It is rare that a lubricants-related story makes it into the mainstream media, but just that happened in Europe in March and April. It was widely reported that the European Commission (EC) had “blinked” about banning internal combustion engine-powered vehicles under pressure from up to eight member countries led by Germany.

The governments were themselves prompted by automotive OEMs and the E-fuels Alliance—an interest group that is promoting the use of e-fuels and represents over 170 companies and organizations, mainly in the synthetic hydrocarbons supply chain. The subject was briefly covered in the Lubes’n’Greases Podcast, The Four Elements of Sustainability, in April.

Some commentators opined that this might result in some “death of the ICE” deadlines being rolled back. This then led to some discussions within the industry about whether any OEMs might consider a new generation of ICE vehicles and whether this could mean a consequent new generation of ACEA sequences.

Legislators in Europe and heads of state in several countries have announced deadlines for the cessation of manufacturing or sale of vehicles powered by the ICE. For some, this refers only to gasoline-powered passenger cars, but in other cases diesel-powered vehicles are affected. Despite this, there are several significant players that have not made specific pledges to stop manufacturing and selling ICE-powered vehicles.

A Door Suddenly Ajar?

In late March, the EC, under pressure from several member states, agreed to create “a perspective for the approval of new vehicles powered by e-fuels after 2035 and develop a practicable methodology by autumn 2024.” In summary, the European Union’s ICE ban would not apply to some new vehicles if they could be driven exclusively on certain fuels.

Welcoming the decision, Ralf Diemer, managing director of the E-Fuels Alliance, said that the decision “has opened a door that should make climate-friendly e-fuels for passenger cars and light commercial vehicles possible in the long term.”

And there could be the nub of the issue: E-fuels manufactured from renewable hydrogen using renewable energy could help reduce the climate impact of transport before the ban on new vehicle sales by allowing the existing car parc to move to a lower-carbon fuel.

The EC and the EU

The European Commission is part of the executive of the European Union. The EC operates as a cabinet government, with 27 members (one per member state, informally known as “Commissioners”) headed by a president. The EC is the sole initiator of legislation in the EU and accordingly includes an administrative body of about 32,000 civil servants.

Euro 7

In November 2022, the EC announced the Euro 7 vehicle emission regulations for all gasoline and diesel vehicles, whether light- or heavy-duty. Tighter emissions standards will become effective on July 1, 2025, for new light-duty vehicles and July 1, 2027, for new heavy-duty vehicles.

The type of fuel allowed was narrowly defined in the EC’s public statements as renewable fuel of non-biological origin (RFNBO). “While we are several months away from seeing the Commission’s implementing regulation, to date, we are only aware of work on an approval process for vehicles that are fueled exclusively, in a permanent manner, with RFNBOs. Unless a further implementing regulation is planned, this would appear to rule out other CO2-neutral fuels,” Jonathan Ramsay, director public affairs and sustainability, EMEA at The Lubrizol Corporation, told Lubes’n’Greases.

If the EC sticks to this position, there are several players in the lubricants industry who believe that this is unlikely to be more than a niche issue for the manufacturers of super cars. They point to Ferrari’s CEO Benedetto Vigna, who has also welcomed the EC’s decision, stating the e-fuels could help Ferrari on its journey to becoming carbon-neutral by 2030 by allowing the use of lower-carbon fuels to the point where a car powered by e-fuels could become a zero-emission vehicle. While the fuel is likely to be expensive, that’s probably not an issue if you own a Ferrari.

“The Commission is legally bound by its own targets for net-zero under the EU’s Climate Law, and CO2 emissions fall squarely within this remit,” Ramsay said. “The last-minute move on e-fuels came as quite a surprise to most Brussels observers, and it would now appear that the Commission is maintaining their line by cherry-picking from the preamble of the legislation to satisfy their deal with Germany, while refraining from addressing the wishes of other Member States contained in the same text.”

Low-Carbon Fuel

The e-fuels lobby successfully argued that its products are low-carbon transition fuels that can make an impact on carbon emissions from transport earlier than electrification. This “technology-agnostic” approach is where legislators support and incentivize carbon emissions reductions, rather than specifying how the emissions should be reduced. If successful, this lobbying position could have significant implications for the automotive market, as one technology—the ICE—could receive a significant reprieve. Could this be deployed by suppliers of biofuels?

At the ICIS World Base Oils Conference in May, one of the plenary speakers expressed their private opinion on stage that the e-fuels derogation would be extended to biofuels. If so, this could mean that new biofuel-powered vehicles will be manufactured into the late 2030s, with potential impacts on lubricants developments.

This is also an opinion held by Angela Willis of Michigan-based Willis Advanced Consulting. Further derogations “could be a strong possibility when it comes to renewable fuels like biodiesel and hydrogen. I believe some key industry stakeholders are discovering that the use of renewable fuels like hydrogen, in combination of some form of electrification, will get the EU closer in achieving its zero-

carbon strategy much sooner than just electrification alone.”

Afton Chemical also sees the benefits of a technology-agnostic approach. “The consideration of e-fuels as an alternative to BEVs and FCEVs is a logical alternative and can help accelerate decarbonization of our energy supply chain,” Ian Bell, senior director, technology development and engine oils new product development, told Lubes’n’Greases. “When we look at balancing the goal of reducing life cycle emissions, supply considerations and energy security, clearly a broader view of technologies can promote innovation and optimization of different solutions for different powertrain needs. We welcome the broadening of the debate and the opportunity for as many valuable options as possible to still be under consideration to deliver clean and sustainable transportation solutions.”

Bell’s colleague Adam Banks, senior marketing manager eMobility, said: “Technologies that provide an opportunity to leverage current infrastructure, whether it be carbon-based e-fuels or blends of hydrogen and natural gas via today’s European network of forecourts, would at a minimum be a bridge to decarbonization and fully green transportation and could also be a fully sustainable path in parallel with EVs going well into the future.”

Light and Heavy Duty

Most experts contacted by Lubes’n’Greases agreed that light-duty and heavy-duty are on separate longer-term paths. “For light-duty applications, the move to electric is well progressed,” said Phil Reeve of the ADLU Consultancy, based in Wantage, United Kingdom. Most western OEMs have moved resources away from new ICE developments toward batteries, electric motors and associated drivetrains.

“E-fuels may provide some relief to niche OEMs,” Reeve continued. In the minds of several key players, the manufacturers of supercars, whose customers can afford an expensive fuel, represent one such niche.

It is almost universally accepted that battery or fuel cell propulsion is unlikely in the short-term to provide the range required for trucking in a physical unit that is sufficiently light and compact. So the transition to electrification for trucks is likely to be longer. However, buses, refuse trucks and off-road equipment for agriculture, construction and mining that “return to base” every day could be amenable to battery-powered or hydrogen-based solutions (fuel cells or combustion) with little change to operating practices.

Could this mean that the only significant heavy-duty engine developments in the future would be for trucking? Willis believes that the wider availability of renewable fuels “could lead to a continuation of ICE development, with the focus of optimizing ICE to efficiently run on renewables. Keep in mind, right now rare earth materials are required for the battery technology.”

Because of limited quantities and fragile supply chains, “alternative fuels, like biofuels and hydrogen, will bridge that ‘gap’ until a breakthrough in battery technology occurs, which would allow battery manufacturers to move away from rare earth materials,” Willis said.

There was general agreement that passenger cars are already heading toward an electrified future mainly based on batteries and that this was likely to happen in Europe, North America and China by the dates that have already been defined by governments. Outside these geographies, where the electric distribution grid is less developed, there will be further demand for ICE-powered vehicles, whether hybrid or pure. “I do not believe these [low-carbon fuel] technologies are going to be just for top-end luxury cars. I believe this will get incorporated into the heavy-duty commercial vehicle market as well as some mid-tier passenger cars from certain OEMs,” Willis said.

The technological pathway for heavy-duty vehicles is less clear and the timelines are likely to be longer. “Afton Chemical’s view is that ICE will have a strong part to play in that extended transition period as well as in certain vehicle duty cycles for the future, especially for commercial vehicles,” said Alan Henderson, senior marketing specialist HDEO at Afton Chemical.

Further derogations from the EC for e-fuels or the creation of derogations for biofuels could affect volumes in the market but probably won’t affect the technology landscape.

Euro 7: The Near and Distant Future

With significant differences in timelines and possibly different pathways to electrification for light- and heavy-duty vehicles, it may seem counterintuitive that some think that the EC’s recent proposals for upgrading emissions regulations could answer the question, “What does this mean for lubricants?”

The Euro 7 regulations are very important because they indicate a change in approach from the EC. Euro 7 is a technology-agnostic approach, and the proposals unify the emissions limits for gasoline- and diesel-powered light-duty vehicles, so it would include e-fuels automatically. Thus, the technology issues faced by lubricants are more likely to come from the changes in hardware than by replacing gasoline or diesel with a synthetic hydrocarbon e-fuel.

Hardware and Testing

“In general, CO2 emissions from combustion of hydrocarbon fuels are reduced by increasing the efficiency of ICEs,” Henderson explained. “Current technologies that enable this include downsizing, boosting, exhaust-heat energy recovery and high compression ratio.”

These hardware changes add thermal and nitro-oxidative stress on the oil. “One would expect this to result in elevated levels of antioxidants versus conventional HD formulations,” Henderson said.

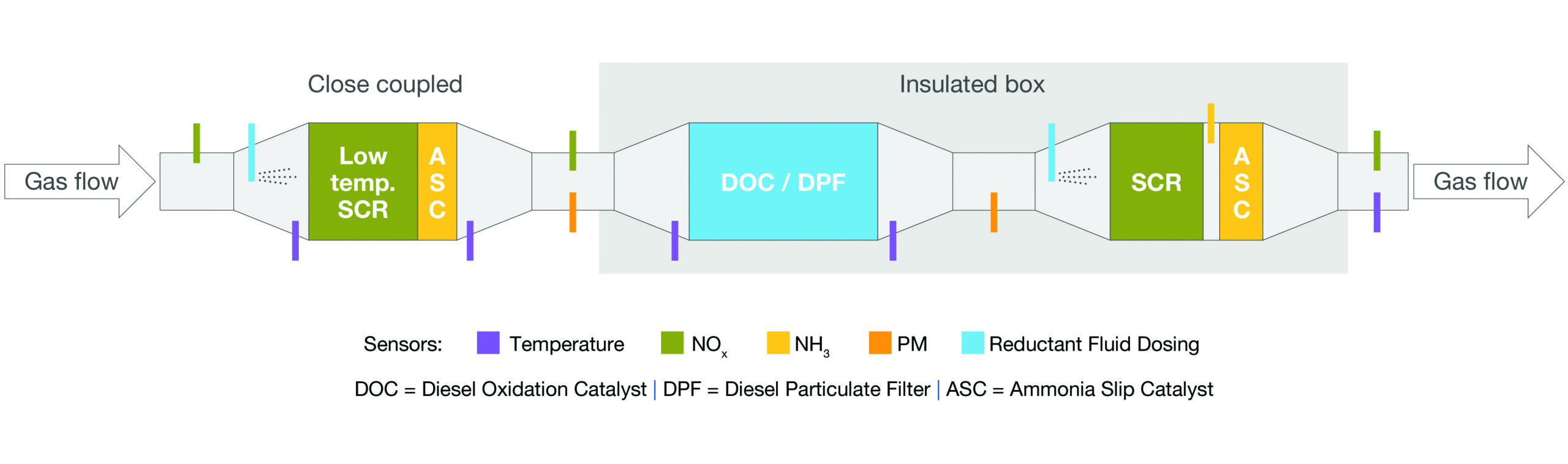

Figure 1. Conceptual Euro 7 Aftertreatment System

Source: The Lubrizol Corporation

Hybridization also brings concerns. “In hybrid powertrains, the engine typically runs more infrequently, and oil temperatures are lower,” Reeve said. “Higher fuel and water dilution in the oil increases the tendency to form emulsions and rust with resulting higher wear and corrosion.”

Euro 7 itself will probably result in changes in aftertreatment hardware, particularly as there are limits when the engine is cold—Euro 7 vehicles will have on-board monitors—and these extend for longer in the vehicle’s life. Thus, lubricant chemistry will have to be benign to any new particulate or exhaust gas treatment technology.

Could E-Fuels Change the Landscape?

Even if the EC extended the derogation on e-fuels to other synthetic or biofuels, there is no indication that it would then recommend that the EU’s ICE withdrawal deadline be changed.

A change from refined fuel to synthetic hydrocarbon is also unlikely to result in significant changes of direction for lubricants developments. There are bigger technical issues for lubricants formulators in Europe. These include Euro 7 for new ICE vehicles manufactured later this decade and increasing electrification of both light- and heavy-duty vehicles, albeit at different paces.

While e-fuels could become part of the portfolio of technologies to reduce carbon emissions from transport, they appear unlikely to have any significant impact on either ICE withdrawal timelines or lubrication requirements.

Trevor Gauntlett has more than 25 years’ experience in blue chip chemicals and oil companies, including 18 years as the technical expert on Shell’s Lubricants Additives procurement team. He can be contacted at trevor@gauntlettconsulting.co.uk