24 cases have involved VLS member products, underlining the importance of anonymity during the investigation process. In many cases, VLS members were grateful to VLS for highlighting internal process errors and giving companies the opportunity to take swift corrective action and protect their company reputations as well as their end users.

Education Is Key

VLS’s primary role is education. Case investigations have produced information valuable not just for

individual parties being investigated but for the entire industry. When looking back over all the cases investigated over the past ten years, some of the key learnings have been the following:

1.Lubricant manufacturers must be aware of not making mutually exclusive performance claims or sweeping statements about which applications or vehicle marks lubricants are suitable for.

Marketing claims must be correct to enable end users to make informed decisions on the correct lubricants for a vehicle and be confident that a lubricant is suitable for use in their application. Greater technical awareness has been needed throughout the industry to ensure that marketers understand the claims they are making about particular products. It is the responsibility of the product marketer to ensure that they have sufficient data from a technically competent individual or organization to justify any performance or application claims.

It is understandable that with margins under pressure, lubricant marketers are keen to service the maximum number of specifications with the minimum number of products. But they must be able to prove their marketing claims, so that technicians and end users can have confidence that the products they select really can deliver.

2. Lubricant manufacturers are responsible for updating all public-facing materials, websites, print and labels.

The information being given to end users at any point must be accurate and genuinely reflect the product currently being sold. Companies must also advise distributors and agents of any changes. They should stress the importance of them updating any marketing materials and websites they have for the product, so that information is consistent and correct.

3. Lubricant manufacturers must regularly audit product claims to ensure compliance.

Manufacturers should not assume that because something was correct once, it is correct forever. Regular product testing and claim checking are vital to ensure continued compliance throughout a product’s life cycle.

4. Lubricant manufacturers should consider proactive quality assurance programs to assess product performance to a given range of standards to support performance claims.

Most manufacturers have quality control procedures in place, but not all are as rigorous as others. Lubricant blenders will likely use quick physical QC tests such as Low Shear Rate Kinematic Viscosity at 100°C (KV) and Low Temperature Cranking Viscosity (CCS) as well as elemental analyses to verify the correct additive treat. But they do not always invest in longer QC tests, such as the Low Temperature Pumping Viscosity or MRV test. This involves the measurement of yield stress and low-temperature viscosity aftercooling at controlled rates over a period exceeding 45 hours. Several VLS cases have been related to this test. If more comprehensive quality assurance programs were in place for all manufacturers, these failures would likely have been picked up, appropriate action could have been taken and the risk of potential damage to customers’ vehicles would have been reduced.

5. Lubricant marketers claiming any ACEA performance standards must be signatories of the European Engine Lubricant Quality Management System (EELQMS) marketers Letter of Conformance.

Any manufacturer claiming any ACEA standards must be a signatory, and this can be simply and easily checked by anyone via https://www.sail-europe.eu/registrations/lubricant-marketers.

6. Additive companies must provide appropriate support for current claims.

Most lubricant manufacturers rely on additive companies for their technical assistance in developing products to meet particular industry and OEM specifications. These additives companies should be able to readily provide documents, such as Candidate Data Packages, that detail results to given test standards and prove that the technology they are supplying can meet the specifications claimed.

At Home and Abroad

VLS’s impact has reached beyond U.K. borders. In 2016, VLS received an enquiry from ATIEL, the European technical association of the lubricants industry. Working with ACEA, the association of European OEMs, ATIEL was looking to establish a global product compliance program to monitor claims being made against the ACEA Engine Oil Sequences. As a result of the support of VLS, ATIEL’s program was launched and based on the principles of VLS.

In 2021, the Australian lubricants industry (ALA) asked VLS for advice in setting up their own program based on the principles of VLS. The Australian program has now been in operation for a couple of years. VLS also received an approach from the South African Institute of Tribology about setting up a similar organization in South Africa.

A Proactive Approach

In 2022, VLS began a proactive approach to product testing. The number of cases reported to VLS dropped post-COVID, so the Board decided to purchase reports from the Institute of Materials and put them through the Technical Review Panel. Several cases were opened and investigated as a result. However, in 2023, VLS has already seen an influx of directly reported cases. Is that bad news that its message isn’t getting through? On the contrary, VLS believes that companies now realize that if they think a product is making false or inaccurate claims, they can confidently report it to VLS, where it will be robustly and impartially investigated.

Additive companies have also commented that more companies are approaching them about the right technology for an application required to support valid performance claims. That behavior change demonstrates that VLS is doing a successful job of raising awareness and educating companies, so that suppliers know just how important it is to check and evidence claims they are making.

Ultimately, VLS’s goal is to educate the end user—to raise awareness of the critical issues and get the message to the marketplace about what a compliant lubricant looks like. The fact the VLS has had fewer cases in recent years is proof that lubricants manufacturers and marketers are paying more attention to what they blend and what they claim.

Constant Evolution

As the lubricants industry continues to evolve, so will VLS. The past decade has seen immense change in the lubricants industry: the trend toward lower-viscosity fluids, the introduction of E10 fuel, new ACEA standards, new Euro 7 regulations and issues like low-speed pre-ignition, to name a few.

We know that an acceleration of change is coming, driven by the impending ban on new gasoline and diesel car sales. We’re already seeing the impact and challenges of electrification. Plug-in and full electric engines could be traveling at 60 mph, and then the engine suddenly has to turn on. Such a high-power cold start is a completely new challenge for an oil, which if not managed can increase wear. Alternately, if used on short trips, the oil temperature may not ever reach the optimum level, which can lead to a build-up of water, causing corrosion.

Zero-emission vehicles are in ascendancy, and hydrogen-fueled combustion engines could become a reality. The only output from these vehicles’ exhausts is steam, which is great for the environment. But with more water created than gasoline or diesel engines, specialist oils must be developed to perform under those conditions and minimize water contamination risk.

Wherever the market goes, VLS’s core purpose will remain the same as it has always been: to uphold standards in the lubricants marketplace while protecting and educating end users.

VLS is immensely proud of what it has achieved to date. Though VLS has made significant progress in raising industry standards over the past ten years, its guidance will be more critical than ever in the years ahead.

Mike Bewsey is chairman of the Verification of Lubricant Specifications. He has been involved in VLS since 2016 as a board member and was appointed chairman in 2021.